Eric Adams’ indictment drama has dominated the news cycle, overshadowing the real estate platforms that other mayoral candidates are rolling out in interviews, forums and press releases. But we are paying attention.

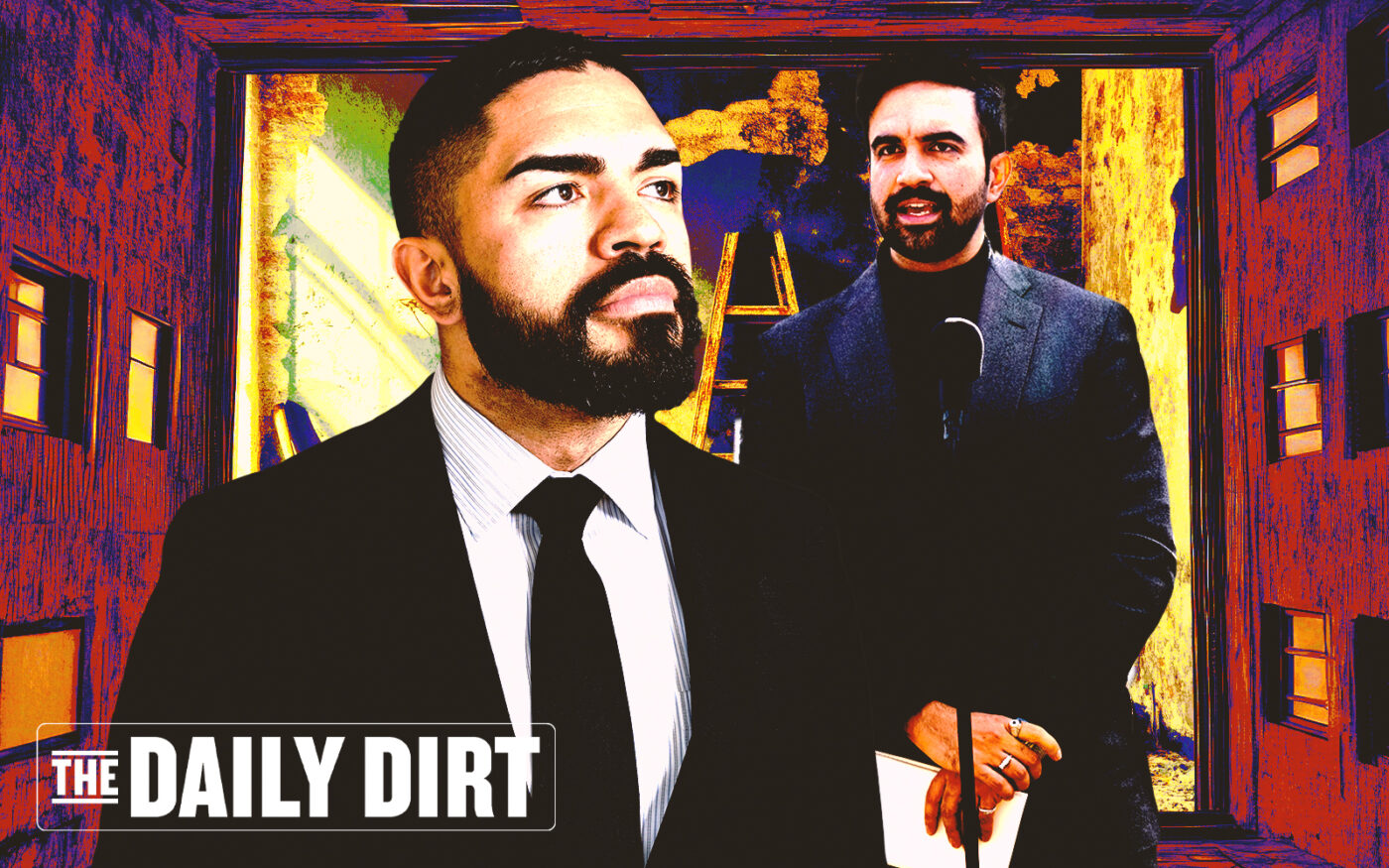

You probably already know that state Sen. Zellnor Myrie has emerged as the YIMBY candidate for advocating an abundance agenda to address the housing crisis. He would harness the powers of the private and public sectors to build 70,000 homes per year.

