The Hamptons summer season is underway and the housing market is heating up with one of the most expensive listings around.

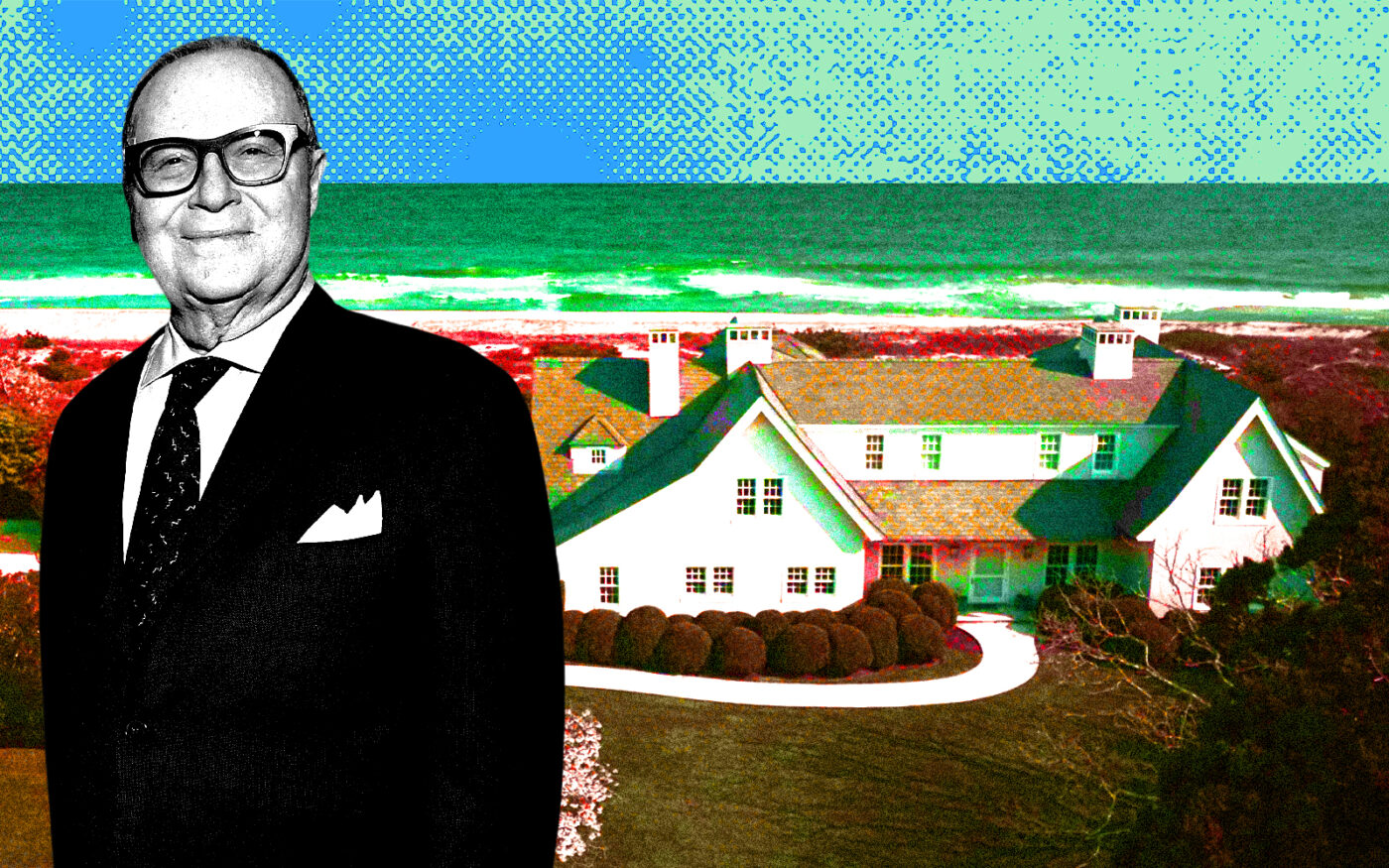

Ann Tenenbaum, a venture capital investor, philanthropist and widow of late financier Thomas Lee, is listing her East Hampton home at 43 East Dune Lane for $120 million, the Wall Street Journal reported. The home may be the most expensive one on the market on the East End; no listing on Zillow exceeds $100 million.

A sale at that price would have been the most expensive in the Hamptons last year.

The listing breaks down to $8,571 per square foot for the 14,000-square-foot main home. The 3.6-acre estate on the oceanfront isn’t far from Further Lane, one of the area’s most expensive streets.

The home has eight bedrooms, and another two in a guesthouse. The grounds include a pool and a tennis court, as well as 225 feet of frontage on the ocean. The sellers created a tunnel from the pool to the home’s lower level to prevent sand from tracking. There’s also a karaoke room and theater on the lower level.

The home was built in the 1900s as part of the sprawling 80-acre estate of ink manufacturer Frank Wiborg. Lee and Tenenbaum bought their slice of the land in 2001 from Lee Radziwill and Herbert Ross for $16.2 million. The couple rebuilt the home twice, including after a fire in 2013 caused by a basement light fixture, which resulted in smoke and water damage, but no injuries.

Hedgerow Exclusive Properties and Modlin Group Hamptons share the listing.

Tenenbaum said she was moving on because she doesn’t love the Hamptons. She hasn’t been back to the Hamptons since Labor Day Weekend, though she expects her children to purchase a smaller place on the East End.

Lee was best known as one of the pioneers of the buyout business, creating Thomas H. Lee Partners in the 1970s. He went on to found Lee Equity Partners.

Last month, the Hamptons scored annual gains in both new signed contracts and new listings, according to Miller Samuel’s monthly report for Douglas Elliman.

Read more