The Gramercy Square Condominiums brought 223 condos to the market in 2018 and allegedly, a whole lot of headaches.

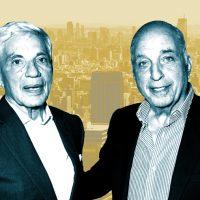

The building’s board is accusing the condominium’s original developers Clipper Equity’s David Bistricer and Chetrit Group’s Meyer Chetrit of creating defective condo units and mismanaging the condominium’s assets at the four-tower project.

In a complaint filed on Wednesday, the board alleged that the “serious and substantial defects” in the building include “widespread and recurring leaks,” improperly installed boilers, inadequate fire stopping, cracked interior window panes and improperly installed wood floorboards.

The board also alleged that Bistricer and Chetrit, along with two other named defendants, misappropriated up to $800,000 in condominium funds.

The board is seeking at least $75 million in compensatory and punitive damages. The board is also seeking to hold Bistricer and Chetrit, whom it claims are the majority owners of the LLC sponsor of the building, personally liable.

A filing plan amendment from 2024 states that Meyer Chetrit is no longer a principal of the sponsor.

Bistricer denied the allegations in an email and said he is working with the condominium “in an effort to resolve” any issues raised by the board. He noted that the sponsor team held weekly meetings with the board president to understand and remediate any issues.

The board claimed it notified Bistricer and Chetrit, as well as Jay Rappaport and Eddie Tischo, who were former board members and named as defendants, of the issues with the building, and the group “continued to flout responsibility.”

The board claimed that the damage, including flood damage, that resulted from the alleged defects caused a “sizable increase” in the board’s insurance costs.

Howard L. Zimmerman Architects & Engineers, whom the board hired to inspect the building, found that the work done did not conform with the development’s offering plan or legal and industry standards, according to the board. The complaint stated that the deviations uncovered by HLZAE posed “life safety issues.”

The board claimed that as a result of the defects, the units in the building are now unmarketable and have suffered in value.

The development launched sales in 2018 and currently has 15 sponsor units listed for sale on StreetEasy. The projected sellout for the project is $834 million, and has garnered several top sales in the past few years, including a penthouse purchased by Grindr co-founder Joel Simkhai for $19.5 million ($10 million off the asking price).

In 2020, Bistricer and Chetrit secured $208 million in new financing to recapitalize the project, after the Reuben brothers bought $100 million of the existing debt on the building at a discount months prior. SL Green Realty had originally provided a $380 million debt package in 2018.

The four-building project, which Chetrit and Bistricer purchased in 2013 for $150 million, has addresses at 215 East 19th Street, 220 East 20th Street, 225 East 19th Street, and 230 East 20th Street.

Chetrit has faced a number of foreclosures around the city in the past year, including at The Times Square Hotel, where the lender alleged Chetrit, along with his brother Joseph, owed $223 million on three mezzanine loans secured by the property. Chetrit has also been sued for unpaid loans at a mixed-use property in New Jersey and an apartment complex in Queens.

Correction: A previous version of this story referred to Meyer Chetrit as a current sponsor of the LLC that owns the building. It has been updated to note that Chetrit is no longer a principal of the sponsor.

Read more