With a big inventory loan in the bag, the developer of a new condominium dubbed the Monogram is hoping to attract buyers to an area best known as a central business district.

Navigation Capital Group, a Manhattan-based affiliate of China’s Hopson Development, received $185 million from Kriss Capital of New York, the private lender confirmed.

The debt is secured by 191 unsold condo units at the 35-story tower, at 135 East 47th Street in Midtown East, and retires $156 million in construction debt issued by Fortress Investment Group in 2022.

Jody Kriss, founder of Kriss Capital, described the loan as “a single-source, all-cash financing solution” and the project’s apartments as “jewel-box-like” and “efficient-sized” with “achievable price points in the center of Manhattan.”

For example, a one-bedroom, one-bathroom apartment spanning 716 square feet is under contract asking $1.5 million, according to StreetEasy.

Navigation’s Scott Shea called the inventory loan “a milestone” for the project and said, “We look forward to working with Kriss Capital through the sellout.” Closings await a temporary certificate of occupancy, which the developer expects to obtain within weeks.

Douglas Elliman Development Marketing, which is taking over sales at the project from CORE, must now woo buyers toward an area of the city better known as a central business district than a residential neighborhood. A representative of the brokerage declined to comment.

One advantage the Monogram will have is limited competition.

Midtown East is “a supply constrained sub-market,” Scott Aiese of JLL, which represented the borrower, said in a statement. No new apartment deliveries are projected for at least three years, according to the brokerage.

Business leaders have focused on Midtown East’s identity as an office district, with little apparent interest in creating a live-work-play neighborhood through the development of residential buildings — an idea which has transformed Lower Manhattan and visited other areas of the city.

However, there was buzz during the pandemic about Midtown becoming a place for younger people to hang out, and some struggling office buildings could be converted into apartments if the state legislature passes a bill to allow and incentivize it.

Amenities at the Monogram include a wellness center, in-house spa, library lounge, punch bar, catering kitchen, private dining room, 24-hour concierge and 3,500 square feet of rooftop space. Anthology Group, a luxury hospitality brand based in Shanghai and partly owned by Hopson, will manage the property.

Although the project is two years behind schedule, it appears to be on budget. With no mezzanine debt, total investment in the project comes to $250 million, records show. That is the amount the developer predicted in 2020 would be spent.

Navigation hopes sales at the Monogram will total $319 million, a goal that might not be quickly or easily achieved.

While the project aimed to attract international buyers, they have yet to return to New York. Foreign buyers account for about 11 percent of new development sales, down from 30 percent before the pandemic, according to data from Corcoran Sunshine.

Since rising mortgage rates dampened buyer demand, condo developers have looked to inventory loans to “survive until ’25”, helping them pay carrying costs while sales get going.

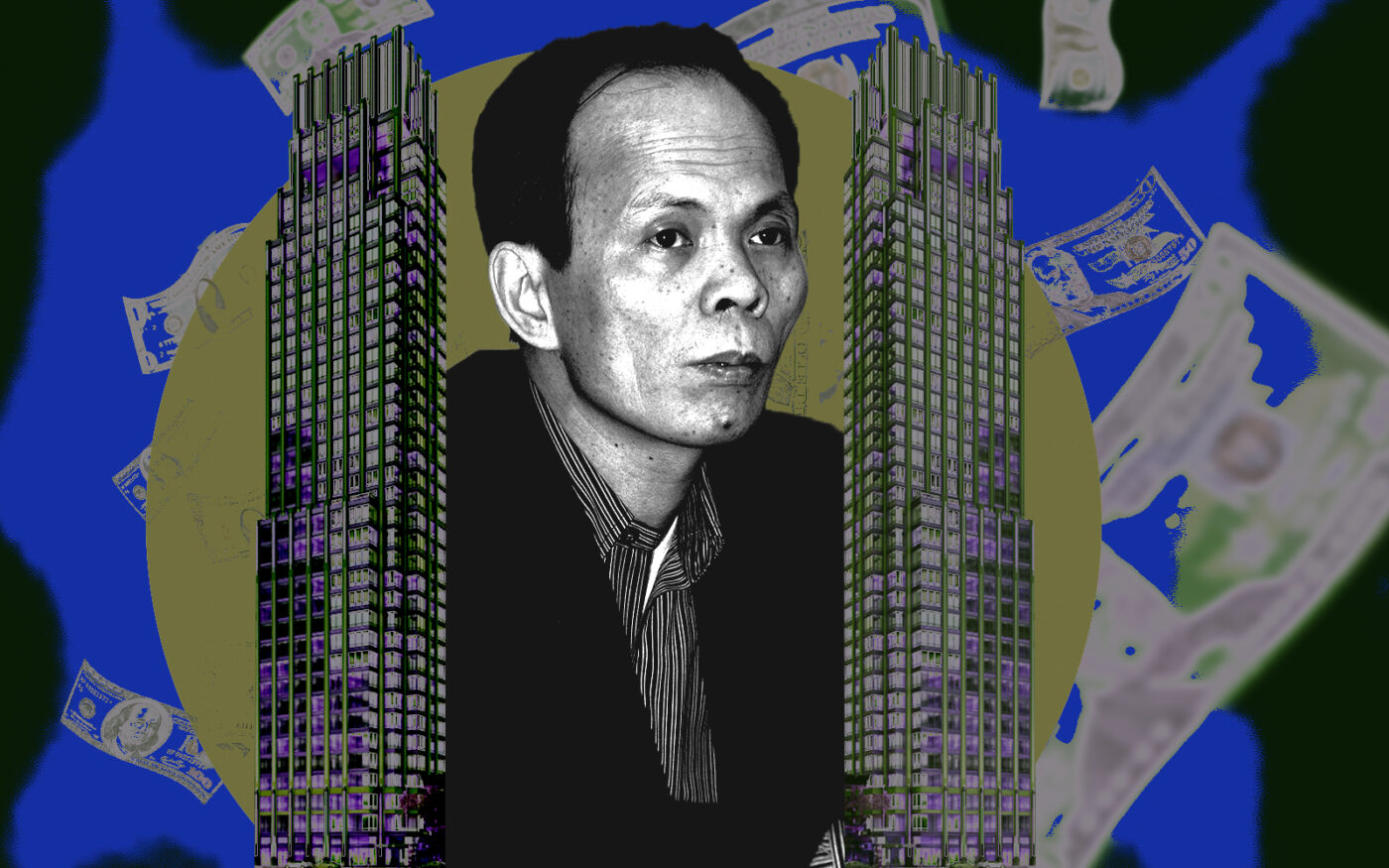

Ismael Leyva Architects designed the Monogram’s Art Deco exterior, and Shanghai’s Neri & Hu the interior. The project has been in the works since 2019 when Hopson purchased the development site for $115 million, with $65 million in equity. It broke ground the next year.

Navigation came on board in 2021 to replace Josh Schuster’s Silverback Capital. Equity partner Hopson, listed on the Hong Kong stock exchange, is among China’s largest property developers. Hopson made a failed bid in 2021 for a majority stake in the country’s largest developer, Evergrande, which entered bankruptcy protection last summer.

Read more

A diminished pipeline of new projects has put New York’s new condo market on unfamiliar footing. Pandemic buying spurred by low interest rates trimmed away excess inventory, and industry experts expect supply to remain tight, supporting higher prices for years to come.

Limited supply coupled with “record amounts of dry powder in the private real estate debt markets” may support a new building cycle, according to JLL’s Aiese, although any such inventory would not begin to arrive on the market for several years.