A fight is mounting over co-op ground leases.

In the final weeks of the legislative session, the Real Estate Board of New York is monitoring a bill that would cap annual rent increases for co-op ground leases and guarantee lease renewals.

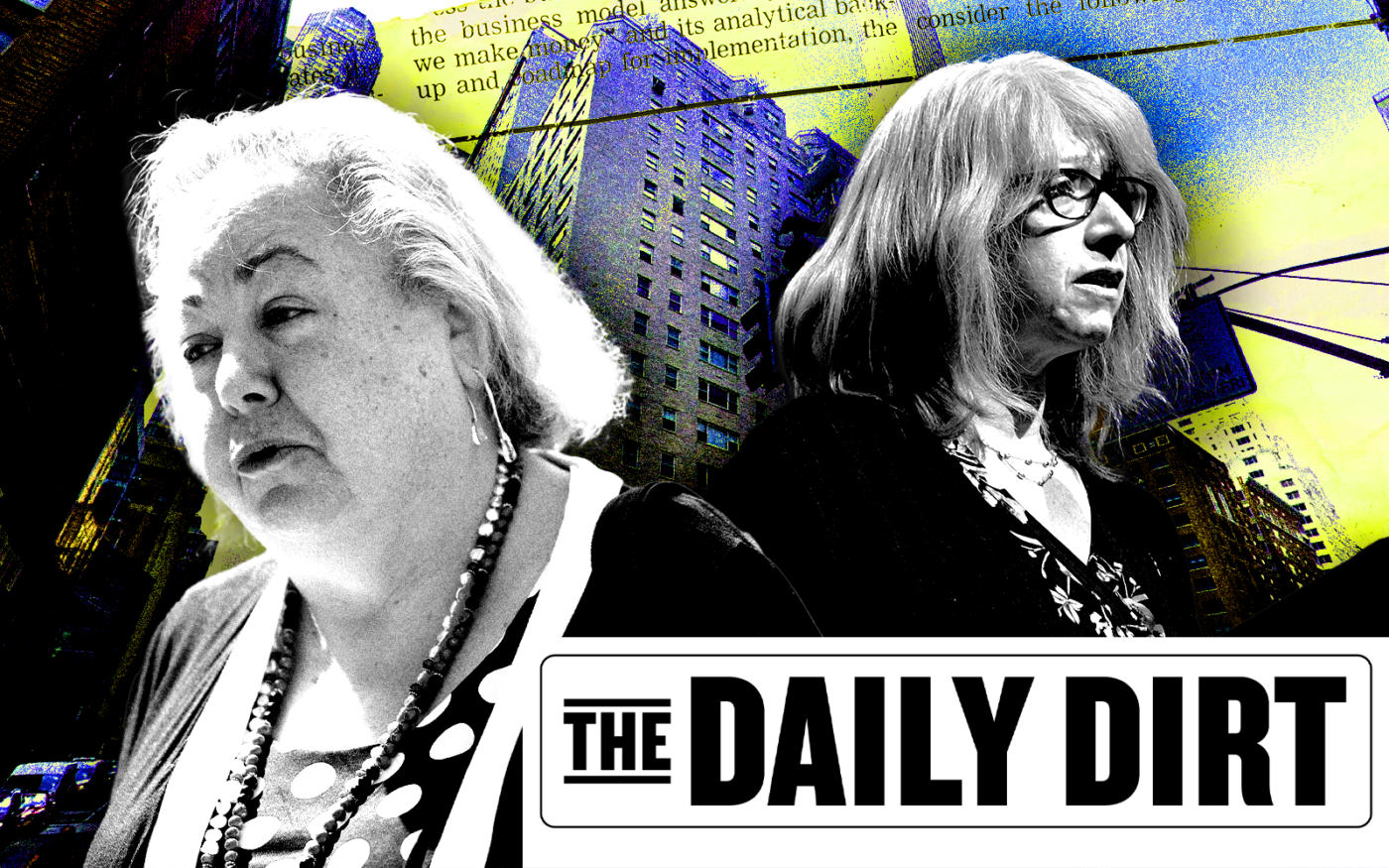

The measure is sponsored by Sen. Liz Krueger and Assembly member Linda Rosenthal and backed by a coalition of co-op shareholders. The coalition and lawmakers plan to rally Tuesday in Albany.

The bill would limit annual rent increases on ground leases to 3 percent or the Consumer Price Index, whichever is greater. Shareholders would also get the right to renew the ground lease and the right of first refusal if the landowner decides to sell the underlying property. And it would override provisions in ground leases that prevent shareholders from borrowing money over certain thresholds.

