High interest rates have slowed demand for most commercial property types, but investors are clearly still hungry for supermarkets.

Last week, Houston-based Hines paid $112 million for the Source at White Plains, a Whole Foods-anchored shopping center at 100 Bloomingdale Road in the Westchester County city, the Wall Street Journal reported Tuesday.

UBS Realty Investors sold the 262,000-square-foot property in the priciest deal for a grocery-anchored retail asset in the U.S. since September.

Resiliency to pandemic lockdowns and other market shifts, including online shopping and inflation, have made shopping centers with grocery stores a hot commodity over the past few years. Hines chief investment officer Alfonso Munk told the Journal that the firm is focused on the asset class going forward, along with housing and industrial properties.

“We’re staying away from malls, office for now,” he said.

Still, the asset’s popularity did not translate into a windfall for UBS, which sold the shopping center for $41 million less than it paid for it in 2005, just before the Great Recession..

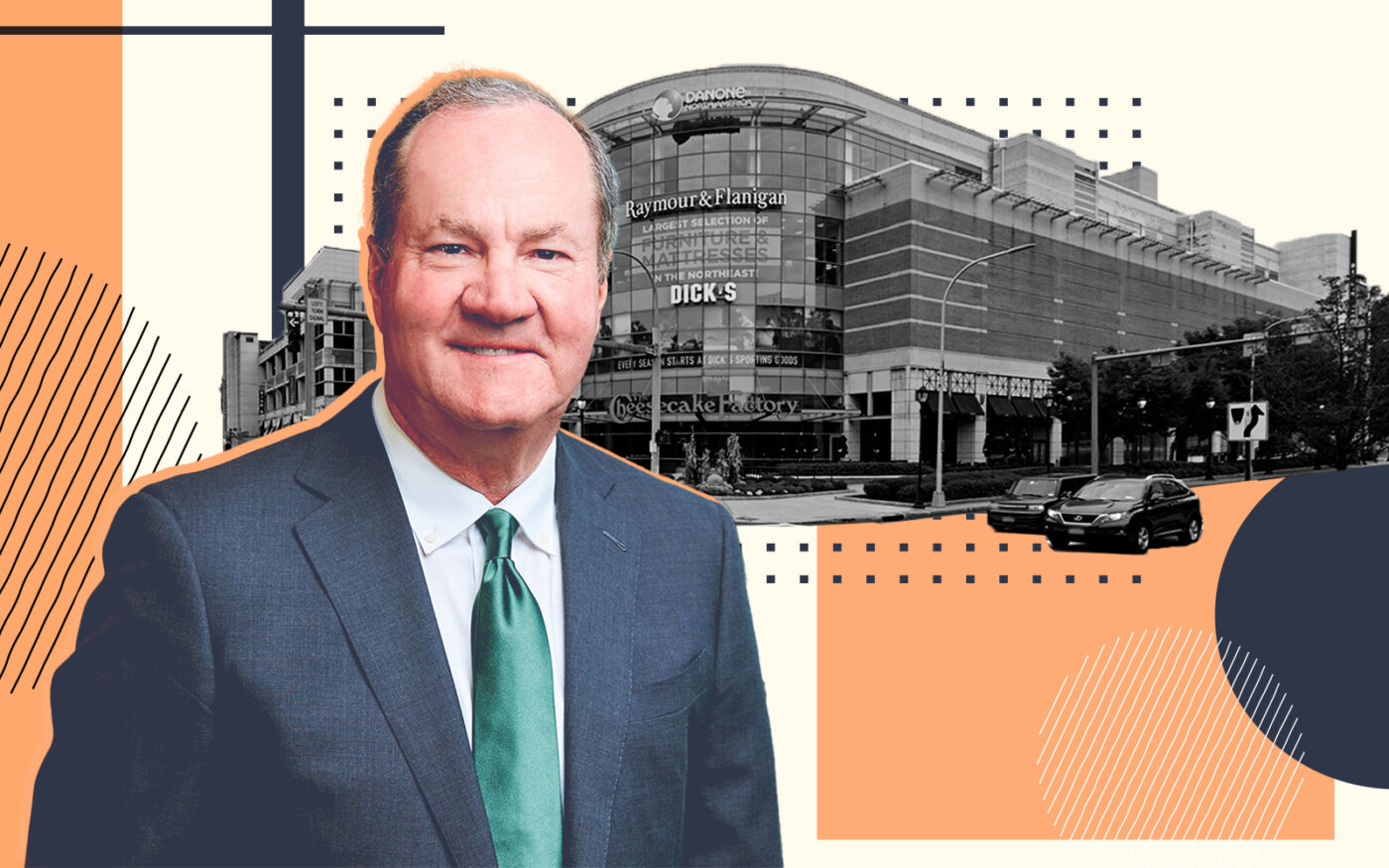

Whole Foods recently signed a 10-year lease renewal at The Source, as did Dick’s Sporting Goods. Other tenants include the Cheesecake Factory, furniture retailer Raymour & Flanigan and a Department of Motor Vehicles branch.

There are several advantages specific to The Source, though. It’s within walking distance of several prominent multifamily developments in the area and sits across the street from the upscale Westchester Mall, which will soon be White Plains’ last remaining indoor shopping mall.

Retail was the only commercial real estate sector to see investment increase from 2021 to 2022, according to MSCI, totaling $85.7 billion in sales last year. Deals declined as interest rates rose during the year, but grocery-anchored assets held up well compared to other property types.