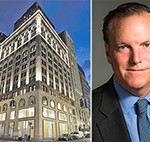

The Vanbarton Group has fallen behind on a nearly $90 million loan backing the Midtown office building where the company has its headquarters.

The investment firm defaulted on the $87.5 million loan that Deutsche Bank provided in 2019 for the 26-story office building at 292 Madison Avenue after failing to repay the debt when it matured last month, The Real Deal has learned.

Vanbarton bought the building in 2016 for $180 million and renovated it in 2018, updating the lobby, modernizing the elevators and upgrading the building systems. The roughly 200,000-square-foot building is about 70 percent occupied, according to marketing materials from Newmark, which was hired by Deutsche Bank to sell the non-performing loan.

A representative for Vanbarton Group declined to comment and representatives for Deutsche Bank did not immediately respond to a request for comment.

It appears that the two sides kept kicking the can down the road but eventually ran out of time. The loan had an original term of two years with three one-year extensions, all of which would’ve expired this year.

Vanbarton and the bank were close to a deal to restructure the loan, when Duetsche Bank decided to put it up for sale, according to a source familiar with the process.

This isn’t the first office building Vanbarton has had trouble with. In San Francisco, the company last year bought the building it had owned at 115 Sansome after the lender put it up on the auction block in a short sale.

In New York, Vanbarton is converting the former office building at 160 Water Street, where it launched sales in December. The company is also planning to convert some former WeWork office space at 980 Sixth Avenue into apartments.

Read more

Correction: A previous version of this post said Vanbarton is converting the former office building at 180 Water Street. The firm was bought out of that property in 2017, and is heading the nearby conversion of 160 Water Street.