New York City’s industrial market posted a peak performance last year.

Activity in 2024 reached the closest resemblance the sector has had to the robust times at the onset of the pandemic. But there are signs that the market is stretched to its limit.

Last year, tenants leased more than 2.8 million square feet in the city’s outer boroughs, according to Crain’s. The data comes courtesy of JLL, which noted 2024 as the year’s second-busiest on record, albeit only half as bustling as 2020, which featured 5.6 million square feet of leases.

Tenants showed increased interest in spaces between 50,000 and 100,000 square feet. There were 18 leases of that size last year, compared to only four in the previous period.

But another data provider recorded signs of a tightening market in the last quarter of the year. Leases from October to December only accounted for 400,000 square feet of activity, according to CBRE. That’s a decrease of 36.8 percent from the two-year average.

The average asking rent in the sector jumped year-over-year in the fourth quarter to $30.39 per square foot. That’s another sign of the compressed market, as tenants like film production studios, food manufacturers and logistics providers battle for less and less space, driving rents up.

Even though developers delivered 2.7 million square feet last year, the vacancy rate was still a hamstrung 4.3 percent, according to JLL. Only five significant projects are in the pipeline — two of which are anticipated to wrap by next year — so space will remain at a premium, a boon for investors and landlords, a hindrance for prospective tenants.

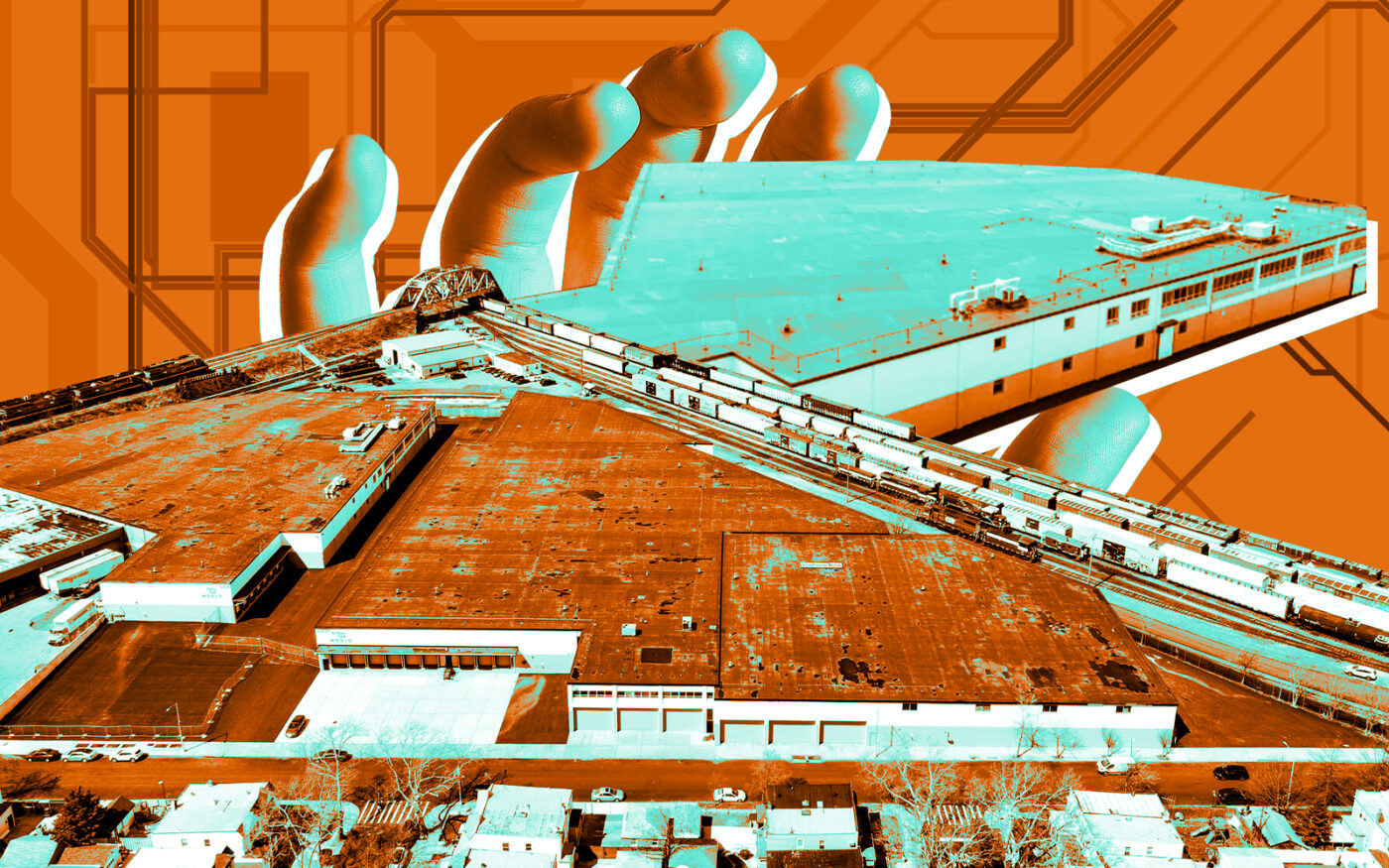

There could be another big project in the offing down the road after industrial giant Prologis acquired 440 Kingsland Avenue on the Greenpoint waterfront from ExxonMobil for $122 million. It’s not clear what the company plans for the site, though a logistics facility or a vehicle storage hub appear to be two viable possibilities.

Read more