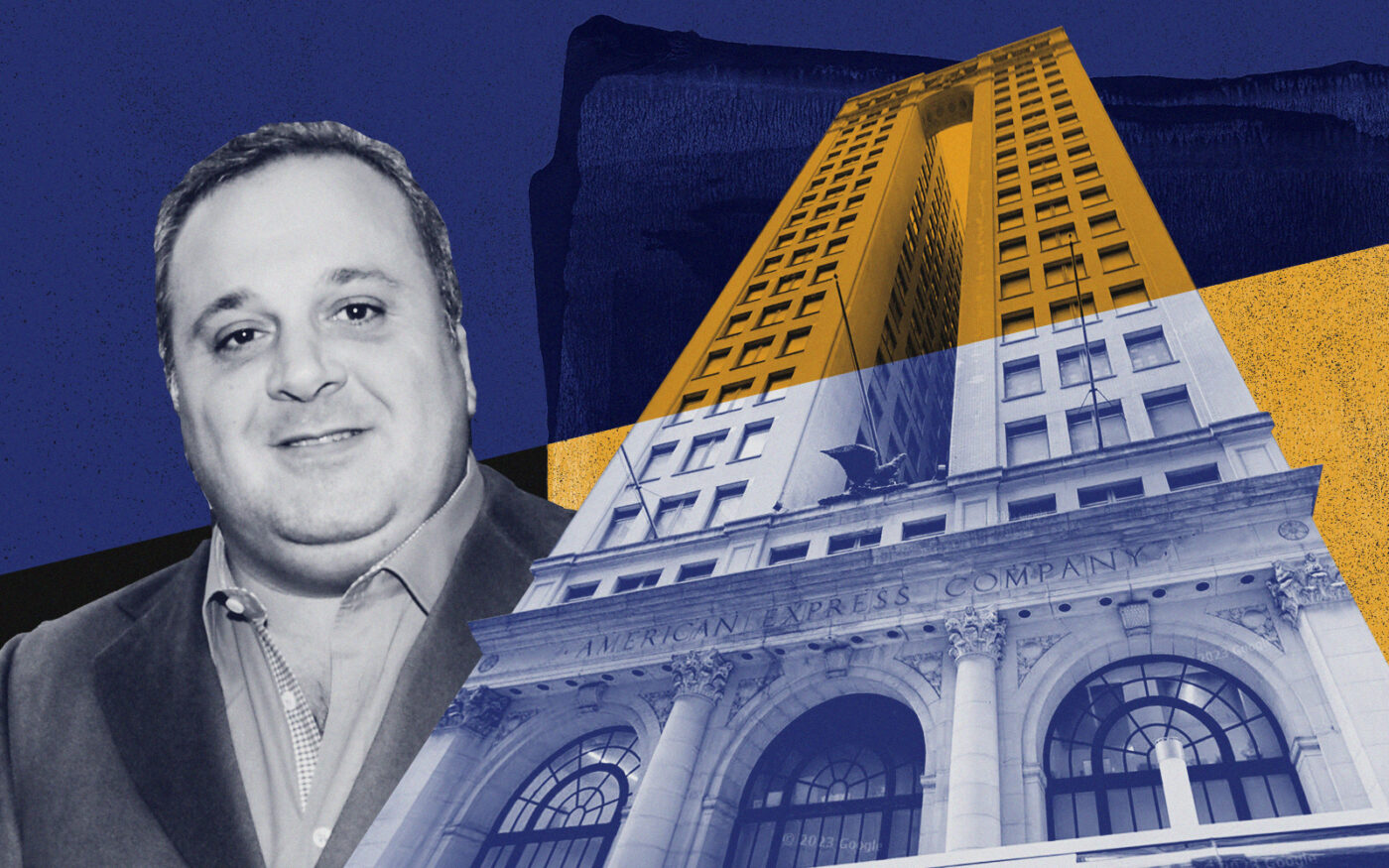

The news at Meyer Chetrit’s 65 Broadway keeps getting worse.

An appraisal this month valued the Chetrit Group’s Financial District office at $104.3 million, according to a Morningstar alert. That’s a 51 percent decline from the $215 million valuation posted in 2019, when a loan attached to the property originated.

Not only is the valuation less than half of the value when the loan was issued, but it’s a third lower than the $151 million loan itself. That could explain why Chetrit didn’t pay off the loan at maturity in April. But a representative of the Chetrit Group told The Real Deal that, contrary to Morningstar’s information, the loan does not expire until August.

The loan tied to the property went to special servicing in March. Chetrit was current on the loan at the time it hit special servicing.

The century-old office tower, formerly known as the American Express Building, has seen occupancy since Meyer Chetrit and loan co-sponsor Robert Wolf of Read Property Group locked in their debt in 2019. Occupancy was close to 100 percent back then, but was down to 75 percent by the end of 2022 and 67 percent in September.

Meanwhile, cash flow has come to a crashing halt. By the end of 2022, revenue was barely covering debt service and was 15 percent below issuance.

This article has been revised to remove references to 459 Broadway, 427 Broadway and 850 Third Avenue, which are owned by a different wing of the Chetrit family.

Read more