Fresh off one of its best quarters — as per chair Stephen Schwarzman — Blackstone is ready to get back into Manhattan’s office market.

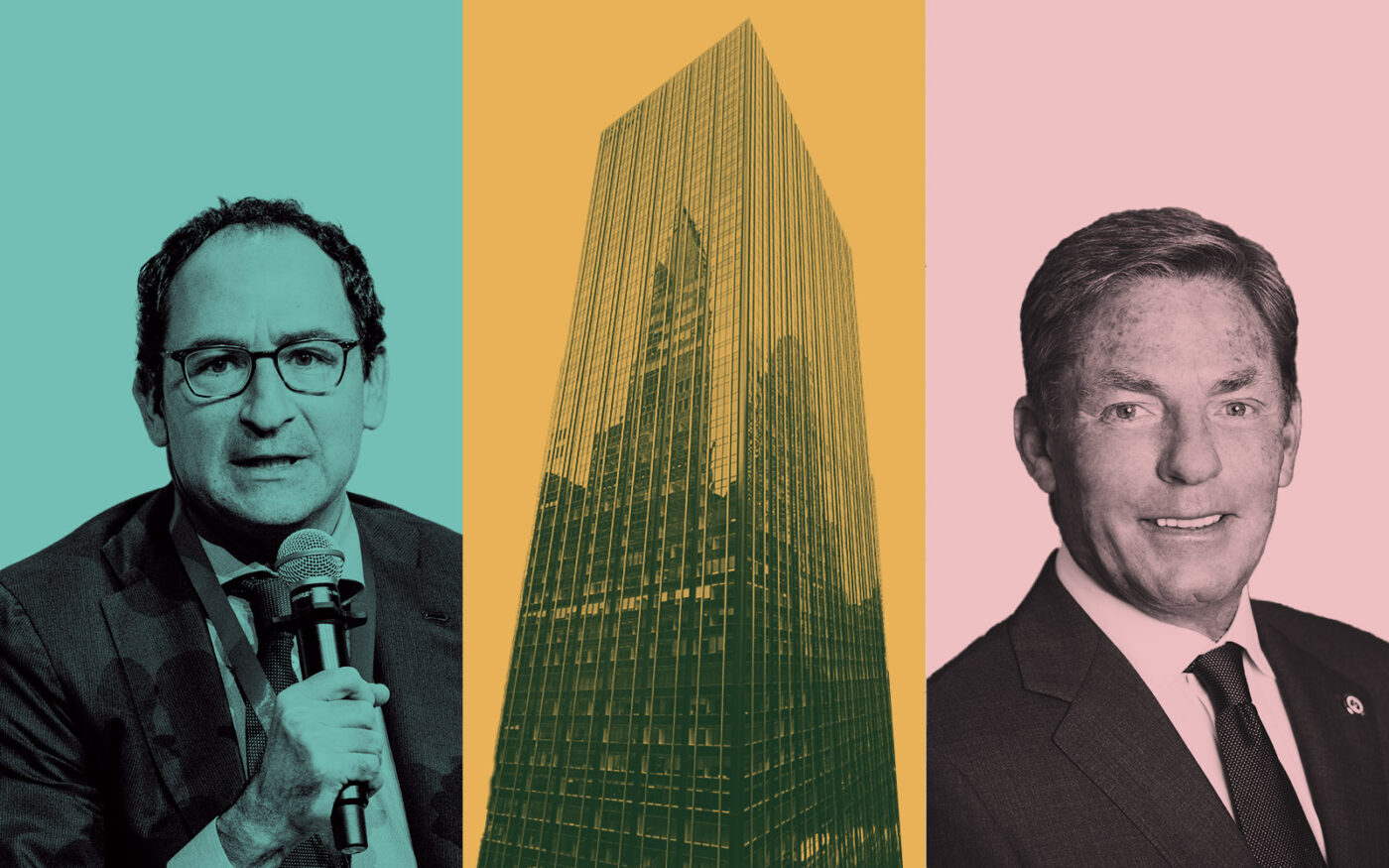

The investment giant is in discussions to purchase 1345 Sixth Avenue in Midtown Manhattan, Bloomberg reported. It’s not clear how much Blackstone would be willing to pay Fisher Brothers and co-owner JPMorgan Asset Management for the 1.9-million-square-foot property.

In November, S&P Global appraised the property’s value at $896 million in a November 2024 report, down significantly from a valuation when Fisher secured a loan.

There’s no guarantee that a deal for the 50-story tower will close. Blackstone declined to comment, while Fisher and JPMorgan did not immediately respond to requests for comments.

In a market motivated by flight-to-quality, 1345 Sixth Avenue is a strong performer, boosted by a $120 million capital project where Fisher updated the exterior and added an amenity floor and a public art installation.

Last year, Intercontinental Exchange signed a lease for 143,000 square feet. A month before, law firm Paul, Weiss, Rifkind, Wharton & Garrison signed a 20-year lease for 765,000 square feet, one of the largest office leases in the country in 2023.

Even though office leasing in Manhattan exceeded 30 million square feet last year for the first time since 2019, Blackstone’s potential reentry into the market still seems to come out of the blue.

A majority of the firm’s real estate holdings prior to the Great Recession were office assets. In the years since, however, the company turned to focusing on apartments, warehouses, and most recently, data centers. Blackstone shrunk its office holdings to less than 2 percent of its broader real estate portfolio.

It’s been three years since Blackstone’s last big move in Manhattan’s office market. In 2022, the company acquired a 49 percent stake in One Manhattan West from Brookfield and the Qatar Investment Authority, a deal valuing the 67-story tower at $2.85 billion.

Read more