The weekend may have begun, but real estate news never stops. So now is as good a time as any to catch up on all the headlines you may have missed.

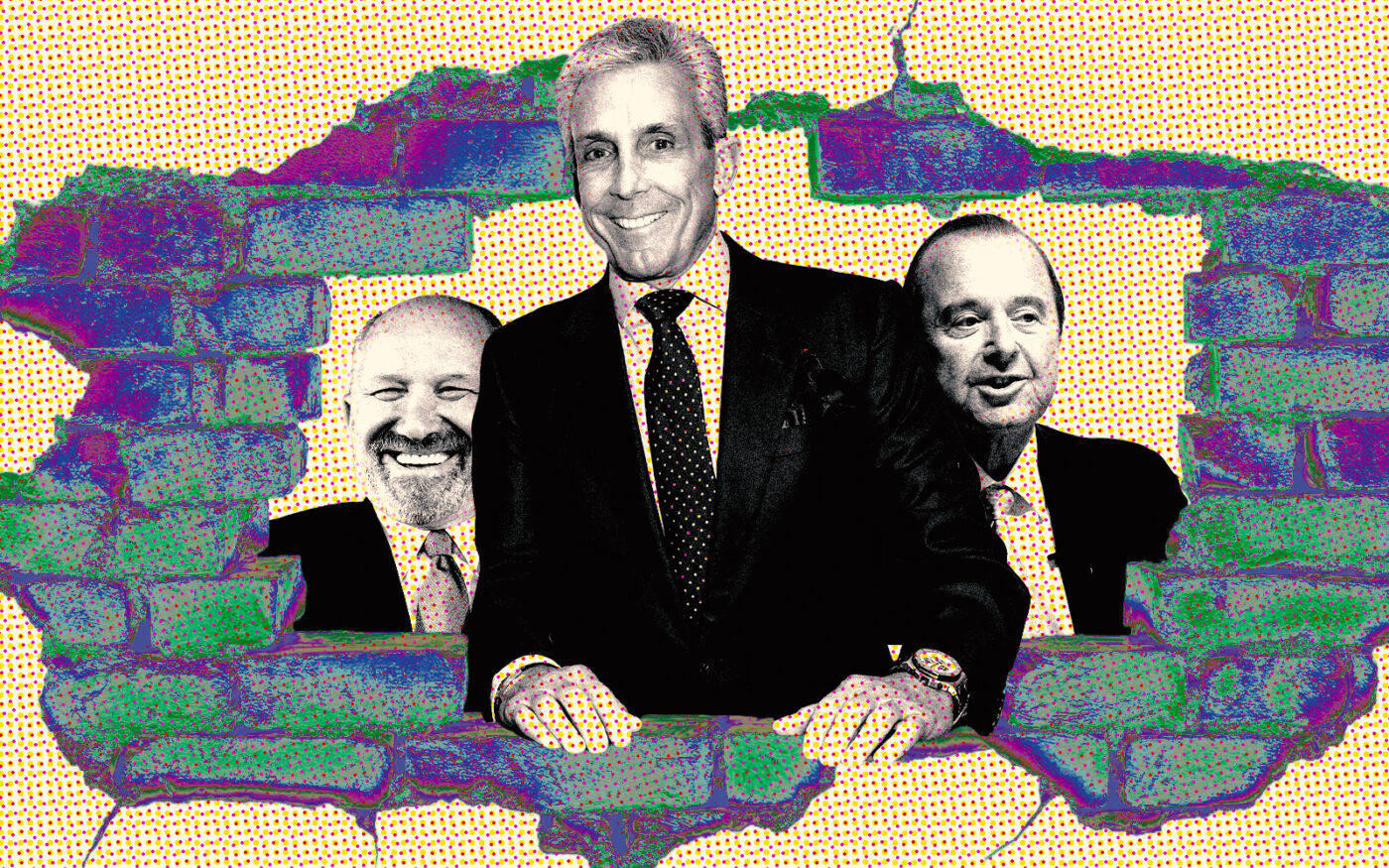

This week was jam-packed with lawsuits, nepotism and other intrigue — involving major players including Charles Cohen, Joseph Cayre and Newmark.

Here are the five stories that were most popular with our subscribers over the past week:

Rent-stabilized building sells for $285K — a 97% value cut

A rent-stabilized building at 312 East 106th Street in East Harlem sold for $285,110, a 97% discount from its 2016 value. The sale price equates to $9,827 per unit, significantly lower than the 2024 average of $110,694 per unit for similar properties.

The disastrous sale indicates significant distress in New York’s rent-regulated housing market.

“It may actually be too late to save New York’s rent-stabilized housing from the destruction of vacancy control passed in 2019,” said Jay Martin of the New York Apartment Association.

Charles Cohen’s last stand buckles, Fortress to collect on $187M personal guarantee

The Appellate Division denied an appeal from billionaire Charles Cohen, meaning he will need to pay up on a massive personal guarantee after a half-a-billion-dollar default.

Fortress Credit Group has been going after Cohen over $187 million personal guarantee he signed to score a monster mortgage for Cohen Brothers Realty in 2022. When Cohen quit making payments on the $534 million loan earlier this year, Fortress sued, alleging default.

Rather than settle, Cohen decided to fight Fortress in court. But this latest ruling means he will likely be on the hook, and Fortress can collect.

Joseph Cayre’s Midtown Equities files class action suit against Rialto over “sinister scheme”

Joseph Cayre of Midtown Equities smacked Rialto Capital Advisors, servicer to the $1.2 billion Signature loan book sold in late 2023, with a suit Monday alleging the firm is illegally manufacturing defaults to force borrowers into paying “crippling default interest and fees.”

Rialto has been pummeling Signature Bank borrowers with one foreclosure filing after another, but now Midtown is striking back.

In the suit, Midtown alleged that Rialto’s strategy is a “sinister pocket veto scheme.” This isn’t the first suit taking Rialto to task.

Gen Z takes over Newmark: Insiders question Lutnick sons’ new roles

Howard Lutnick raised eyebrows last week when he named his 28- and 27-year old sons to key leadership positions at Newmark and Cantor Fitzgerald.

It’s fair to question what kind of expert guidance a pair of 20-somethings can offer seasoned CRE veterans who have been in the business since before the Lutnick sons were even born.

And some insiders are questioning the move.

“They’re kids,” one person familiar with the Lutnicks said. “There’s no more or no less than what you see.”

Elie Schwartz hit with new fraud charges by SEC

The Securities and Exchange Commission announced new charges against Elie Schwartz, alleging the Nightingale Properties CEO defrauded at least 700 investors out of more than $52 million through the internet platform CrowdStreet.

The SEC echoed the DOJ’s allegations that Schwartz falsely told investors their funds would go to purchase an office complex in Atlanta or recapitalize a Miami Beach office building, but instead used the funds to prop up other Nightingale real estate projects.

The agency is seeking injunctions, disgorgement and civil money penalties against Schwartz. It’s also looking to permanently ban Schwartz from directly or indirectly participating in securities offerings.