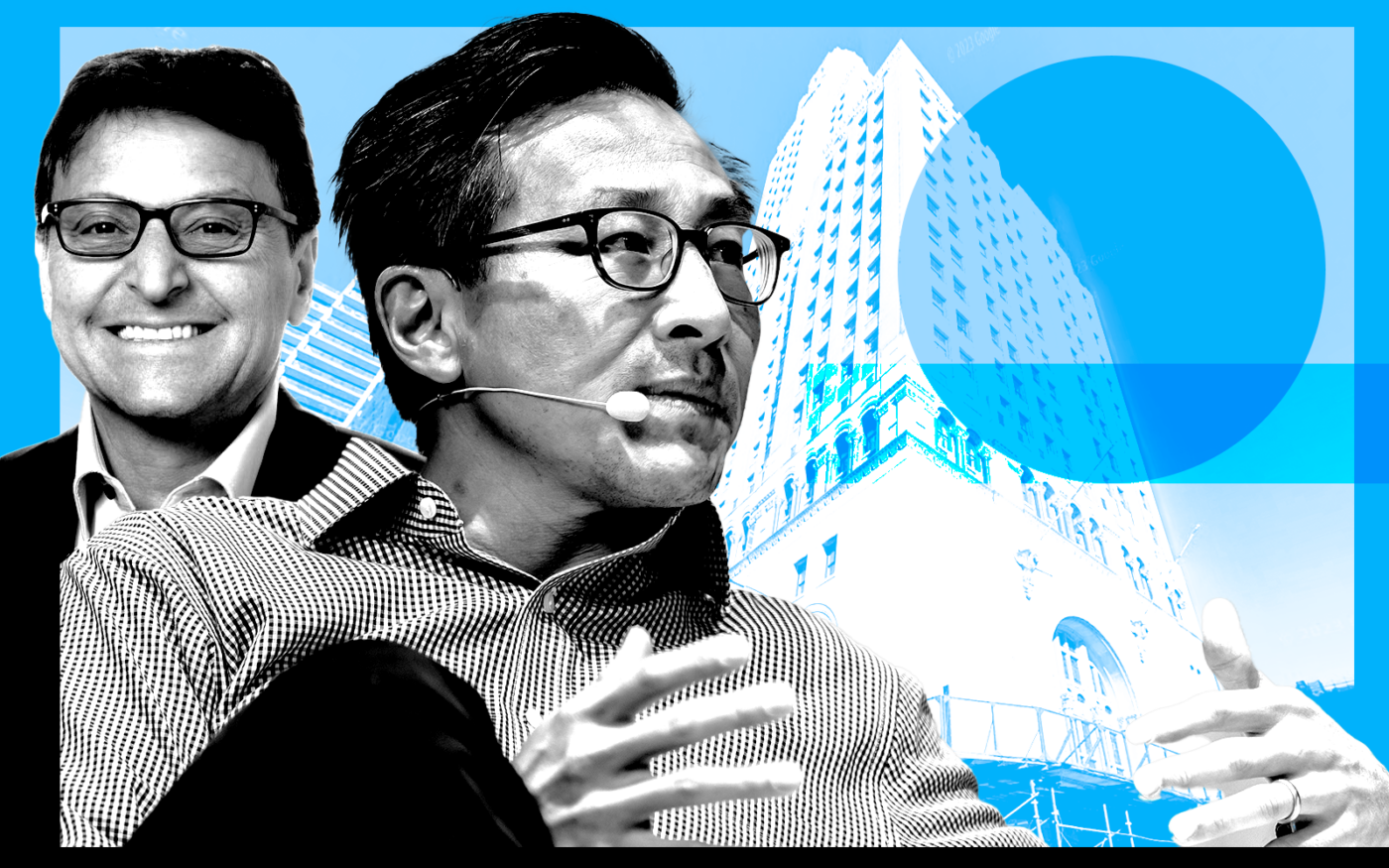

Alibaba co-founder and Brooklyn Nets owner Joe Tsai is adding a new property to his roster.

Tsai’s BSE Global — the holding company for the Brooklyn Nets, Barclays Center and the New York Liberty — paid $10.3 million in a foreclosure sale for the retail portion of the Williamsburg Savings Bank Tower, a block from the arena.

It’s unclear what he plans to do with the property in the former bank building also known as One Hanson Place, which for decades was its tallest structure. BSE is in the midst of a five-year plan to “enhance the fan experience” at Barclays with multiple renovation projects, according to its website.

A BSE spokesperson confirmed the purchase but declined to comment on its plans.

The sale of the 41,400-square-foot retail condo, first reported by PincusCo, comes three years after lender Amherst Capital brought a foreclosure action against its owner, a joint venture between Madison Realty Capital and private equity firm Siguler Guff.

Madison and Siguler Guff bought the property in 2015 for $18 million, betting on a new wave of high-end retailers coming to Downtown Brooklyn. A year later, the joint venture secured three loans totaling $22.2 million from an Amherst fund.

But finding a tenant proved difficult. The tower is landmarked, making changes to the exterior or interior nearly impossible. Then came Covid and, still without a retail tenant, Madison and Siguler Guff defaulted on the loan in the summer of 2020.

A judge finalized the foreclosure judgment in January, calculating the amount owed on the loan at $23.8 million along with default interest.

Read more

One Hanson Place was built between 1927 and 1929 and served as a headquarters for the Williamsburgh Savings Bank. Until 2009, it was the tallest building in Brooklyn at 512 feet and was known for its four-faced clock and dome top, which mimics a cathedral.

Dermot Company converted the aging office building, which was known for its preponderance of dentists, into nearly 200 condo apartments in the mid 2000s.