A rule of thumb about custom-built mansions is they sell for far less than they cost to build. One famous example was Michael Jordan’s Chicagoland estate, which he listed in 2012 for $29 million and, after numerous price cuts, finally sold last year for $9.5 million.

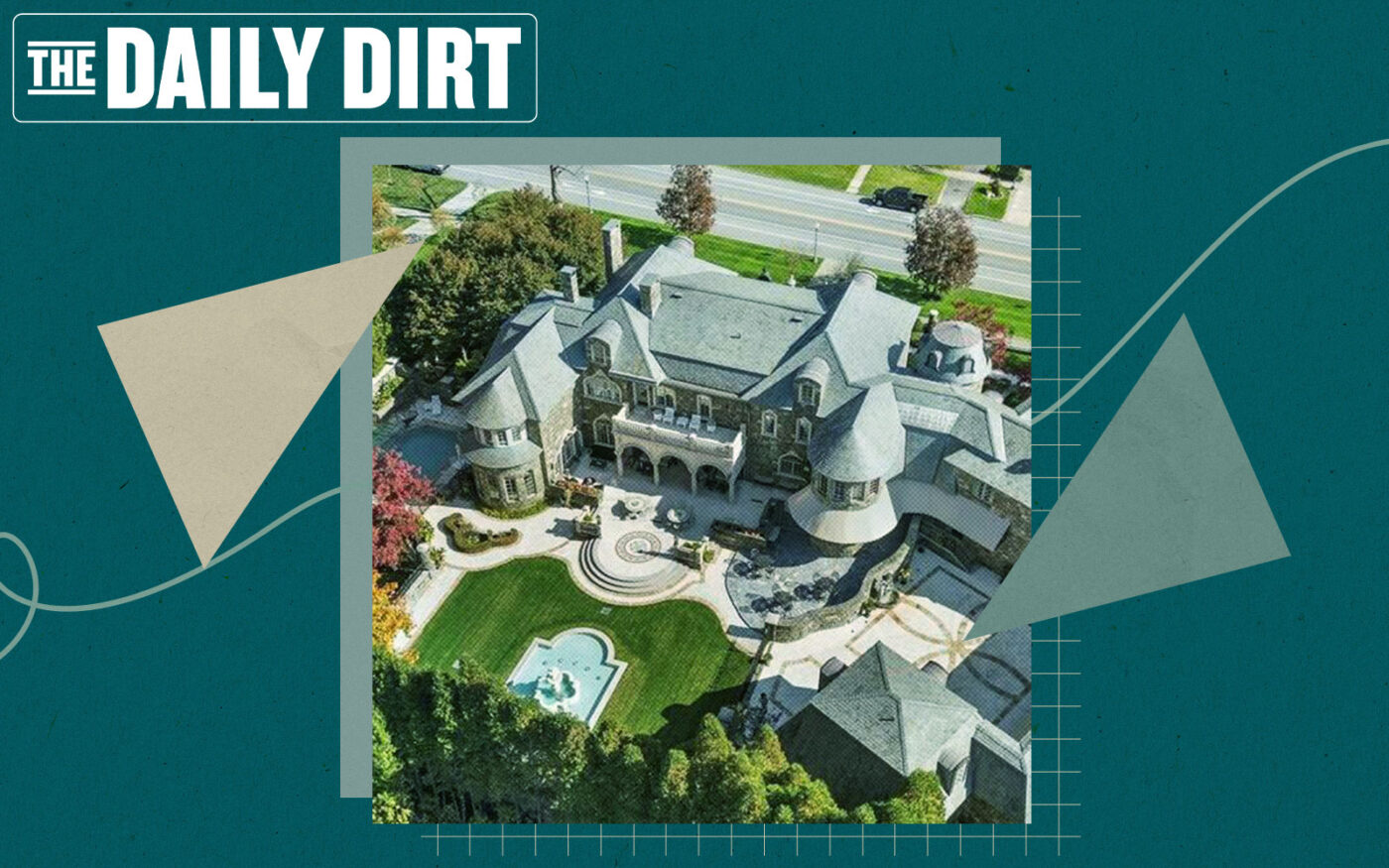

A more recent case in New York is Palazzo Riggi, the 20,000-square-foot house that businessman Ronald Riggi and his wife Michele built in Saratoga Springs in 2003. After Ronald died in 2022, Michele listed the estate for $17.9 million, but no one bit.