Meanwhile, Assembly member Zohran Mamdani put out a socialist version of the abundance agenda, pitching an impossible plan for the government to build 20,000 affordable units per year for $500,000 each using only union labor.

That’s far from the only thing that annoys the real estate industry about Mamdani. He also voted against allowing rent-stabilized buildings a modest rent increase for repairs, claiming they can get a city subsidy instead.

Yet in advocating for this, the candidate admitted that few owners actually receive the subsidy, which he didn’t identify.

“Only one landlord has applied to that program and I believe part of that is because doing so requires them to open up their books and it’s much easier to have a public debate where you are crying about the impacts on your finances,” Mamdani told the New York Editorial Board.

Kenny Burgos, CEO of the New York Apartment Association, took issue with that.

“His assertion that there are valid hardship programs available to rent-stabilized buildings is misleading,” Burgos told The Real Deal in a statement. “These programs have proven to be ineffective, which is why there is little participation, and when owners do want to participate they are often rejected.”

Burgos noted that a growing number of rent-stabilized buildings are entering foreclosure or being sold at steep discounts. It’s hard to imagine that owners are choosing those outcomes rather than accept city money to save their properties.

“Suggesting that a lack of buildings receiving help from the government is a sign that there isn’t a problem is denial of the truth,” Burgos said. “New York doesn’t need another politician trying to drive a wedge between renters and property owners.”

What we’re thinking about: Burgos’ tweet about rent-stabilized housing, “The ship is sinking, people,” recalls a line by then-Knicks player Michael Ray Richardson during a losing streak in 1981. “The ship be sinkin,” Sugar Ray famously said. Asked how much worse it could get, he added, “Sky’s the limit.” Were you following the team then? Send your thoughts to eengquist@therealdeal.com.

A thing we’ve learned: Automated devices placed over stoves can extinguish fires. The developer Jonathan Rose recommends the devices, which cost less than $100 (and as little as $28), to combat the most common cause of apartment fires. Read about the deal that sparked Rose’s career here.

Elsewhere…

The stock price of Easterly Government Properties, a real estate investment trust that owns buildings leased to the federal government, is down 25 percent from a peak reached two weeks before the presidential election. The Trump administration’s Elon Musk has been terminating federal workers at a frantic pace.

Composting in New York City gets serious when violators are subject to fines. That begins April 1 — no fooling! Building owners must separate yard waste, food scraps and food-soiled paper from trash and recyclable materials. Buildings of 10 or more units can request a free training or presentation from the Department of Sanitation. Live and recorded information sessions are linked here.

If you think someone should have done a forensic audit of the notoriously high-spending Metropolitan Transportation Authority before implementing congestion pricing, you’re not alone. The state legislature had the same thought the last time the MTA had a funding crisis and came hat-in-hand to Albany. The results of that audit are here.

Closing time

Residential: The priciest residential sale Monday was $11.5 million for a single-family brownstone at 36 East 64th Street in Lenox Hill. The home is four stories and 7,600 square feet. A Compass quartet including Richard Steinberg and Alexander Mignogna have the listing.

Commercial: The most expensive commercial closing of the day was $7.3 million for 517 East 75th Street on the Upper East Side. The five-story apartment building has 12 units.

New to the Market: The highest price for a residential property hitting the market was $14.5 million for 15 St. Lukes Place in West Village. The townhome is 7,400 square feet and is listed by Compass’ Hudson Advisory Team.

Breaking Ground: The largest new building application filed was for a 21,155-square-foot, six-story residential building at 30-71 29th Street in Queens. Chang Tan of Tan Architect was the applicant.

— Joseph Jungermann