Pyramid Management Group has a lot of problems, but a delinquent loan in Orange County is no longer one of them.

The New York-based mall operator reached a settlement Nov. 4 with lender Axonic Capital after defaulting on a $20.5 million mezzanine loan on the Galleria at Crystal Run shopping mall in Middletown, New York, court filings show.

Pyramid took out the loan for the mall at 1 Galleria Drive in September 2018, but stopped making payments in April 2020, according to a complaint filed by Axonic in August. When the loan matured in September 2020, Pyramid failed to pay the outstanding principal and all other amounts due, including interest.

A payment guaranty stipulated that Pyramid or its guarantor was required to pay $5.1 million, or the entire outstanding loan balance, whichever amount was lower. By July of this year, Axonic alleged that Pyramid had still failed to make any payments and its outstanding balance, including interest, had climbed to $25.7 million.

Axonic repeatedly demanded that Pyramid pay the required $5.1 million under the terms of the guaranty, culminating in an Aug. 2, 2021, phone call, in which Pyramid “failed to provide an acceptable solution.”

Meanwhile, the mall reopened in September 2020, and, aside from three tenants, has remained operational. During negotiations prior to the lawsuit, Axonic claimed Pyramid provided financial statements on the Galleria mall that indicated its cash flows were sufficient to cover its payments for the loan.

The parties settled out of court in September and Axonic formally dropped the complaint in November. Terms of the agreement were not revealed.

But it’s not the last of Pyramid’s problems.

Reappraisals tied to the firm’s mounting mortgage delinquencies have slashed valuations on eight of Pyramid’s malls by an average of 59 percent, leaving several of them worth less than their debt, Bloomberg reported in March.

Among the New York malls having issues are Destiny USA in Syracuse and Palisades Centre in West Nyack.

Destiny USA’s value was slashed to $203 million after a 71 percent appraisal reduction. It faces $430 million in CMBS debt. Palisades Centre had its value cut to $425 million last December from $881 million in its 2016 appraisal.

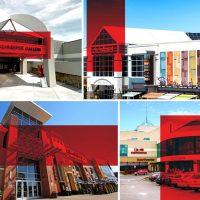

Destiny USA and Palisades Center, along with three other of Pyramid’s New York malls — Walden Galleria Mall in Cheektowaga, Crossgates Mall in Albany and Poughkeepsie Galleria — all went into special servicing last year.

Meanwhile, the remaining $240 million balance on Pyramid’s nine-year-old loan at the Walden Galleria in Cheektowaga, New York, will come due in six months, according to Buffalo Business First.

Located about 7 miles east of downtown Buffalo, that property has one glimmer of hope: the return of Canadian shoppers with the easing of international travel restrictions.

“Our Canadian customers have always represented a significant part of our business,” Pyramid CEO Stephen Congel told the New York Times last month. “So we are excited to welcome our beloved northern neighbors back into the country.”

Read more