Queens scored three of the top five largest loans in November, another sign that the unpretentious outer borough has ascended the real estate throne.

The loans were spread across three different asset classes. Santa Monica-based Macerich reeled in a $525 million refi at its 966,000-square-foot Queens Center mall. It was the REIT’s largest outstanding loan.

The New York City Football Club scored $425 million for its planned 25,000-seat Willets Point stadium. And Rockrose nabbed a $240 million refi for its 709-unit Long Island City rental building Linc LIC.

Meanwhile, in Manhattan, Dan Brodsky and his partners grabbed a $357 million construction loan for their condo conversion of the Flatiron Building.

TRD broke down the five largest loans in Manhattan and the top five in the outer boroughs. Here are more details.

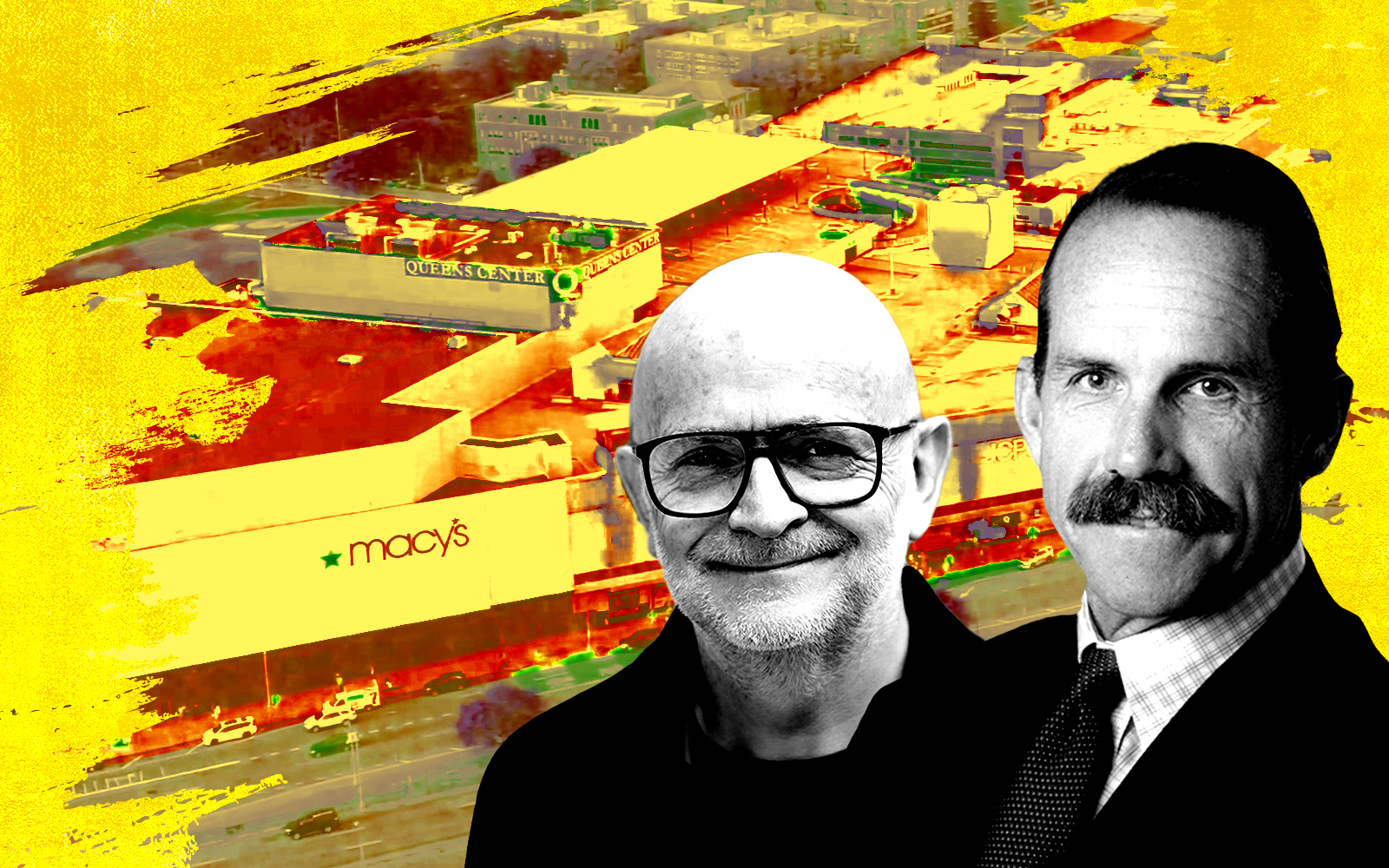

Mall madness | $525M | Elmhurst

Deutsche Bank provided a $525 million loan to Macerich for the Queens Center mall. The REIT chipped in $75 million to secure the financing for the mall at 90-15 Queens Boulevard in Elmhurst, according to Crain’s. The previous $600 million CMBS loan was transferred to special servicing for six months during Covid. The new five-year loan has an interest rate of 5.4 percent, according to a press release from the REIT. Macerich President and Chief Executive Officer Jack Hsieh called the Elmhurst mall “one of the best-performing properties in our entire portfolio.”

