Vornado Realty Trust is looking at office conversions, retailers who want to buy their space and owners who are in over their heads.

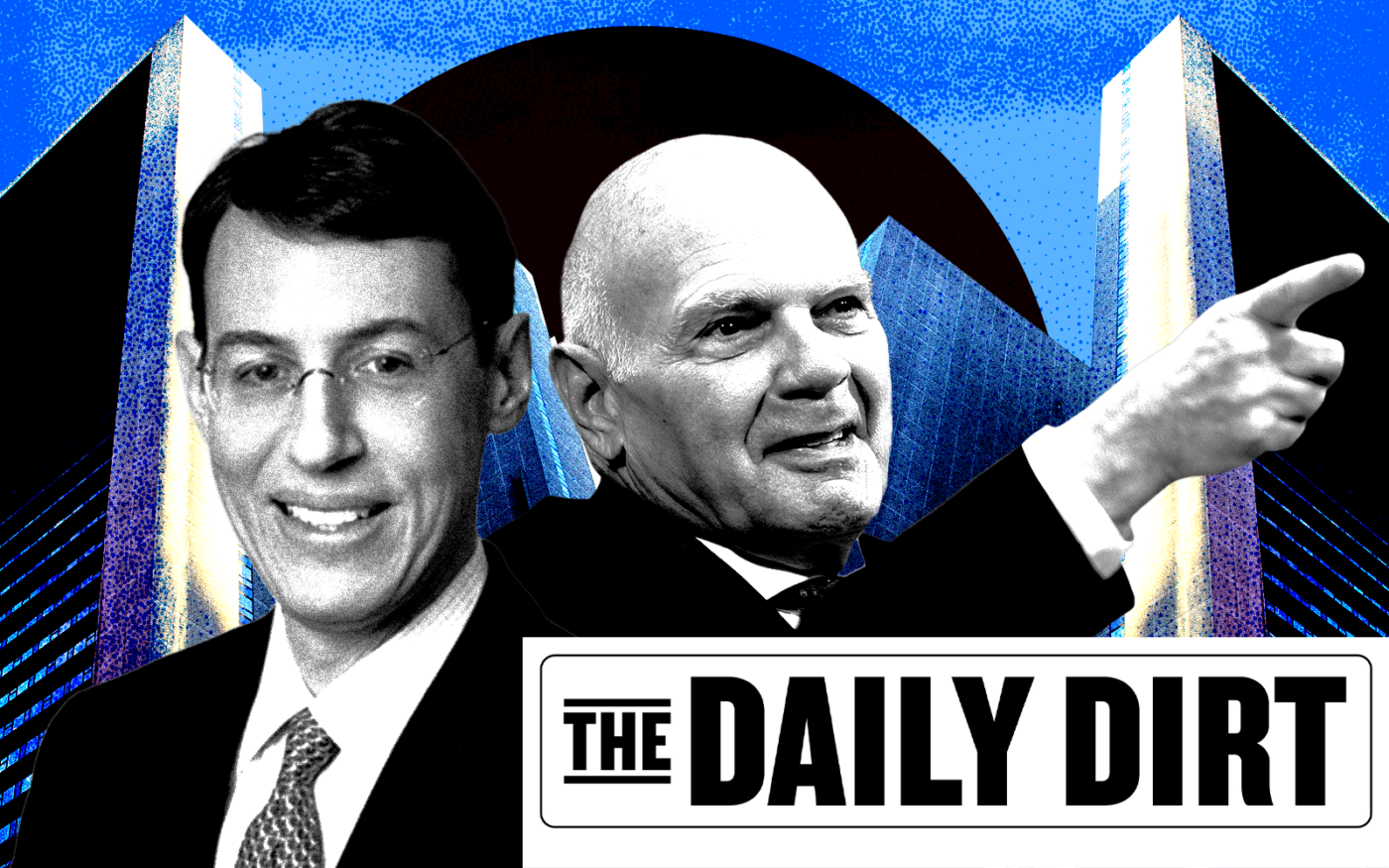

During its first-quarter earnings call on Tuesday, Vornado president Michael Franco hinted that retailers may be eager to scoop up the real estate investment trust’s properties on Fifth Avenue.

“I don’t think you’ve seen the last of the retail purchases, and obviously, given our portfolio, we’re fertile ground,” he said, referring to Prada and Kering’s purchases on the famous retail thoroughfare. “So we expect to be in the mix there.”

He did not go into specifics.

On distressed buildings, he said: “Lenders in general know that taking back assets and operating them, certainly in the office space, is not a winning strategy. Value deteriorates fairly quickly; tenants don’t want to go into those buildings.”

Vornado is looking for opportunities where buildings can be leased back up or, in cases where a property is no longer viable as office space, be repurposed as residential. Either way, they are looking for healthy returns, which implies higher risk.

“This is an opportunity that is not for the faint of heart,” he noted.

The real estate investment trust saw funds from operations for the quarter drop to $108.8 million or $0.55 per share, on an as-adjusted basis. That’s down from $116.3 million in the prior year’s first quarter.

The company attributed the dip, in part, to vacancies at 280 Park Avenue, 770 Broadway and 1290 Sixth Avenue. The real estate investment trust reported net losses of more than $9 million, compared to $5.2 million during the same period last year.

CEO Steve Roth touted that Vornado was able to extend Bloomberg LP’s lease through 2040, even though “every developer in town tried to poach Bloomberg.” The company is in the process of trying to refinance the building’s mortgage, which is due next month. Roth is not thrilled about where interest rates are, and noted that his “personal favorite” strategy is to pay the debt down or even pay it off.

“We shall see,” he said.

What we’re thinking about: Are you going to TRD’s New York forum Wednesday? Make sure to say hi! Or, if you prefer, send your reactions to kathryn@therealdeal.com.

A thing we’ve learned: During Vornado’s earnings call, Franco said the company completed an “important long-term renewal at one of our Times Square assets at the highest annual dollar rent we’ve achieved in our portfolio since pre-Covid — over $15 million per year.” I have an idea who the tenant is, but do you know?

Elsewhere in New York…

— A 16-year-old boy was shot and killed in Soho on Tuesday, Gothamist reports. No arrests had been made as of early evening.

— Last month, the state approved “Sammy’s Law,” named for 12-year-old Sammy Cohen Eckstein, who was killed outside his Park Slope home by a driver in 2013. The law grants local control over speed limits, allowing the City Council to lower the citywide speed limit to 20 mph, the New York Daily News reports. The city’s Transportation Department can bring that limit as low as 10 mph.

— A state Supreme Court judge ruled on Tuesday that the legislature did not follow the procedures required to place an amendment to the state’s constitution on the November ballot, the Times Union reports. The amendment would enshrine abortion rights and prohibit discrimination related to gender or gender identity. Senate Majority Leader Andrea Stewart-Cousins said she is confident the legislature will prevail on appeal.

Residential: The priciest residential sale on Tuesday was $9.95 million for a 5,100-square-foot townhouse at 48 Garden Place in Brooklyn Heights. Team Wilding Woods of Compass had the listing.

Commercial: The largest commercial sale of the day was $10 million for a seven-story, 28,000-square-foot office building at 124 West 36th Street in the Garment District.

New to the Market: The highest price for a residential property hitting the market was $9.25 million for a co-op unit at 830 Park Avenue in Lenox Hill. Cathy Franklin and Alexis Bodenheimer of the Corcoran Group have the listing.

Breaking Ground: The largest new building application was for a 37,000-square-foot, 10-story mixed-used building at 42-76 Hunter Street in Long Island City. Permits were filed by Tom Mui of My Architect PC. — Matthew Elo