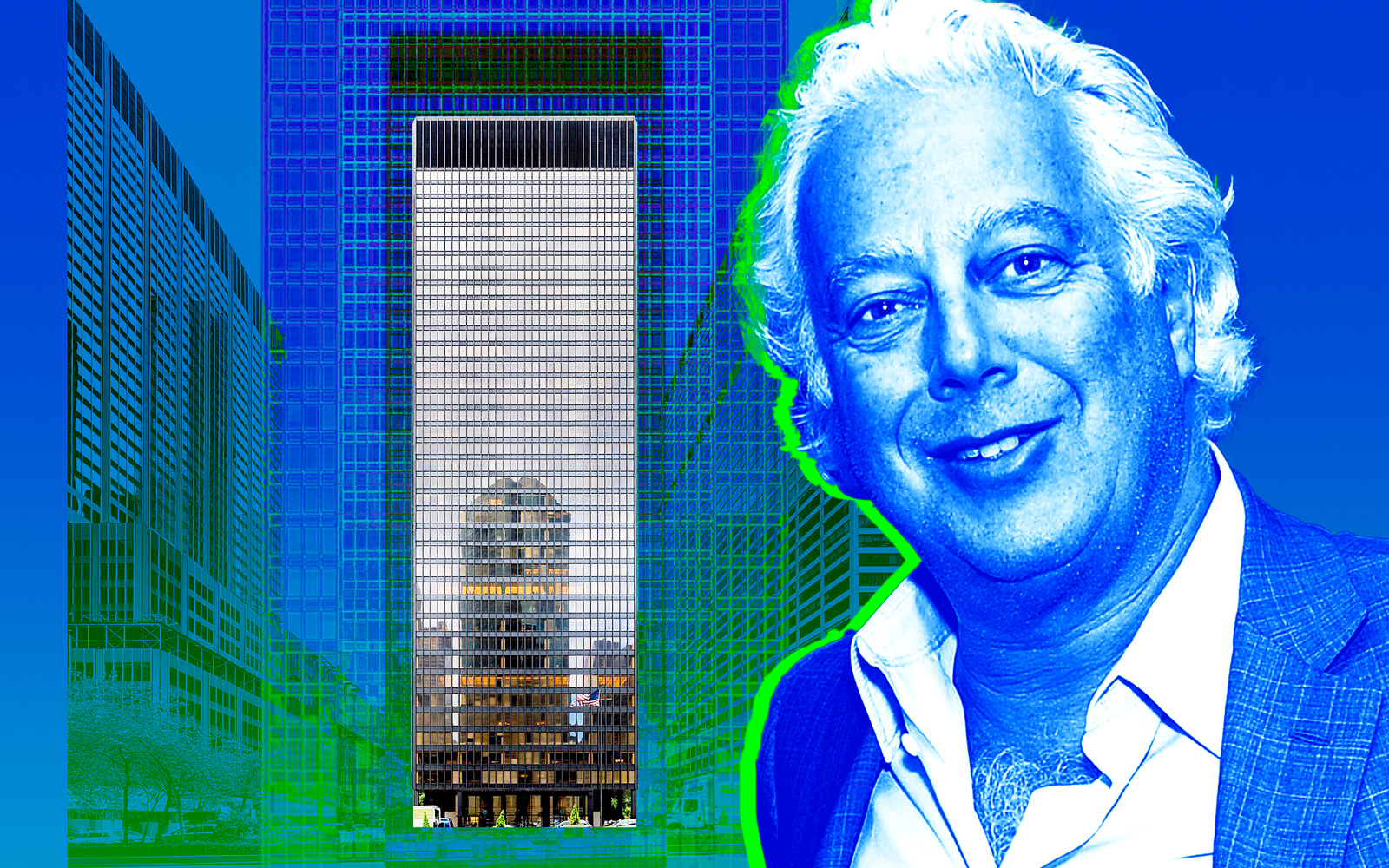

Aby Rosen is the latest Manhattan office landlord to close in on a 10-figure financing package for their building.

RFR Holding is finalizing a $1.2 billion CMBS loan to refinance the Seagram Building at 375 Park Avenue, Bisnow reported, citing a KBRA presale report. Once closed, the deal will mark one of the largest office refinancing deals so far this year.

Newmark recently appraised the 38-story, 860,000-square-foot property at more than $1.8 billion.

The four-year, fixed-rate loan originated by Morgan Stanley, Citi Real Estate Funding and JPMorgan Chase will carry a 6.25 percent interest rate, nearly double the 3.53 percent rate on the existing debt, according to Morningstar Credit.

The refinancing package will retire $1.15 billion in existing debt, utilizing $24.6 million from existing reserves to complete the payment. The forthcoming loan structure will fund significant reserves, including a $26 million escrow for contractual free rent and $21.3 million for outstanding landlord obligations.

RFR declined to comment to Bisnow on the refinancing.

The trophy office tower boasts a 96 percent occupancy rate, bolstered by recent tenant expansion. Alternative asset manager Blue Owl Capital recently increased its footprint by 42 percent to 240,000 square feet, agreeing to pay $220 per square foot for the space, according to KBRA.

The deal resolves uncertainty surrounding one of Manhattan’s largest maturing office loans. The loan was transferred to special servicing in April 2023 due to imminent monetary default, maturity a month away at the time. The loan’s maturity was extended twice since then and was due to mature in three months.

The pending refinancing is one of a wave of major CMBS deals in Manhattan, including Tishman Speyer’s record-breaking $3.5 billion refinancing of Rockefeller Center and Irvine Company’s expected $1.5 billion refinancing of the MetLife Building.

Read more