The Chetrit Group defaulted on a loan at a shovel-ready development site at Hudson Yards.

Chetrit defaulted on the $85 million loan at 545 West 37th Street, the Commercial Observer reported. The debt — a $53.7 million senior loan and $31.3 million mezzanine loan — was originated in 2018 by JPMorgan Chase and Mack Real Estate. Mack is now the sole owner of the debt, which is collateralized by the full equity interest in the site.

The outstanding balance excludes default interest and other costs and expenses. The all-in rate of the senior loan is LIBOR plus 15.7 percent, while the all-in rate of the mezzanine loan is LIBOR plus 20.5 percent. When considering an $18.5 million payment guaranty, the loan purchaser’s basis would be roughly $178 per square foot.

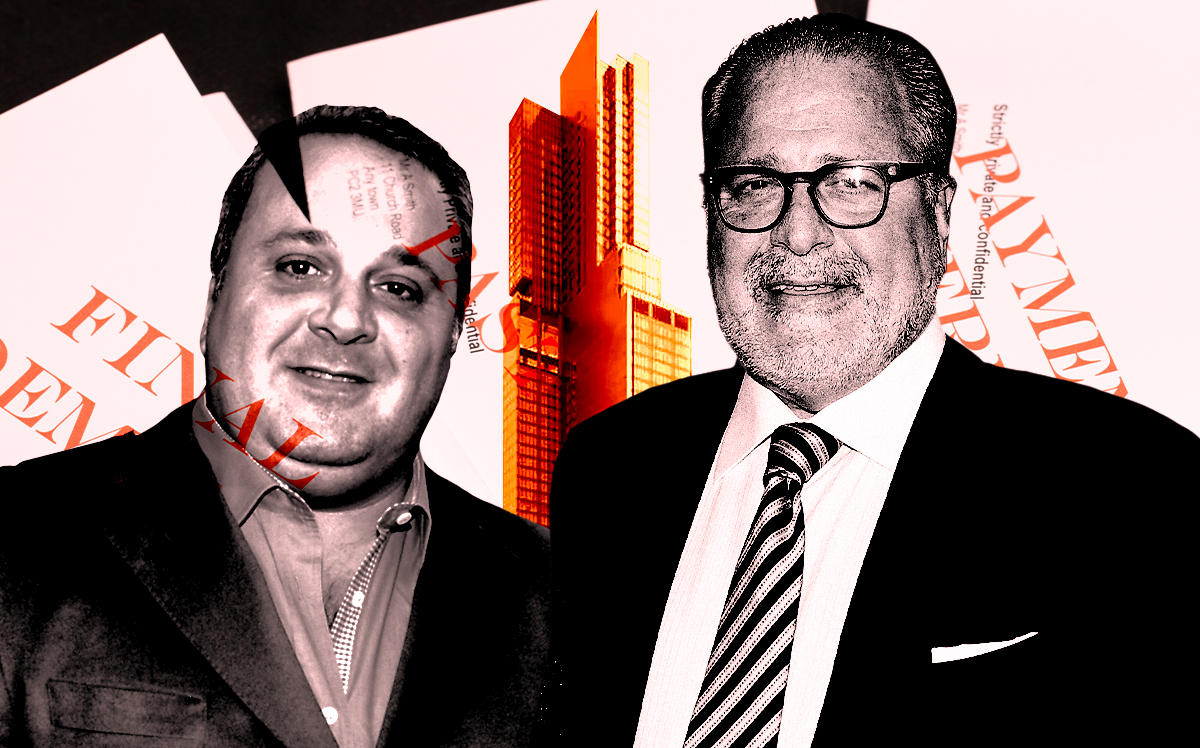

The loan is being marketed by veteran dealmakers in commercial real estate. Adam Spies and Doug Harmon, who jumped to Newmark earlier this month from rival Cushman & Wakefield, have been engaged for the sale, along with Dustin Stolly and Jordan Roeschlaub. The loan sale is the first partnership between the two prominent commercial brokerage teams.

The sale is being marketed as “a direct and quick path to ownership via a UCC foreclosure.”

Chetrit, which could not immediately be reached for comment, purchased the site in 2012 for $26.5 million. The purchase came after lender Fortress Credit took control of the site from previous owner Baruch Singer through foreclosure.

Ironically, Chetrit considered selling the site, but took it off the market and proposed a project of its own.

In 2016, the developer filed plans to build a 622-foot-tall, 373,275 square-foot tower. The 46-story property would’ve included 358 hotel rooms and on the floors above that, 131 residential units.

Read more

Chetrit ran into trouble last year on a $481 million loan, also originated by JPMorgan Chase, that financed the 2018 acquisition of 43 properties in New York, the Sun Belt and the Midwest. The developer said last month it made progress on the debt and set its sights on paying it off in the next few months.

— Holden Walter-Warner