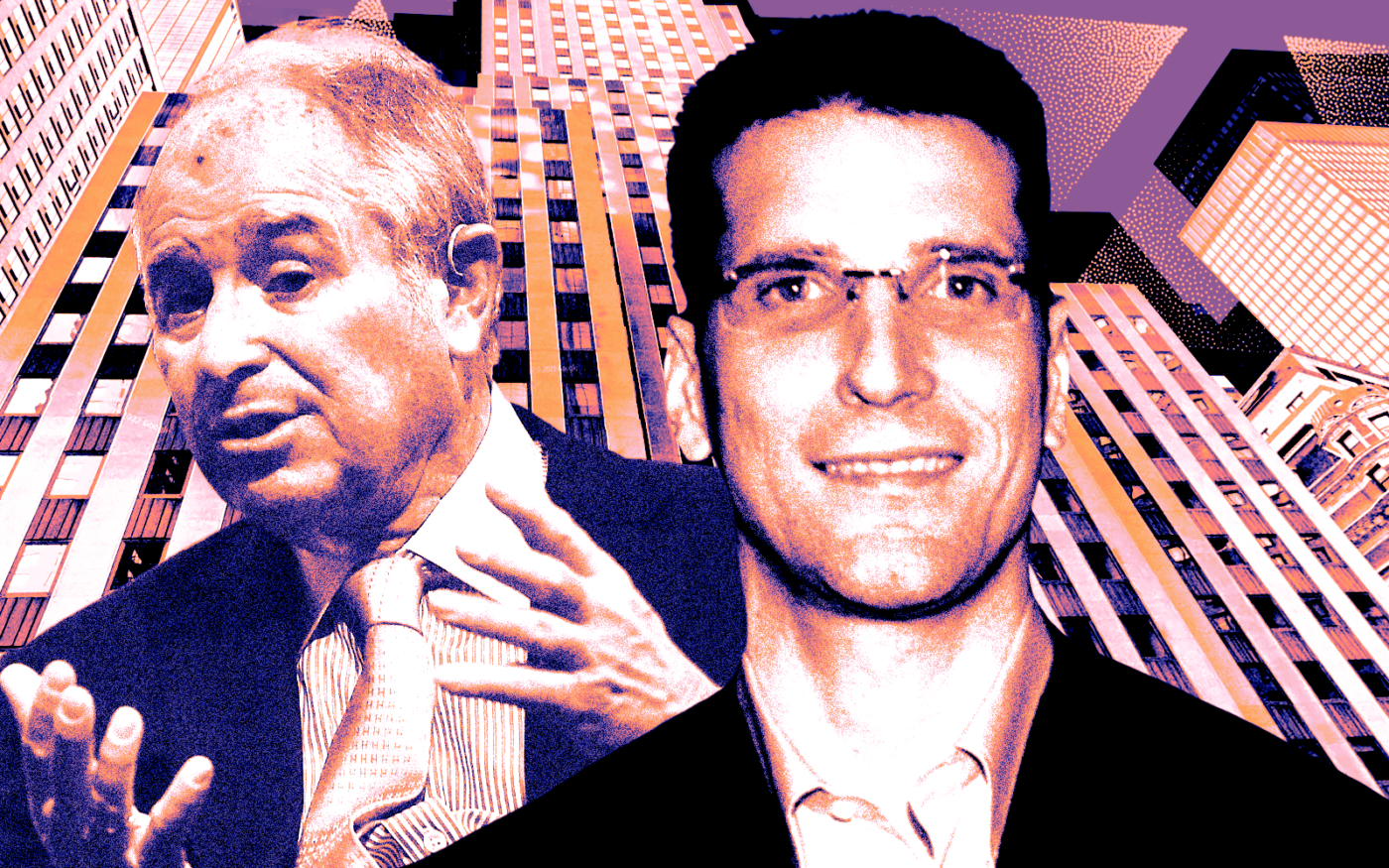

Isaac Hera’s Yellowstone Real Estate has swooped in to buy the defaulted commercial mortgage-backed securities loan on Blackstone’s 1740 Broadway.

Hera’s firm spent nearly $200 million to acquire the note, the Commercial Observer reported. The deal for the $308 million loan works out to a purchase price of approximately $300 per square foot.

A JLL team including Steven Binswanger and Andrew Scandalios led the note sale. A few months ago, JLL was marketing the debt at a 50 percent discount; Midland originally brought on CBRE to sell the note, only to quickly pull it from the market.

Blackstone acquired the property from Steven Roth’s Vornado Realty Trust in 2014 for $605 million. A year later, Deutsche Bank originated the loan as part of a CMBS single-asset, single-borrower transaction.

But Blackstone ran up against some headwinds in recent years. L Brands downsized and relocated, leaving behind 418,000 square feet. Prior to that, law firm Davis & Gilbert left for Rudin’s property at 1675 Broadway.

In March 2022, Blackstone defaulted on the loan backed by the 26-story, 621,000-square-foot office building. Blackstone hasn’t made any payments on the building since its transfer, according to the Observer.

PNC Bank’s Midland Loan Services came in as the special servicer and tapped JLL to lead the note sale.

The property’s appraised value as of last year was $175 million.

Read more

Blackstone declined to comment on the note sale, but a spokesperson for the company noted to the Observer the company “wrote this property off nearly three years ago and have now exited this investment.”

Yellowstone’s big decisions related to 1740 Broadway aren’t limited to purchasing the debt, as Hera is considering converting the longtime office building into a residential property. Officials of the company could not immediately be reached for comment.