Ryco Capital, a relatively new addition to the city’s multifamily investment scene, dropped $132 million in June on a multifamily portfolio in need of some elbow grease.

The deal closed in the same quarter that New York City’s sleepy multifamily market sprung to life.

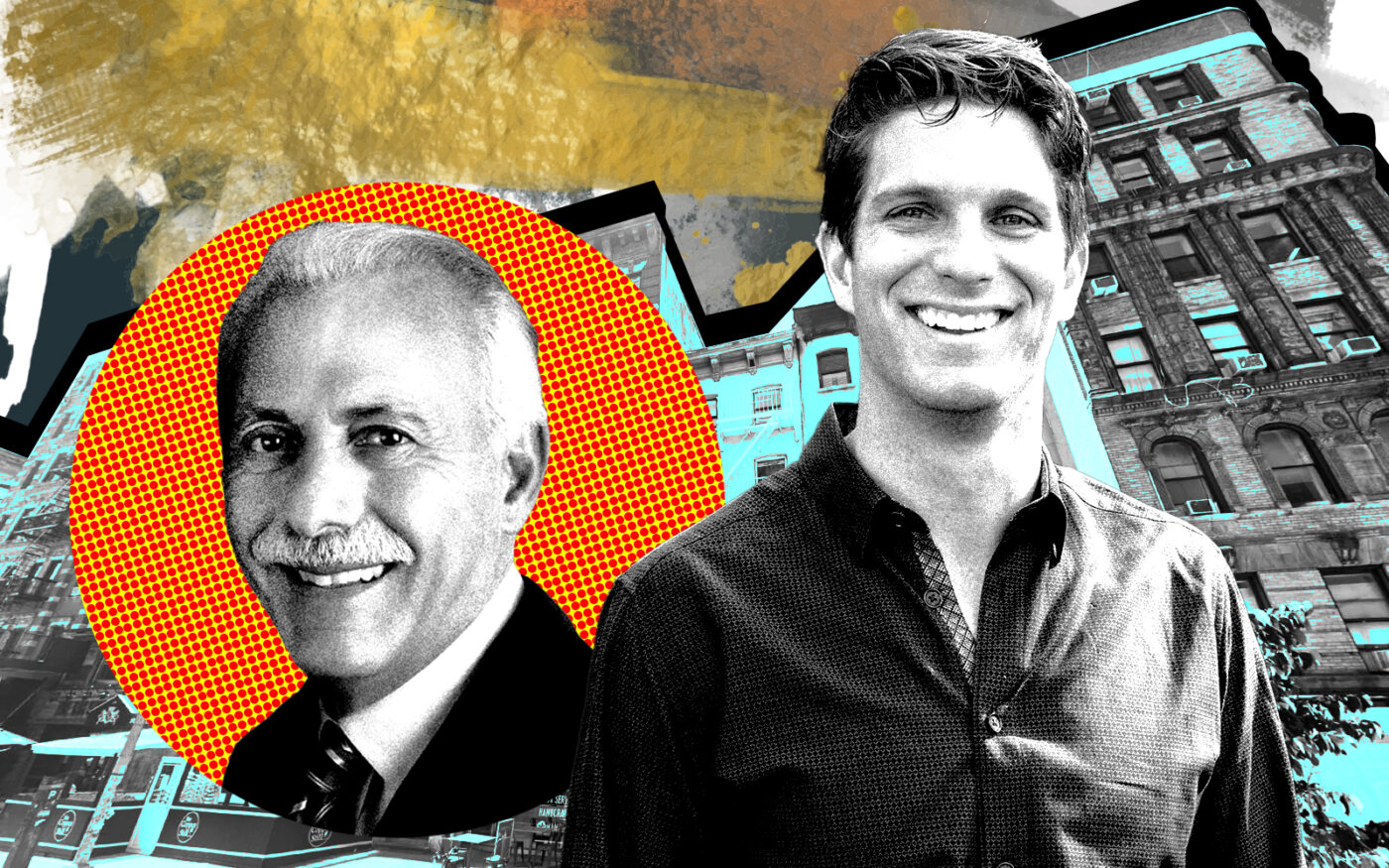

Ryco, founded in 2018 by James Ryan, bought nine East Village apartment buildings from Nathan Halegua and son Josh Halegua of Jonis Realty and Martin Newman. The properties are on Second Avenue between East 7th and East 10th streets and comprise 170 residential units and 13 ground-floor retail spaces, according to property records and a spokesperson for the sellers.

Ryco did not respond to a request for comment.

The Haleguas and Newman offloaded the portfolio in two chunks. The three buildings at 127 and 129th Second Avenue and 36 St. Marks Place traded for $29 million or $685 per square foot, according to the sellers’ spokesperson.

The other six buildings, which span Second Avenue between 8th and 10th Street and contain 109 apartments plus retail, sold for $865 per square foot, the spokesperson said. The price is a premium to the $757 per square foot similar buildings fetched in the second quarter, according to a recent report by Ariel Property Advisors.

A combination of fewer violations and rent-regulated units likely boosted pricing for the larger portfolio. The three-building deal has nearly 7 violations per unit and about one-quarter of those 61 units are rent-stabilized, according to city records. The six-property portfolio has under 3 violations per apartment and is about one-fifth rent-stabilized.

For Ryco, fewer violations mean less money spent on fines or repairs, and landlords of buildings with a smaller share of rent-stabilized units have a greater runway for revenue increases. The Haleguas and Newman, in their 25 years of ownership, converted a number of the portfolio’s apartments to market rate when the state’s rent laws still allowed for deregulation, the sellers’ spokesperson said.

Ryco specializes in renovating assets that have “suffered from under-investment and deficient management,” according to its website, meaning a fixxer-upper like the Second Avenue portfolio is its bread and butter.

Renovations will allow for rent hikes on market-rate units as city prices continue to flirt with fresh highs. In June, the most recent month for which data is available, Manhattan’s median rent hit $4,300, matching a record for the month set last year.

A two-bedroom at 127 Second Avenue rented for $3,300 in March, according to StreetEasy, an indication that Ryco has some room to run.

Read more

The properties are 127, 129, 141, 145, 149, 151, 156 and 157 2nd Avenue, and 36 St. Marks Place.

This article has been updated with information from a spokesperson for the seller.