In just 10 days, the future of Charles Cohen’s fortune is to be decided on the courthouse steps.

On the line for the real estate scion are assets tied to a $534 million loan Fortress Investment Group alleges is in default and a $187 million personal guaranty the lender won the right to collect on.

It would be the largest UCC foreclosure ever. Still, the auction would likely fail to satisfy what Cohen owes, court filings indicate.

“[Fortress] could then, potentially, pursue [the claim] against Cohen Realty Enterprises, if it’s solvent,” Fortress attorney Lindsey Harris said at a hearing this summer, referring to the Cohen’s company at issue in the case.

Cohen Realty Enterprises is the parent company to entities that collateralize the Fortress loan, according to court records. It is separate from Cohen Brothers Realty, a firm that owns many of Charles Cohen’s New York office towers.

But Cohen Realty Enterprises might not be solvent. A January audit that just hit court records found “substantial doubt about the company’s ability to continue as a going concern.”

Cohen Realty Enterprises lost $22.5 million and posted negative equity of $502.5 million for the fourth quarter of 2022, independent auditor RSM US found. The latter is a harbinger of bankruptcy.

Neither Cohen’s attorney Donald Harwood nor Fortress’ Harris responded to requests for comment. At the summer hearing, Harris said Fortress would have an unsecured claim against Cohen’s firm if the auction didn’t cover his debt.

In a May deposition that also hit court records this month, Cohen confirmed that the collateral for the Fortress debt is bleeding. The assets — which include a New York office building, a design center and a hotel in Dania Beach, Florida, a Westchester development site, and two movie theater companies — are running a collective net loss of $42 million.

In a rigorous line of questioning, Harris asked Cohen to confirm the net losses of each individual property. Several pages of the deposition offer a rare peek into how Cohen runs his business.

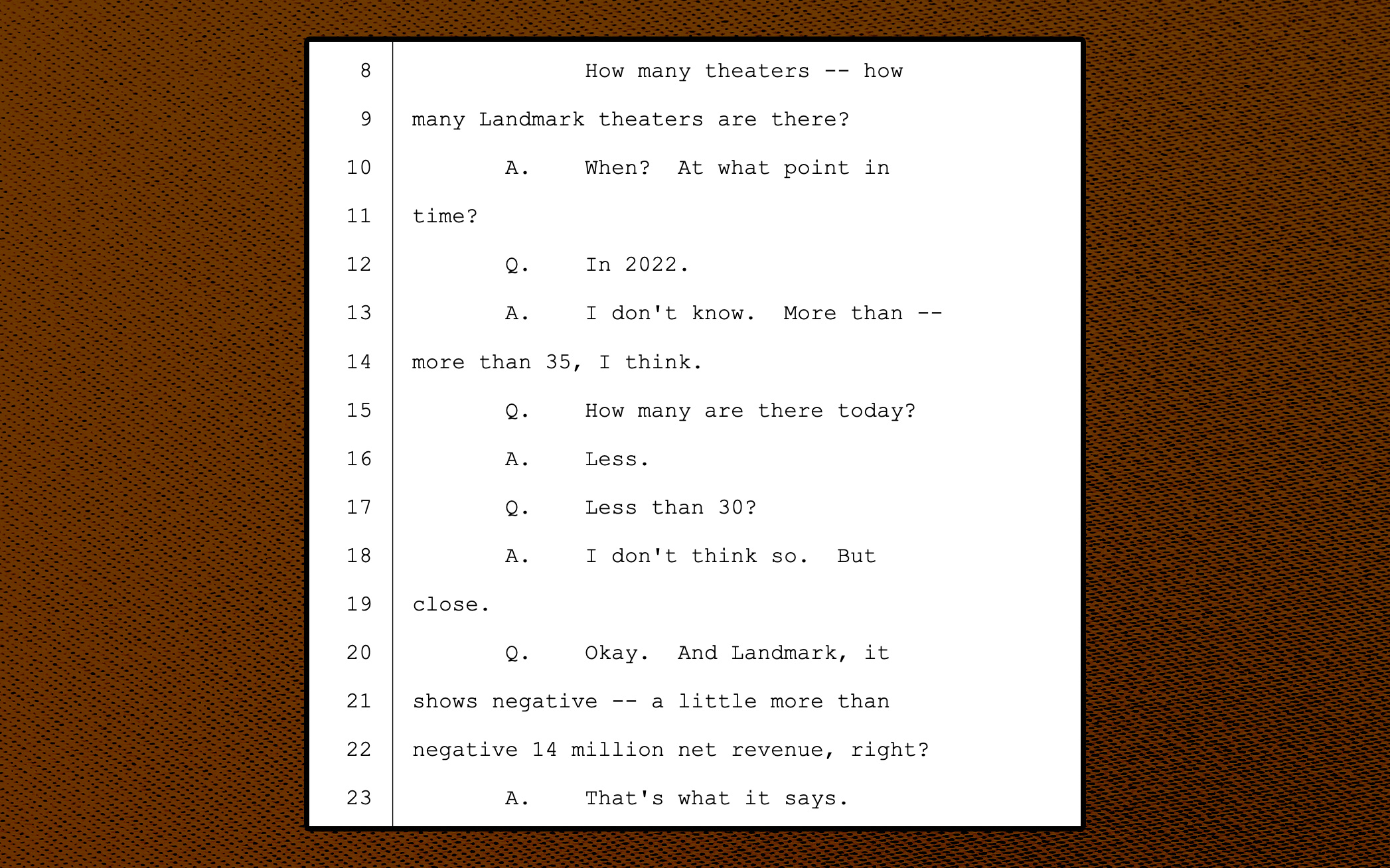

The principal faltered several times when asked for specifics on how many movie theaters he owned through the chain Landmark, for example, or what the item “Fortress loan draws, $7.1 million” refers to.

“Do you understand what that means?” Harris asks.

“No.” Cohen says.

It’s unclear if he was being obstinate because he doesn’t want to be in court. It’s also possible he afforded little time to his property investments as he dived into passion projects including a New York society magazine, Saint-Tropez vineyard and two London-based luxury retailers.

Cohen’s team has rebuffed the characterization of the film buff who took over his uncles’ and father’s real estate portfolio as uninterested in the industry.

“He is a hands-on executive” who approves and signs “every contract … every lease and virtually every check,” Cohen Brothers chief operating officer Steven Cherniak said this summer.

Cohen and Fortress may yet settle the foreclosure case before the Nov. 8 auction date.

But the billionaire’s apparent efforts to shield personal assets from Fortress suggests he is bracing for the worst: an auction that does not cover his personal guaranty. Fortress can’t collect on the judgment until the auction wraps.

Cohen, meanwhile, appealed the decision that awarded Fortress the $187 million, arguing there are “factual disputes” as to whether Cohen defaulted under the loan agreement, an appellant’s brief reads.

Cohen has allegedly transferred $70 million in assets, including a $20 million mansion in Greenwich, Connecticut, to his wife Clodagh Cohen, and a quartet of luxury boats to entities controlled by a Cayman Islands-based attorney, Fortress claims in court filings.

Fortress this month asked the court to block Cohen from selling or transferring any other interest in his properties.

This article has been updated to mention Cohen’s appeal and to add details about Cohen Realty Enterprises.

Read more