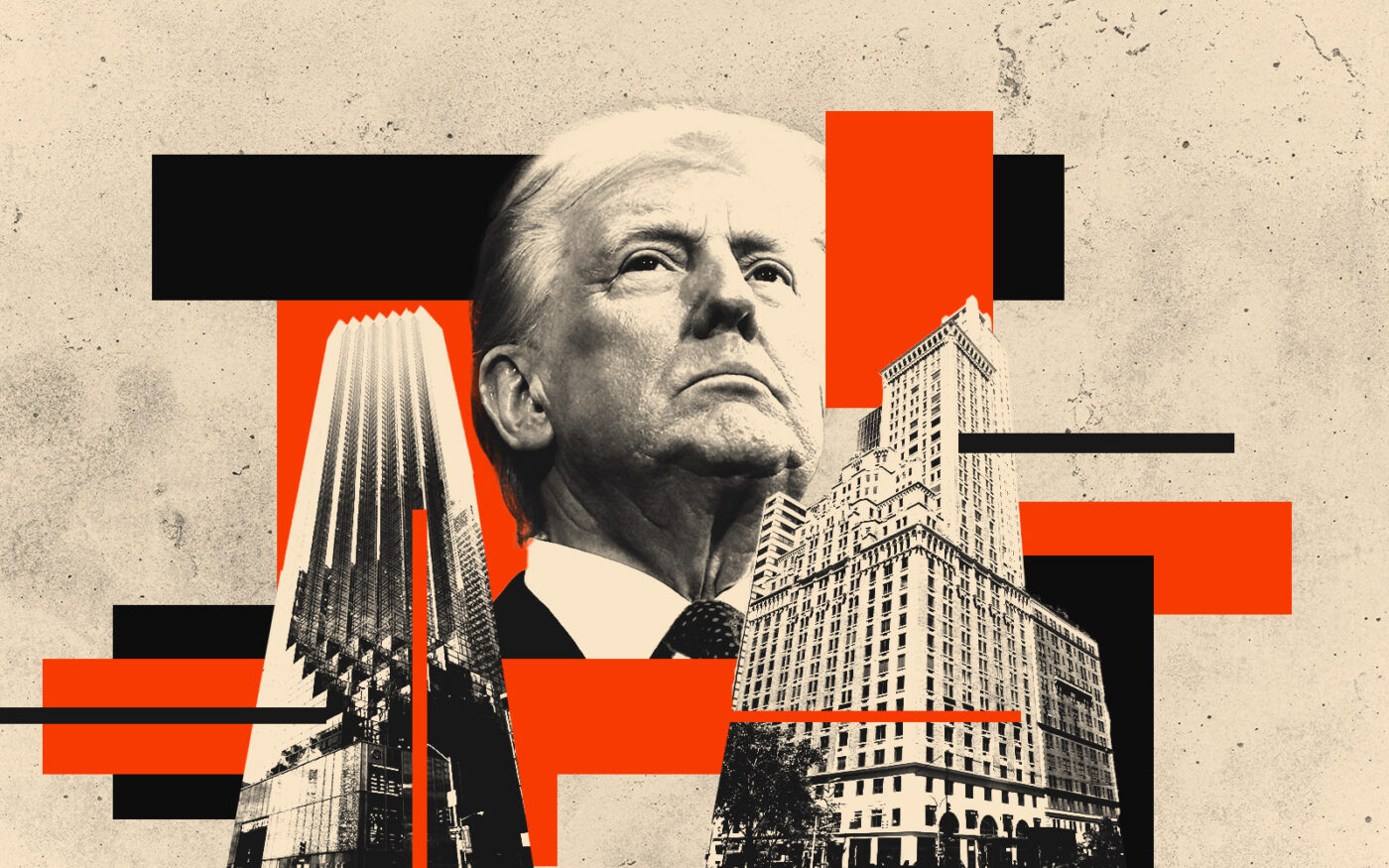

During Donald Trump’s political rise, his brand took a big hit from left-leaning New Yorkers disgusted by his politics and rhetoric. In his second term, many seem less troubled by the association.

The stigma of buying a Trump-branded condo in Manhattan is fading, brokers told Curbed. Agents relayed a shifting tone for buyers, who are either more willing to wear their political affiliations on their sleeves (or heads) or those who simply don’t care about the connection anymore.

“It’s been night and day,” said Brown Harris Stevens’ Lisa Simonsen, who has a $10 million listing at Trump Park Avenue. “It’s just a completely different climate now.”

Trump’s first ascension to the White House shell-shocked many in Manhattan, who wanted little to do with the real estate titan who made a name for himself in the city. Residents of at least four buildings successfully pushed for Trump branding to be removed from their properties over recent years.

Data justified those decisions. Condominiums with the Trump name underperformed against the rest of the condo market beginning in 2016, the same year of his first election.

Between 2013 and 2023, seven Manhattan condo buildings that kept the Trump name saw price per square foot values drop by 23 percent, according to CityRealty. In the same span, values rose by 9 percent in the former Trump-branded buildings.

That may be a thing of the past according to brokers, who noted the stigma around Trump doesn’t seem as strong, evidenced by the gains Trump made among New York voters in the most recent election.

“People are less fearful to speak their mind,” Compass commercial broker Adelaide Polsinelli said.

Anecdotes are not empirical evidence, however, and many of the brokers with listings at Trump properties are incentivized to make them sell. It’s too early from the election to know if the values of Trump-branded condos are improving against the rest of the market. The sample size of buildings bearing his name has shrunk to five properties.

The market forces could also be a contributing factor, according to Miller Samuel’s Jonathan Miller, such as pent-up demand, an acceptance of higher interest rates and the stock market.

Read more