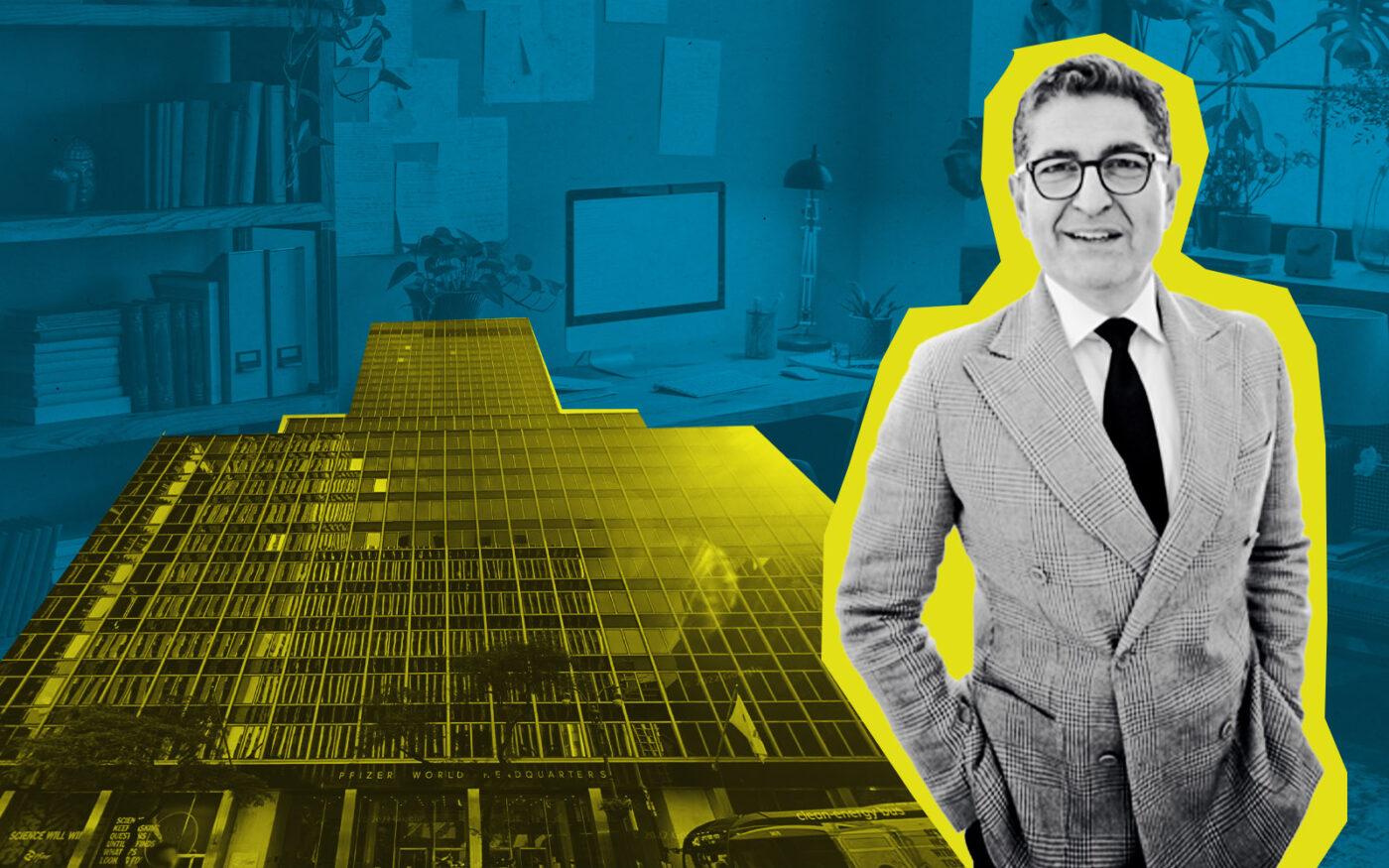

Metro Loft Management and Investments’ historic office-to-residential conversion of the former Pfizer headquarters in Midtown Manhattan is getting a shot in the arm.

Northwind Group provided a $135 million loan to the developers for their project at 235 East 42nd Street in Midtown Manhattan, Bloomberg reported. The debt is being secured by the fee interest in the building.

Northwind’s most recent debt fund originated the loan, which was arranged on the borrower’s behalf by a Newmark team including Adam Spies and Jordan Roeschlaub.

This is the second time Northwind provided debt for the project; over the summer, the firm provided $75 million to the same joint venture at 219 East 42nd Street, which is part of the firms’ development plans.

Almost a year ago, Nathan Berman’s Metro Loft reached a deal to convert the former Pfizer headquarters into approximately 1,500 rental units, which would represent the largest office-to-resi conversion in New York City.

Berman agreed to buy a minority stake in the buildings from David Werner, who had bought the interests in the property five years earlier when Pfizer relocated to Tishman Speyer’s Spiral.

Werner owns the leasehold on the larger of the two buildings, the 33-story 235 East 42nd Street, after buying it for $407 million. It purchased the smaller 10-story 219 East 42nd Street in partnership with life sciences developer Alexandria Real Estate Equities for $142 million with plans to renovate it for life-sciences tenants, but Werner ultimately bought the property from the REIT.

Metro Loft has emerged as one of the city’s leaders in the redevelopment process. Beyond East 42nd Street, the developer is working on a 1,300-unit conversion at 25 Water Street in the Financial District, one of the city’s biggest office-to-resi conversions in the works.

Northwind is carving out its own lane in the conversion space. Two years ago, it bought the $100 million A-note on the residential conversion of the former Hudson Hotel in Midtown.

Read more