The script was all but written, and it was a good one.

Nick Mastroianni II, the local kid who made it big in real estate, was going to revive the aging Nassau Coliseum back to the grand arena he remembered from its glory years. The breathless news stories would have penned themselves.

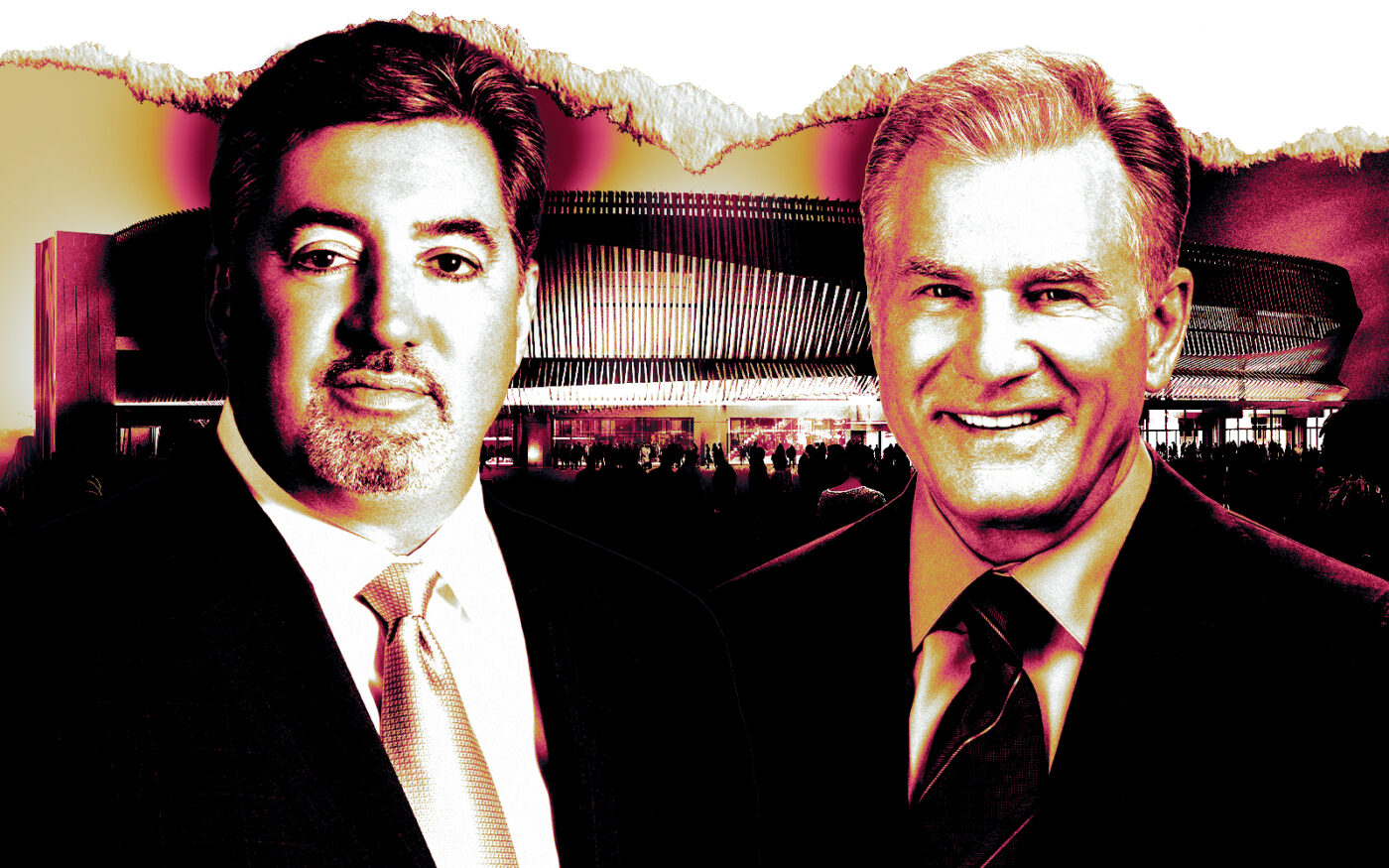

Mastroianni scored a long-term lease from Nassau County, the venue’s owner, and planned a $1.5 billion redevelopment with Scott Rechler’s RXR, which county officials had named master developer of the site.