Stadium score | $425M | Willets Point

JP Morgan Chase provided $425 million for a New York City Football Club’s planned soccer stadium at Related Companies’ and Sterling Equities’ massive Willets Point development. The privately owned soccer club took over the ground lease at 37-11 126th Street for Etihad Park, New York’s first stadium dedicated only to soccer. It broke ground on the $780 million stadium in December and it is expected to open in 2027. Owners include the deputy prime minister of the United Arab Emirates, Sheikh Mansour bin Zayed al Nahyan, whose net worth is reportedly $300 billion. The stadium is part of the second phase of the development at Willets Point, which will also include 1,400 affordable apartments, a 250-key hotel and 80,000 square feet of retail.

Flatiron funds | $357M | Flatiron District

Tyko Capital provided $357 million to Dan Brodsky and his partners for their conversion of the Flatiron Building. Brodsky, the Sorgente Group and GFP Real Estate plan to convert the iconic building at 175 Fifth Avenue into 60 residential condos. Brodsky paid $40 million last year to buy a 25 percent stake in the Flatiron Building, which had fallen into limbo as its owners disagreed on a strategy for the aging icon.

CMBS cash | $267M | Williamsburg

Mishmeret Trust Company provided a $267 million CMBS loan to Joel Gluck’s Spencer Equity Group and the Rabsky Group for five Williamsburg rental properties. The deal was split into two transactions – a $158 million loan for the residential condominium portions of 322, 330, 342 and 352 Wallabout Street, and a $109 million loan for the retail and parking condo units in those properties and the entire building at 13-15 Gerry Street, according to PincusCo.

Linc loot | $249M | Long Island City

Wells Fargo provided $249 million to Rockrose Development for its Long Island City rental building Linc LIC. The fresh financing replaced a $240 million CMBS loan originated by Morgan Stanley in 2014. The 731,000-square-foot luxury building at 43-10 Crescent Street has 709-units across 42 floors. It’s located in the Court Square neighborhood, where nine noteworthy new projects were completed around the same time a decade ago. A studio apartment at Linc LIC rents for $3,700 and a two bedroom for $6,800, according to the building’s website.