REBNY says the measure wrongly interferes with private contracts and is misleadingly framed as a big help for middle-class New Yorkers when it will in fact disproportionately benefit wealthy Manhattanites.

“This bill is an unconstitutional solution in search of a problem,” Zachary Steinberg, senior vice president of policy at REBNY, said in a statement. “It is simply bad public policy to give a legislative handout to the millionaire co-op owners who bought their homes at cut prices years ago with full knowledge of these ground lease arrangements.”

The measure would not apply to co-ops on city- or state-owned land purchased prior to January 1, 2023, but would apply to commercial co-ops.

Roughly 100 residential properties have ground leases that are privately controlled, my colleague Sheridan Wall reported in November. The residents of the 324-unit Carnegie House at 100 West 57th Street are staring down a potentially massive rent reset when their ground lease expires in March 2025.

Krueger said it is a misunderstanding that the bill would simply be a gift to wealthy owners in Manhattan. The coalition, based on its own survey of city co-ops, estimates that most ground lease co-op units are in Queens (4,718 apartments), and Manhattan (3,991).

Krueger said the rent increase cap is modeled after the original good cause eviction bill, which would have allowed tenants to challenge rent increases of more than 3 percent or 1.5 percent plus CPI. The version included in the state budget last month set the threshold at 10 percent or 5 percent plus CPI, whichever is lower. Krueger sees 3 percent as a “not unreasonable starting point.”

As for the constitutionality of the measure, she noted that the state approved similar rent limits for manufactured homes in 2019.

“This is very much a parallel story line,” she said.

Paul Larrabee, a spokesperson for the Ground Lease Co-op Coalition, said the group hopes to get the measure passed before the end of the legislative session, June 6.

“They are looking for the same protections that have been extended to everyone else in the housing market,” he said. (Good cause, however, had a lot of rental housing carved out.)

Ground leases are typically 99 years with rent adjustments every 20 or 30 years, if not more frequently. But the adjustments are not cut and dried, which leads to negotiations that can get ugly. Often, appraisers will disagree on a property’s fair market value, which helps determine the increase.

Anita Laremont, a partner at Fried, Frank, Harris, Shriver & Jacobson, noted that in rulings on New York’s rent law, the courts have recognized the state’s authority to regulate matters of important public interest. But co-ops are different, she said: Shareholders bought into them knowing the risks of future rent resets. The prices were low because a large dues increase would occur when the ground lease reset.

“These are sophisticated purchasers who are acquiring properties at a discounted price,” she said. A law that limits ground lease rents and therefore raises the value of their units, said Laremont, “is not an appropriate use of government power.”

What we’re thinking about: There are four unsold units at Vornado Realty Trust’s 220 Central Park South. Who will buy them? Send a note to kathryn@therealdeal.com.

A thing we’ve learned: The Department of Buildings reports that seven construction-related fatalities were reported in 2023, the fewest since at least 2015. Injuries and incidents, however, rose last year. (The agency tracks construction deaths differently than Occupational Safety and Health Administration, which typically includes more types of incidents.)

Elsewhere in New York…

— Columbia University canceled its main commencement ceremony, which is typically on the South Lawn, where police cleared a pro-Palestinian encampment last week, the Wall Street Journal reports. The school is still holding smaller ceremonies for individual majors, but could not find a large enough venue to accommodate more than 50,000 people for the main event.

— Mayor Eric Adams is heading to Rome to meet Pope Francis on Thursday, the New York Times reports. Adams’ former chief of staff Frank Carone told Gothamist that he also received an invitation and hopes to join the mayor.

— A report by the state watchdog Mental Hygiene Legal Services and nonprofit legal group Disability Rights Advocates found that psychiatric patients at public hospitals in the city are often not permitted outside for days or even weeks, Gothamist reports. No law requires them to get time outside, so advocates are pushing the city to adopt a policy. In response, NYC Health + Hospitals indicated that providing outside access poses safety and staffing challenges, as well as liability issues.

Residential: The priciest residential sale Monday was $18.6 million for a 5,000-square-foot condominium unit at 135 East 79th Street on the Upper East Side. Holly Parker, Michael Passaro and Joan Swift of Douglas Elliman had the listing.

Commercial: The largest commercial sale of the day was $47 million for two adjacent lots totaling 38,650 square feet at 45-28 and 45-40 Vernon Boulevard in Long Island City. ZD Jasper Realty purchased the property from Quadrum Global, Baron Property Group and Simon Development.

New to the Market: The highest price for a residential property hitting the market was $56 million for a 7,000-square-foot condominium unit at 111 West 57th Street in Midtown. Kane Manera and Janet Wang of the Corcoran Group have the listing. — Matthew Elo