Fast forward a few years. The anticipated rebirth and transformation of the Coliseum has been all over the news lately, yet Mastroianni’s name is buried deep in the coverage — if it’s mentioned at all.

That’s just fine with him.

“It could have been a disaster.”

Nick Mastroianni II

“The best thing for the public and the county and the people of Long Island was for us to let go of the property and give it to someone with all the resources, skills, knowledge to get it over the finish line,” Mastroianni said in a phone interview.

That someone is gambling giant Las Vegas Sands, which plans a $4 billion dollar project at the Coliseum centered around a casino — if it wins one of the three downstate licenses to be awarded by the state.

Mastroianni on Friday officially sold his 49-year ground lease on the arena to the Sands, which had negotiated a new, 99-year deal with the county. County legislators approved the agreement in a 17-1 vote — a rare display of bipartisanship on what could have been a controversial issue.

The casino proposal faces opposition from people who see gambling as a morally bankrupt enterprise that triggers addiction and related problems for society, but resistance to the other bids for the state licenses is even stronger, especially in Manhattan.

The Sands’ primary competition is likely Mets owner Steve Cohen, but his quest to build a casino next to Citi Field has been blocked by the local senator, Jessica Ramos. Mastroianni is rooting for Nassau, and reveals not an iota of bitterness, jealousy or regret about giving up the project.

It helps that, according to Mastroianni, he made a profit on the lease sale. After a series of unfortunate events, it had looked like he would take a bath on the Coliseum.

“It could have been a disaster,” he said.

Initially Mastoianni was primarily a lender at the site. His specialty — what propelled him to macher status in the real estate world — is raising money from investors seeking U.S. residency through the EB-5 program. Cash for visas, critics call it.

A decade ago, Mastroianni cobbled together $100 million in EB-5 money for the Coliseum renovation for Brooklyn Nets and Barclays Center owner Forest City Ratner, which sold the team and Brooklyn arena to Russian billionaire Mikhail Prokhorov. Prokhorov sold the team and Barclays to Joe Tsai in 2019, defaulted on the Coliseum loan the following year and returned to Russia.

Mastroianni took over the Coliseum lease and set about revamping the arena with Rechler, but with Covid shutting it down, it was all he could do to keep the lights on. He put in $20 million, operating the arena through the New York Islanders’ final season there.

That kept county officials and the unions happy and gave fans who came of age during the hockey team’s 1980s dynasty — including Mastroianni, whose father’s restaurant was a regular dinner spot for Islanders players — a final chance for nostalgia.

Nostalgia, though, doesn’t pay the bills, and the Coliseum’s road got rougher when the Cuomo administration put its muscle behind a new arena at nearby Belmont. At the same time, Mastroianni’s bread and butter, the EB-5 program, virtually dried up.

It’s hard to say what would have happened had the casino licenses and the Sands not come along to not only rescue the Coliseum redevelopment but greatly increase its scope. But they did come along. And as it happens, in the same few months, EB-5 roared back as well.

For Mastroianni, after years of struggling with an unpredictable oligarch and pandemic, and being out of his comfort zone in a development role, the planets are aligning.

“We are fully engaged in EB-5 again, traveling the world and working on projects from Dubai to India and China,” he said. And in New York City, with EB-5 investments in Times Square, Halletts Point and the still incomplete Atlantic Yards, now called Pacific Park.

Read more

“I’m the senior lender on that,” Mastroianni said. He’s restructuring the debt with Greenland, the Chinese firm that bought the development from Forest City, so it can finish the megaproject.

Greenland has run into some trouble over the years. Mastroianni knows what that’s like. He knows what it’s like to get out of it, too.