More than a year later, she dropped the asking price to $12 million. Crickets.

The widow then bit the bullet, putting the opulent mansion up for auction with no reserve, the Albany Times Union reported. The winning bid, in September 2023, was $7.1 million.

Joseph Gross of Gross Electric in Queensbury, New York paid only $355 per square foot — less than you might pay for a storage unit in Manhattan. And the price included an adjacent parcel of land.

Gross appears to have bought the home to flip it. He made some improvements and put it on the market for $24.9 million.

Julie Bonacio has the listing, but initially I didn’t find it on her website: The property-search box maxes out at $20 million. It’s Saratoga Springs, not East Hampton.

For fans of real estate porn (and let’s face it, we all are), check out this video or the Times Union’s description of the property, at 637 North Broadway:

Set on 1.3 acres, the expansive estate features six bedrooms, 13 bathrooms, two kitchens, four fireplaces, a five-car garage, and an elevator. The property also includes themed spaces, including the “Saratoga” and “Bali” rooms, along with a home theater, fitness room, bowling alley, bar, in-ground pool, pool house, koi pond, landscaping and carriage house suite.

The home is being sold fully furnished, with some exclusions. Recent updates include state-of-the-art mechanical systems, including new electrical, heating, plumbing, lighting, a Savant home control system, and a new security system. According to the current real estate listing photos, the home’s interior maintains much of its original aesthetic.

What we’re thinking about: City comptroller candidate Mark Levine said on Wednesday that if elected, he would invest $2.5 billion of the city’s pension funds in affordable housing and lend pension money at “competitive rates” to developers of such housing “while ensuring strong returns for pensioners.”

Should public pension fund managers try to achieve policy goals in addition to high returns? Keep in mind that pension benefits are guaranteed, so if returns fall short, taxpayers make up the difference. Send your thoughts to eengquist@therealdeal.com.

A thing we’ve learned: Two six-story elevator buildings in the Bronx with 139 apartments between them just sold for just $9 million. Obviously, at just $65,000 per unit and $63 per square foot, they are entirely rent-stabilized.

“If this were an empty lot, it would have sold for a higher amount,” Jay Martin of the New York Apartment Association tweeted. No doubt that’s true, but what would you build at 1930 Anthony Avenue or 1475 Wythe Place? Has anyone got a construction loan for a 485x project yet?

Elsewhere…

Adam Gordon’s Wildflower had one obvious reason to buy an e-commerce building from the New York Times for $35.8 million in College Point, Queens: to lease it to a big tenant.

But there was likely a secondary motivation: The city government could also make it — and other industrial properties — more valuable by requiring a special permit to build distribution centers.

Existing ones would be grandfathered and would face less competition from new warehouses if special permits were mandated. Special permits require approval from the local City Council member. It’s no secret that many members (perhaps all 51 of them) don’t like distribution centers, which they see as increasing truck traffic in their districts.

That is why, in exchange for approving City of Yes, the Council demanded special permits be considered for such projects, which currently are built as-of-right.

The strategy has worked before: In 2021, the Council and de Blasio administration required special permits for new hotels. The measure was designed to deter construction of nonunion hotels — and has succeeded. Hotel projects have almost entirely stopped happening.

Closing time

Residential: The priciest residential sale Thursday was $82.5 million for a 6,591-square-foot condominium unit at 220 Central Park South in Times Square North.

Commercial: The most expensive commercial closing of the day was $50 million for a development site at 355 East 86th Street in Yorkville. Extell Development sold the property to Cheskel Schwimmer’s Chess Builders, which plans a 99-unit building, Commercial Observer reported.

New to the Market: The highest price for a residential property hitting the market was $10.5 million for a 7,080-square-foot, single-family townhouse at 51 West 73rd Street on the Upper West Side. Dexter Guerrieri of Vandenberg has the listing.

— Matthew Elo