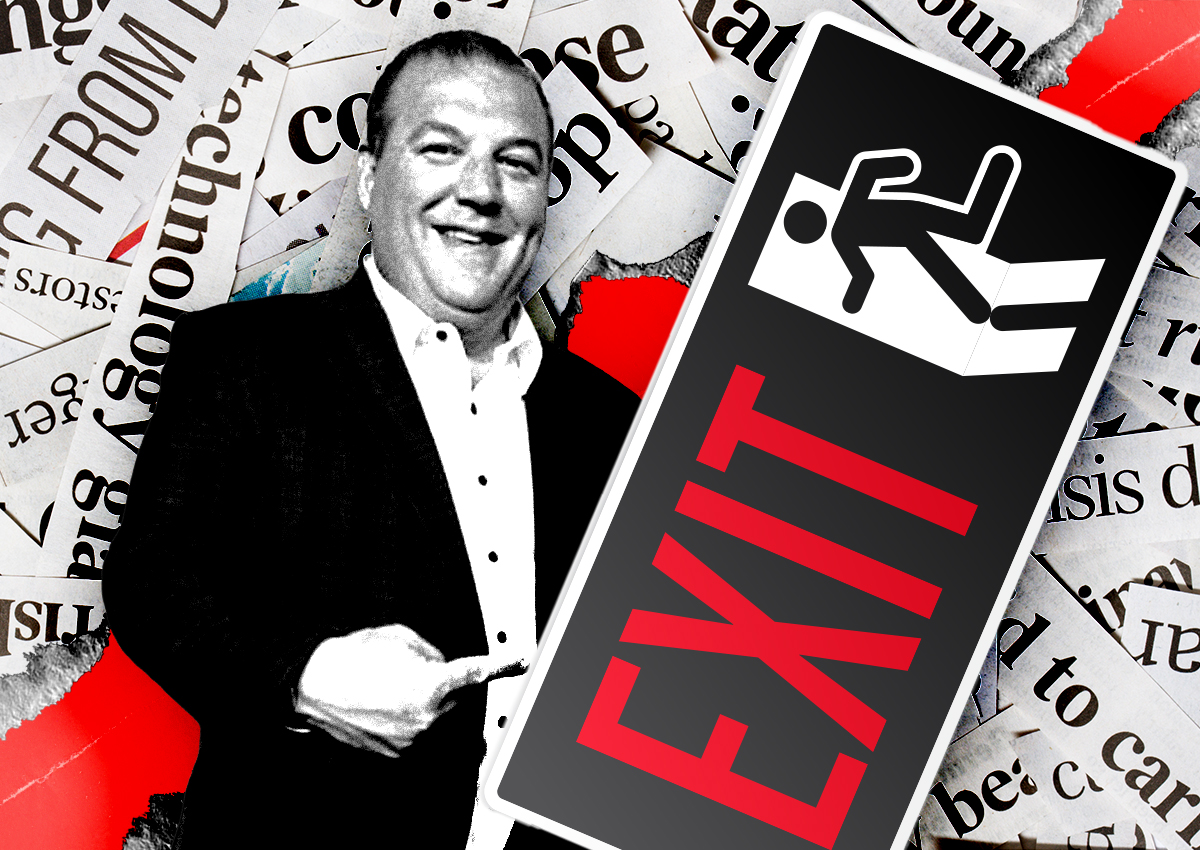

Signature Bank’s former head of commercial real estate lending is jumping to Douglas Eisenberg’s A&E Real Estate to launch a lending platform.

Joseph Fingerman will lead a team of about 20 people, including other former employees from Signature. The new platform, A&E Real Estate Finance, will lend to multifamily properties throughout New York City.

A&E, one of the largest multifamily owners in the city, will join other established real estate developers, such as Silverstein and Naftali, in adding a lending arm.

Higher interest rates and the lack of a replacement for the 421-a tax abatement have left few opportunities for developers to build or acquire properties. Providing debt is one of the remaining avenues they have to achieve returns higher than Treasury notes are paying.

A&E plans to launch the lending venture in the next few months. It will focus on first mortgage loans, but Eisenberg said the firm has the option to make other loans depending on a borrower’s needs.

“We are extremely well-capitalized,” said Eisenberg. “We have the ability to do as much or as little as we want.”

A&E will support its lending business with existing capital and money from institutional investors. The company hopes to start with smaller mortgages in New York City before expanding beyond the five boroughs.

“This is a response to a lot of banks and lenders pulling back from the New York City market, as a result of both the lending environment and what has happened politically the past couple of years,” said Eisenberg. “We just have a fundamental belief that New York is not going anywhere.”

A&E, which has over 20,000 units under management, has the ability to buy distressed loans and take over the properties backing them, but Eisenberg said that’s not the firm’s strategy. The asset management and lending side will be two distinct entities.

“They are completely separate,” said Eisenberg. “One has nothing to do with the other.”

Eisenberg said the firm is open to lending to rent-stabilized properties, which many lenders have backed away from because of changes to New York’s rent laws in 2019.

Signature Bank was among the biggest financiers of rent-stabilized properties. Last year, the bank was seized by regulators after depositors scrambled to pull out money. Fingerman and his team at Signature were laid off shortly after that.

Fingerman joined Signature in 2007. Prior to that he led real estate lending at North Fork Bank.

A&E’s portfolio has grown from a single 49-unit building in Fort Greene in 2011 to more than 20,000 apartments across New York City. In late 2022, CEO James Patchett, who previously led New York City Economic Development Corporation, left A&E after less than two years to become a partner at McKinsey, and Eisenberg stepped back in to run the business.

Read more