Last year Vornado Realty Trust executives floated tennis courts at the old Hotel Pennsylvania site to ride out an “office apocalypse.”

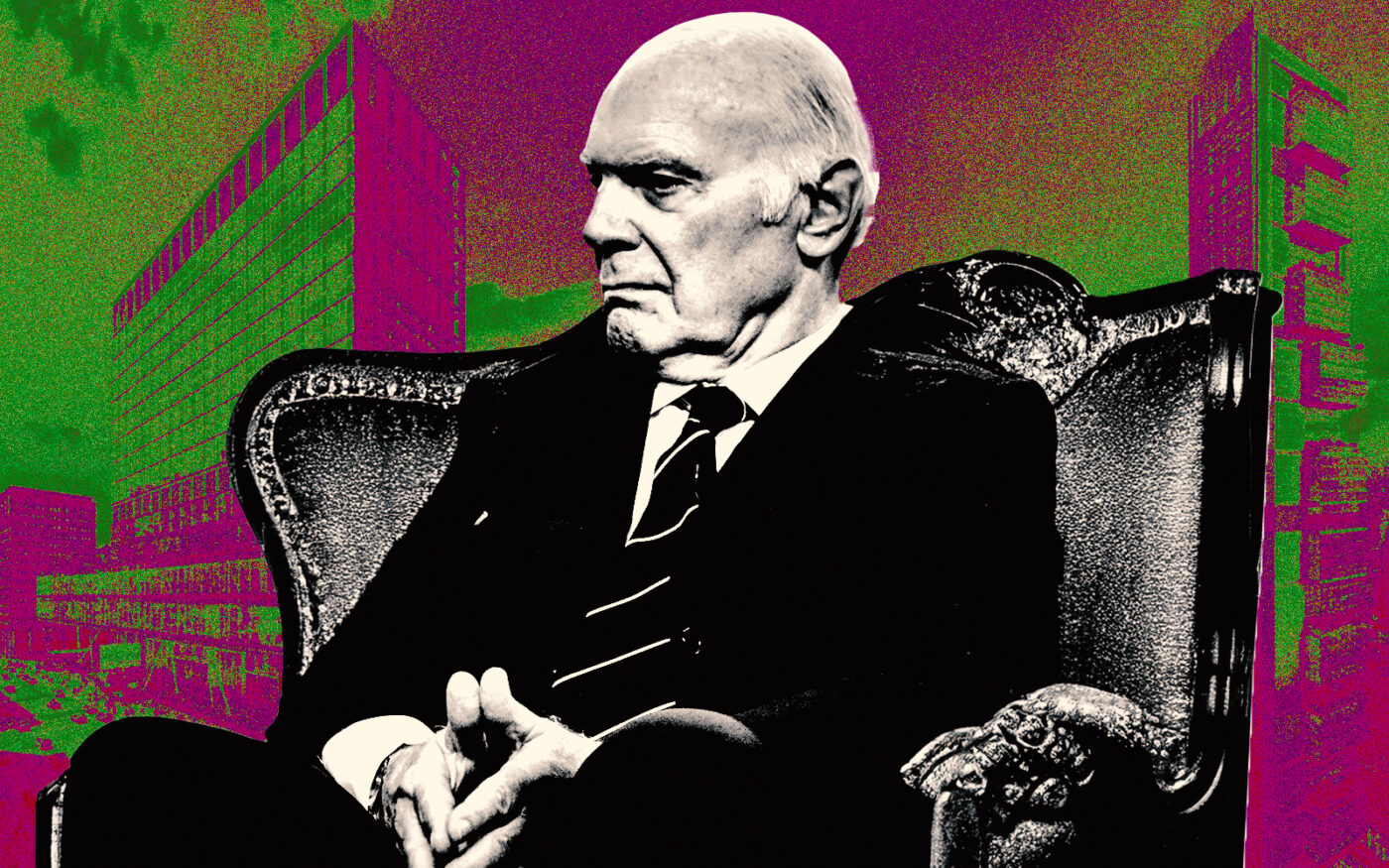

On Tuesday, CEO Steve Roth dismissed the threat of the remote work trend as “a scare,” and said the Hotel Penn site, also known as Penn 15, “was down to the ground and ready to go.”

The hotel has been demolished, but “ready to go” comes with big caveats: Roth said interest rates remain stubbornly high and “aggressive capital” is in short supply. He also noted that the price of steel, the latest target of President Donald Trump’s suite of tariffs, could further complicate the math around ground-up development.

The company is moving forward with its plans for the 1.8 million-square-foot office tower at 350 Park Avenue and is expecting to enter public review next month. But that tower is different: Vornado already has an anchor tenant, Ken Griffin’s Citadel, which is also a 60 percent partner in the project.

“350 Park is an isolated, different point of view,” Roth said during the real estate investment trust’s fourth quarter earnings call. “My prediction is that almost no other building will get off the ground. And by the way, that could very well include, for the short term, Penn 15.”

Still, Roth said if the company views the land at Penn 15 as a sunk cost and if rents rise to the high $100s or even above $200 a foot, the tower could get off the ground.

“That obviously is the next site,” Roth said. “We are considering all options.”

He clarified that “clearly” office space would be at the front of the building, but that the company was also considering apartments as part of the project.

He said he has high hopes that asking rents at Penn 1 and Penn 2 will rise well above $100 per square foot. He said the company is weeks away from signing a 300,000-square-foot lease at Penn 2 and is negotiating a letter of intent for a “major headquarters” at the redeveloped office building.

Roth emphasized that demand for high-end office space was on the rise as only a handful of major new office projects have broken ground in the past five years — the perfect recipe for a landlord’s market. The office availability rate in Manhattan hit 17.9 percent in the fourth quarter of 2024, the lowest level seen since 2020, according to Avison Young. Class A office space made up the largest share of leasing activity during that quarter.

Vornado is also cutting its losses at the Rego Park Mall. Roth said the company is relocating the remaining tenants, Burlington and Marshalls, at Queens Boulevard and Junction Boulevard, which he referred to as a “failed shopping center.” Alexander’s, the REIT that owns the property and is controlled by Vornado, plans to sell the five-acre parcel or develop it, Roth said.

Ikea paid $10 million last year to end its lease at Rego 1. Roth said the land was worth more than the 66-year-old building on the site. Burlington and Marshalls will move to the newer part of the mall, dubbed Rego 2.

Read more