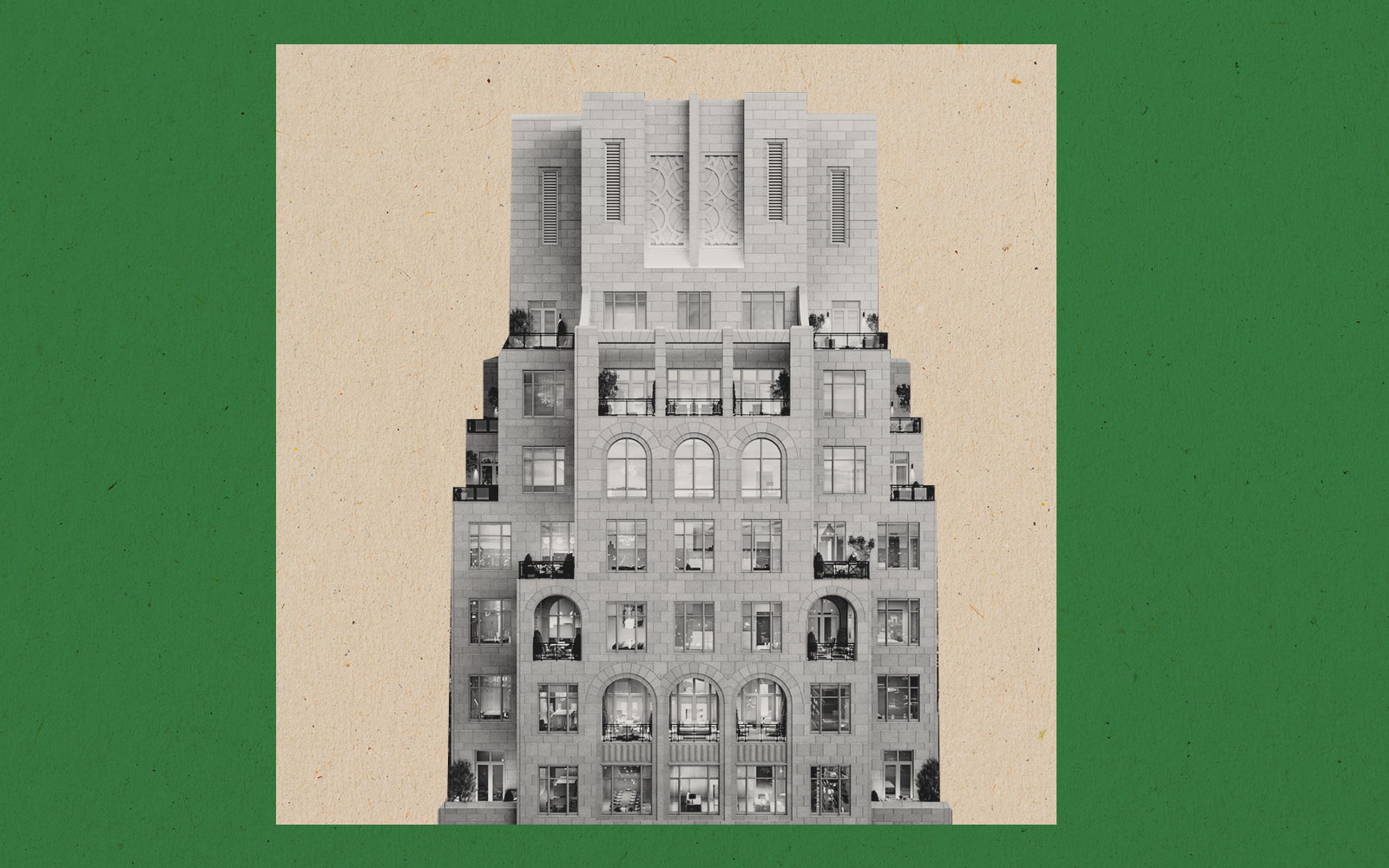

Condo currency | $205M | Murray Hill

Kriss Capital and Klirmark Capital provided $180 million to Ian Bruce Eichner’s Continuum Company for its condo project at a former Murray Hill church site. The New York-based private lender and Israeli firm provided the senior loan for the planned 137-unit building at 26 East 35th Street. Real estate investment firm Corigin issued the $25 million mezzanine loan. The loan term is 30 months. The 173,000-square-foot building — at the intersection of NoMad, Midtown South and Murray Hill — is expected to be completed by early 2027. The 18-story project will include a below-grade parking garage and ground-floor medical offices.

Naftali net | $140M | Lenox Hill

JPMorgan Chase provided a $140 million construction loan for The Naftali Group’s development at 255 East 77th Street. This is the lender’s second loan at the Lenox Hill project; last year, JPMorgan and Barry Sternlicht’s Starwood Capital provided $236 million for the 62-unit, 500-foot-tall tall development. The debt was split between JPMorgan’s $195 million senior loan and Starwood’s $41 million in mezzanine debt. Naftali purchased the land for the condo project three years ago for $73 million. The building is set to span 190,000 square feet and has a projected sellout of $531.6 million, according to documents filed with the state attorney general.

Discount debt | $119M | Upper East Side

Acore Capital provided $118.5 million to Ofer Yardeni’s Stonehenge and Carlyle Group for the purchase of a 150-unit Upper East Side luxury apartment complex. The New York-based real estate company and private equity giant teamed up to buy The Henley at 165 East 66th Street for $128 million from Los Angeles-based investment firm CIM Group. CIM spent $200 million to purchase the property half a decade ago, representing a 36 percent drop in value likely tied to elevated interest rates.

Multifamily moolah | $110M | Manhattan, Brooklyn

Hudson Bay Capital provided $110 million to Davean Holdings and Meadow Partners for 18 multifamily properties in Manhattan and Brooklyn. The New York-based firms refinanced the portfolio, which includes 112 apartments and 29 commercial units, with a floating-rate bridge loan. They purchased some of the properties in 2021 for $58 million in separate, all-cash deals, then secured a $50.5 million loan from Fortress Investment Group. They added more buildings to the portfolio and sold some. The properties span several neighborhoods including the East Village and Park Slope.

Office refi | $72M | Bryant Park

Bank of America provided $72 million to Ben-Josef Group Holdings for its office building a block from Bryant Park. The fresh financing at 104 West 40th Street replaced a loan for the same amount from Wells Fargo. Ronen Ben-Josef’s firm bought the 200,000-square-foot Class A building in 2012 for $103 million.

Read more