Years after a spirited fight between landlord and tenant over Covid protections, the retailer at 170 Broadway may be unintentionally exacting revenge.

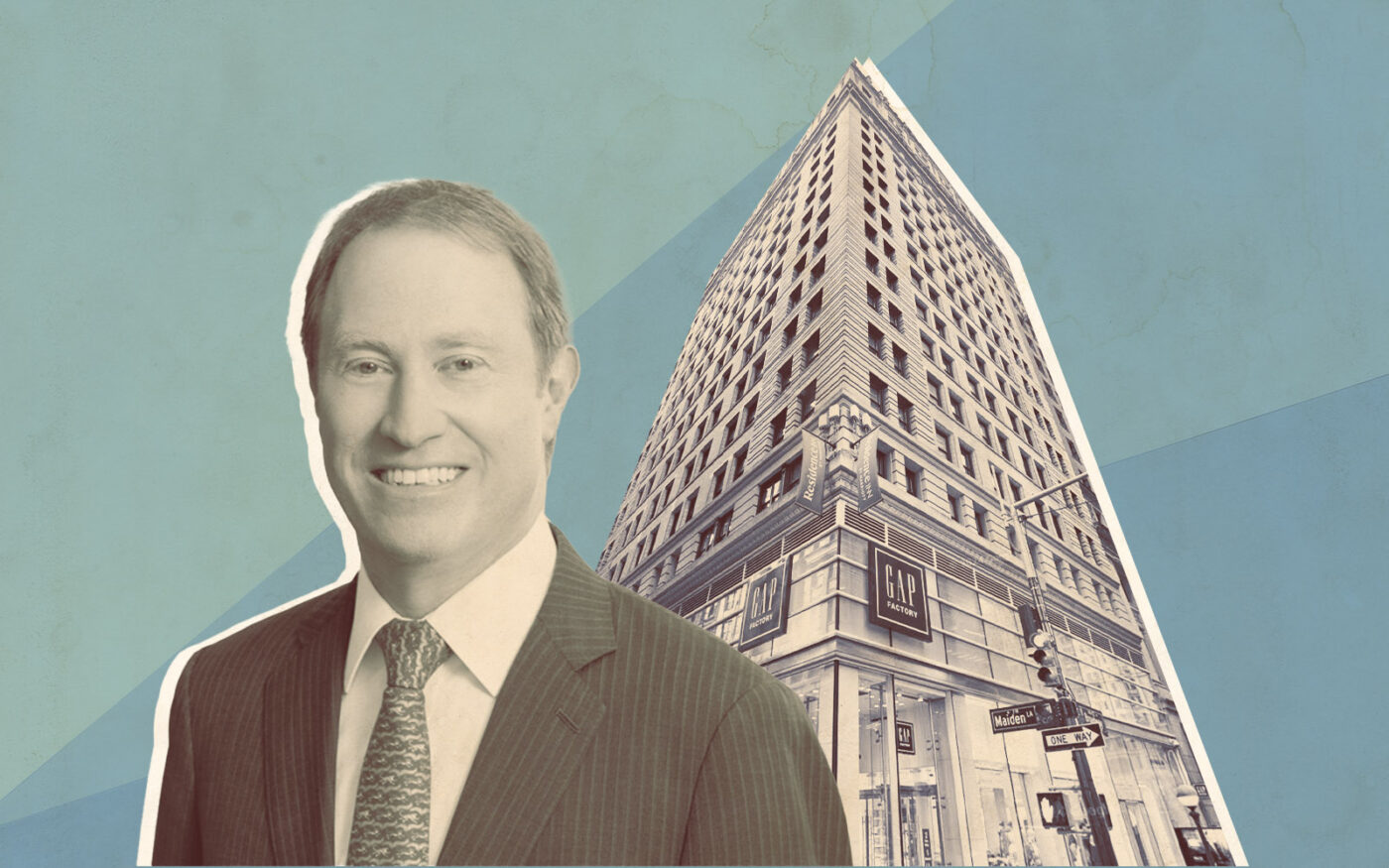

A $64 million mortgage backing the Lower Manhattan retail property was sent to special servicing as “imminent monetary default” looms in April, according to credit rating agency KBRA. The landlord, a partnership of Morgan Stanley and an affiliate of Crown Acquisitions, is behind on loan payments, Crain’s reported.

The entirety of the property’s 16,000 square feet is occupied by Gap, which took the space in 2015 for $263 per square foot on an annual basis. The lease included escalations of 3 percent annually until its expiration in 2030.

While there’s still five years to go until that lease comes due, Gap already appears unlikely to renew its deal, according to KBRA. Due to its outsized impact on the property, there are concerns the landlords may not be able to refinance the mortgage when it comes due in a few months.

Gap and Morgan Stanley did not return requests for comments from Crain’s.

This is not the first time the presence of Gap — or lack thereof — has given the landlords grief.

In March 2020, Gap closed its location at 170 Broadway in response to the state mandate to shutter non-essential stores. A month later, Gap declared in public filings that it would stop paying rent on shuttered stores, leading to a dispute with the landlords.

During the summer, Gap sued to block a lease termination at the property, arguing it had already terminated the lease earlier because the pandemic had “completely frustrated” the retail lease. The retailer argued it was entitled to a refund for a prorated portion of the rent and expenses paid that March, as the store closed roughly halfway through the month.

Ownership ultimately won the legal battle, forcing Gap to pony up the overdue rent.

Read more