One High Line, the condo complex caught in a years-long saga involving a mob scandal, fraud scheme and foreclosure, is showing signs of life.

On a Monday afternoon in January, the development at 500 West 18th Street had a steady pulse of unremarkable activity: elevators filled with a group touring the property; a pair of men busy with crunches in the fitness center; another working from a laptop near the property’s golf simulator.

But even the daily drumbeat of residential life seemed out of reach three years ago, when the twisting towers overlooking the Hudson River that sat empty and half-finished under their former developer, the now-defunct HFZ Capital Group.

It’s been three years since Witkoff Group and Access Industries took over the buildings, which closed 2024 by surpassing $1 billion in sales.

The sales momentum for the project, which was at the center of its former sponsor’s fantastic decline, has seen more than half of its 236 units sold, including two pinnacle penthouses.

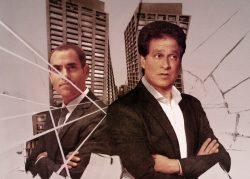

The project, once a symbol of HFZ’s downfall, is shaping up to be a victory for its current set of developers. Bringing One High Line across the finish line could be a boon for Alex Witkoff, the son of founder Steve Witkoff who was left as sole CEO upon his father’s nomination to Trump’s administration.

So far, a smooth takeover, improved market conditions and a lack of competition in the area have added to the project’s momentum, but it’s still one to watch as it embarks on the roughly $800 million in units left until sellout.

The towers’ tangled past

Witkoff and Access took over the Eleventh Avenue site in 2021 after the project’s primary lender foreclosed on HFZ’s stake. Under the disgraced firm’s purview, the development was plagued by conflicts with its contractors, sluggish sales and mounting concern over HFZ’s financial standing.

The new developers paid $900 million for the property, about the same amount HFZ paid for it in 2015. But by the time the development landed in a fresh set of hands, it was already nearly two-thirds complete.

“It was the best type of deal — a good asset with a bad financial structure,” said Alex Witkoff. He added that the duo “got to own an A+ piece of property” due to issues with the group developing it, not the actual product.

HFZ’s initial deal for the site raised its fair share of eyebrows. At $1,100 per square foot, the trade ranked among New York City’s priciest land deals ever. Two years later, the developer scored one of the largest financing packages of the cycle with $1.25 billion from the U.K.-based Children’s Investment Fund.

HFZ dubbed the project the XI, and with a projected $2 billion sellout, it was shaping up to be the crown jewel in their portfolio. Plans for the site included two Bjarke Ingels-designed towers housing roughly 240 condos, a 137-room five-star hotel and 90,000 square feet of retail space.

By 2018, HFZ was ready to start delivering on its nine-figure bet and launched sales with Douglas Elliman’s top-producing Eklund-Gomes Team at the helm.

But within two years, the developer was falling short of its goals. Word got around that its sales team was marketing bulk sales of condos at a discount. Construction was stalled over disputes with contractors. Lawsuits started stacking up over unpaid bills. The development was pulled into a federal indictment over an alleged kickback scheme connected to the infamous Gambino crime family.

Then came rumors the project’s chief investor was shopping for a new developer, a lawsuit against HFZ for $160 million in missed interest payments and a UCC foreclosure.

By the end of the year, HFZ lost the project to Witkoff and Access. But the beleaguered developer’s turmoil over the property only escalated.

HFZ and some of its executives, including Nir Meir, were indicted last year for allegedly defrauding investors out of $86 million. Prosecutors accused Meir of diverting more than $250 million in funds loaned for the project to cover shortfalls at other developments and to pay HFZ executives. He moved money back into the project’s account, though he was short $37 million.

To cover the discrepancy, prosecutors allege executives from HFZ and its contractor, Omnibuild, told subcontractors to inflate monthly invoices, which signaled to lenders that the project was progressing more quickly than it was and prompted them to release more funds. When investors began asking questions, Meir allegedly told an HFZ executive to forge bank statements to make it appear as if they had more funds in their accounts. In reality, they had only $814.

