A developer appears to be following in the footsteps of two failed predecessors at an expansive site in Sunset Park.

Watermark Capital Group was sued by Rialto Capital Group last week for allegedly defaulting on a $45.3 million loan, according to Crain’s.

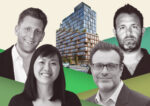

Maguire Capital Group was also named in the suit, but a source close to the situation told The Real Deal that Watermark bought out Maguire’s stake shortly after the two firms acquired the development site. Maguire’s Marvin Azrak had brought the distressed debt to Watermark as a development opportunity and initially had equity in the property.

Foreclosure would cut short Watermark’s plans to construct a 28-story, 497-unit project at 6128 Eighth Avenue. It would be the third failed attempt by developers to convert the parking lot, formerly a railyard.

Signature Bank, now defunct, issued the loan in January 2023, but the lawsuit claims the developers stopped paying in December. The outlet said two Watermark executives, Wolfe Landau and Meir Tabak, are also named as defendants.

Plans for the spot have met resistance from the community.

The property is a 3.7 acre parcel next to the N subway line in Brooklyn. Members of Brooklyn Community Board 10 have complained that the building would be much larger than any in the immediate area and argue that it should be subject to a public review because it was once a railyard.

But the Department of City Planning determined that no special permit was needed. That was a huge break for the developers, yet still the project did not happen.

Landau said the project would create housing in the midst of a severe housing shortage.

The developers before him didn’t have much luck either. Andrew Kohen’s MSK Properties wanted to build an 11-story tower and a Home Depot at the location, but backed off in the wake of the Financial Crisis. He sold it to Great Neck developers, whose names have not been reported, for $52 million.

The Long Island group, with funding from EB-5 investors, had even bigger plans. The architect Raymond Chan and the developers planned a massive, mixed-use development, The Real Deal reported. It would be anchored by a three-story mall with small retailers — Chelsea Market-style — with a 10-story hotel, two 15-story residential towers with a total of 350 apartments, and a 17-story office tower.

But they ultimately unloaded it to the Watermark-Maguire group in 2021, Crain’s reported. They also had their share of troubles, including a lawsuit by an EB-5 investor.

The group first filed for permits in 2022. The most recent application called for a 28-story tower with homes, medical offices and a grocery store, the outlet reported.

— Christina Previte

This has been revised to include that Maguire Capital Group was bought out of the project, according to a source close to the transaction.

Read more