Westchester’s multifamily market remains an attractive option for investors, judging by a recent $200 million sale in New Rochelle.

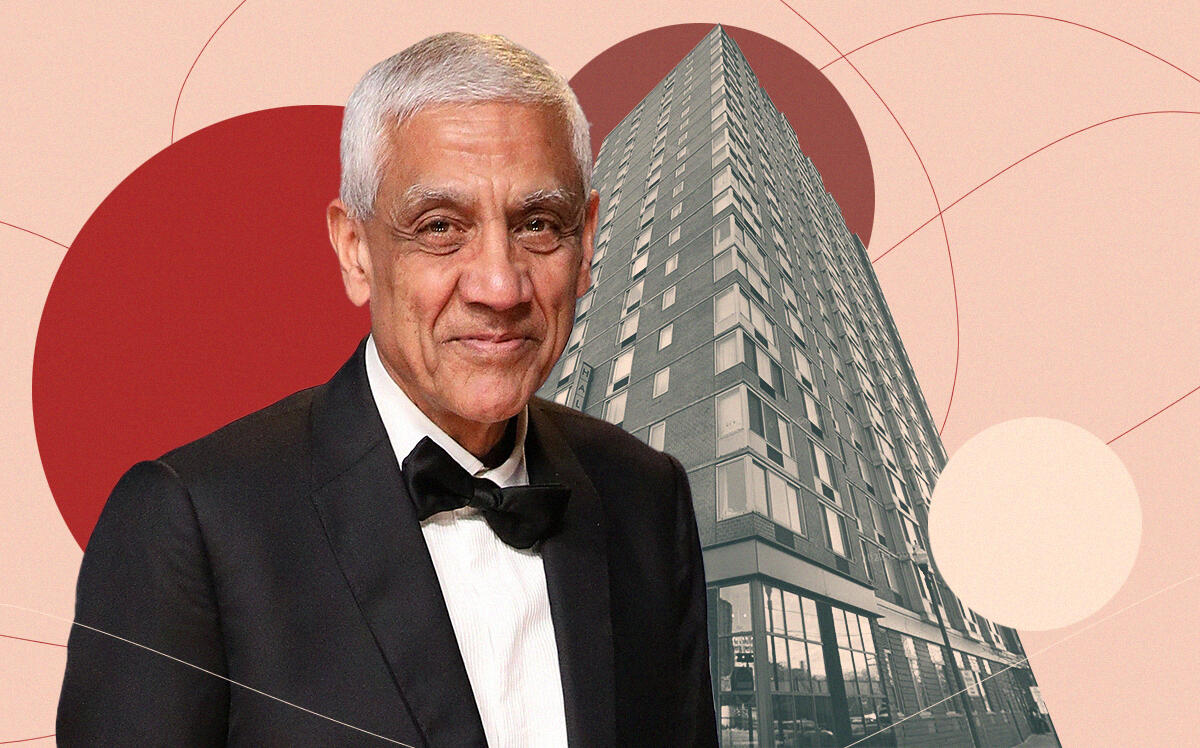

Vinod Khosla’s Khosla Capital and Pacific Urban Investors partnered on a $200 million purchase of the apartment building Halstead Station, JLL announced, paying roughly $490,000 per unit. The seller was the DSF Group.

The 24-story, 408-unit luxury community was built in 2001. Apartments range from one to three bedrooms, and community amenities include a fitness center, lounge, training studio, outdoor swimming pool, courtyard with barbecue grills and a business center with private conference pods.

The building is at the entrance to New Rochelle’s Metro-North station, giving residents easy access to Grand Central Terminal, Harlem and soon Penn Station and the East Bronx.

A JLL team including Jose Cruz and Steve Simonelli represented DSF in the sale.

Khosla Ventures was an early investor in Opendoor and the second largest shareholder when the company went public. Khosla led the Series A round in 2014 and invested $40 million over the next few years, according to regulatory filings. Its investment was worth about $1.4 billion in January 2021, after Opendoor’s IPO, but the iBuyer’s stock price has since dropped by 85 percent.

Read more

Multifamily assets in the tri-state area have been a hot commodity in the wake of the pandemic as investors have looked to take advantage of rising rents and city dwellers in search of more space.

In July, affiliates of Harbor Group International and Azure Partners purchased a 617-unit garden-style community in Elmsford for $306 million, almost $496,000 per unit. AvalonBay sold the property to the partners, who plan to spend $9.2 million on modernization and upgrades.

In June, another multifamily property changed hands in Elmsford, as Ares Management sold a 416-unit complex for $143 million to Tokyo Trust Capital and New York-based MC Real Estate Partners.