Meir, who’s being held at Rikers, has pleaded not guilty to the charges. HFZ and one of its affiliates have pleaded guilty to three counts of grand larceny and criminal city tax fraud.

Omnibuild, which was also included in the indictment, has denied the allegations. The contractor sued HFZ, Meir and the firm’s founder, Ziel Feldman last year, alleging they repeatedly told the firm that it was behind on payments but was encouraged to continue working anyway.

A new beginning

Though the XI’s new owners billed their acquisition as a win, it came with a few unknowns.

“We really wanted to make sure that what we thought we had in terms of what we were buying, call it a 70 percent complete building, was truly 70 percent built, and that we were not going to have to dismantle it,” said Jonah Sonnenborn, senior managing director and head of real estate for Access.

It appears luck was on the developers’ side. They brought in their general contractor, Suffolk Construction, to evaluate the construction that had been completed, and got the okay to continue.

“There could have been a possibility for a number of missteps in terms of missing parts of construction that were incomplete or if there had been problems with the prior construction,” Sonnenborn said. “But there really weren’t.”

The developers added their own stamp on the property, changing unit designs so that no two in either tower were identical. They reconfigured the amenity package and the finishes in the hopes that new leadership and their alterations would prompt a better outcome on the market than their predecessors had achieved. They swapped Six Senses Hotels Resorts Spas for a five-star Faena Hotel.

In the summer of 2022, sales re-launched at the project rebranded as One High Line. They tapped a team from Corcoran Sunshine, led by Deborah Kern and Steve Gold, to head sales and marketing. Contract signings started picking up. About a year later, the development notched its first closing, and buyers began moving in.

Given the development’s history, “the biggest concern was the idea that there could be a taint on the sales side,” Sonnenborn said. “That hasn’t been the case.”

Now the project is about 65 percent sold, after two years of sales momentum that landed One High Line among the top-selling new developments in the city in 2023 and 2024. In August, the developers scored one of the largest single-asset loans of last year when JP Morgan and Tyko Capital agreed to a $1 billion refinancing package.

Much of its largest units are already in the hands of buyers, usually among the last to go in a development of this size. Both pinnacle penthouses topping each tower have sold, for $47 million and $45 million respectively — discounted from their initial listing prices, though notable deals nonetheless. Penthouse 36, the more expensive of the two, was the priciest downtown condo closing last year.

Overall, discounts at One High Line have been relatively minimal. Of the roughly 140 units that had closed by Jan. 20, sale prices were down, on average, just 8 percent from the offering price, according to The Real Deal’s analysis of property records. Marketproof data shows units at the dual towers have sold for roughly $3,300 per square foot.

Though the project has surpassed the billion-dollar mark, it still has a ways to go before the books are closed with roughly 80 units remaining.

One High Line’s sales progress since its reinvention is a sign that Feldman and Meir were on the right track when they levied their ambitious wager on the site, if only it had been spared from HFZ’s downfall.

But the few lost years could have set the stage for a turnaround at the property.

When HFZ launched sales at the project in 2018, the city’s market was already saturated with new development condos following the development boom years earlier. Supply was outpacing demand, and projects across the city saw their inventory languishing. The building’s location wasn’t yet a hot spot, with foreign buyers looking to invest in more well-known areas like Midtown.

By the time the buildings started selling again, the new development glut had subsided. Much of the supply was absorbed as buyers scooped up units in the pandemic buying frenzy, and few new projects were on the horizon to take their place. Plus, projects tend to sell more quickly the closer they are to completion.

One High Line is one of only a few developments of its size in the area with ongoing sponsor sales. Its best comparison is The Cortland, a Related Companies project on West 22nd Street that was completed around 2022, but even that building has just 144 units, compared to One High Line’s 236. Additional rival buildings — namely Zeckendorf’s highly anticipated 80 Clarkson Street — are still years away from selling.

“That’s one of the reasons we stepped into this transaction in the first place,” Sonnenborn said, pointing to the lack of competition in the area. “That is always the ideal condition to deliver new product into because you are the game in town.”

Read more