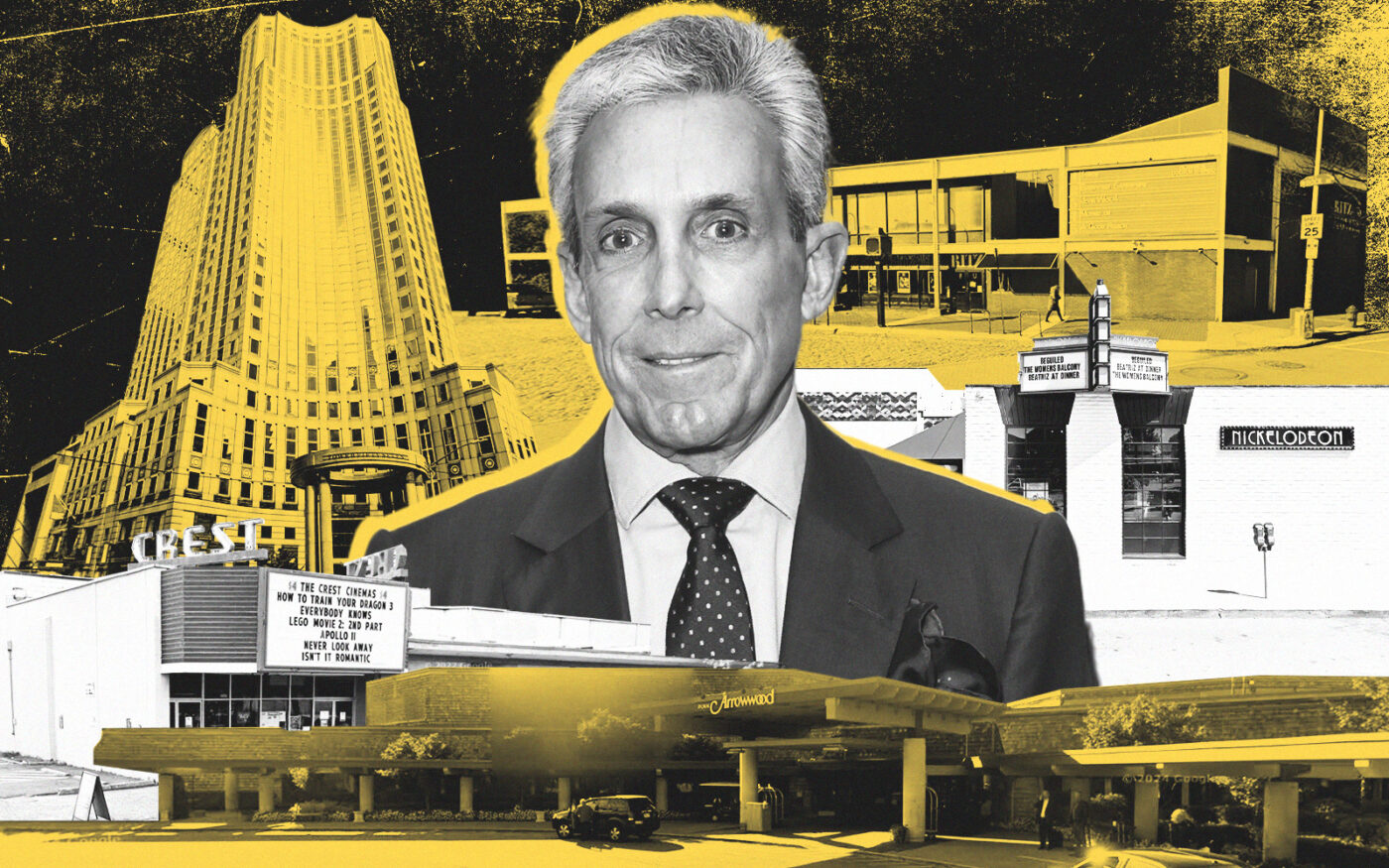

Billionaire Charles Cohen’s troubled debt is starting to rival his net worth.

The head of Cohen Brothers Realty, through a handful of entities, defaulted on $534 million in debt tied to seven properties: a Florida design center, Westchester redevelopment site, New York office tower, Fort Lauderdale hotel and three theaters in as many states.

The firm’s lender, a subsidiary of Fortress Investment Group, filed suit Monday asking for a $187 million judgment — Cohen’s payment guaranty — plus interest, legal fees and expenses related to the default, court documents show.

Cohen does not intend to roll over.

“We want to take the high road — we don’t litigate in the papers and we intend to defend,” said Dave Fogel, senior vice president at Cohen Brothers.

A Fortress spokesperson declined to comment. Fortress executive Steven Stuart said at The Real Deal’s New York Showcase + Forum last year that his firm does not make loans for the purpose of taking over assets.

Fortress’ filing is only the latest headache for Cohen Brothers. In October, the firm fell delinquent on $635 million in other loans backed by New York City office properties.

The company said at the time that it was “working with lenders to bring any past-due loan payments current.”

At two of those properties — 805 Third Avenue and 3 Park Avenue, which Fitch Ratings in September was reviewing for a possible downgrade — Cohen dug himself out of delinquency, bringing the loans current in February, according to Morningstar.

But payments are more than 30 days late on $172 million in debt backed by 222 East 59th Street and the Decoration & Design building at 979 Third Avenue, according to loan data.

The $130 million in loans tied to 750 Lexington landed in special servicing in November. The Lenox Hill building is home to Cohen Brothers’ office and a WeWork location where the co-working firm quit paying rent in October but has yet to reject its lease.

All told, Cohen Brothers is now late on at least $966 million in debt.

The $534 million default filing shows Cohen’s troubles have spread from Class A offices — ownership of which he called “the day job” in a 2018 Variety article — to his passion, cinemas.

“I always wanted to be a theater chain owner,” he told Variety for a piece subtitled “Charles Cohen Takes Cinema Seriously.” Cohen owns Cohen Media Group, an independent theatrical distribution and production company.

The theaters that help collateralize the Fortress loan include Philadelphia’s Ritz V, the Nickelodeon Theatre in Santa Cruz, California, and Crest Cinema Center in Shoreline, Washington.

All are Cohen-owned under Landmark Theaters, which the investor bought in 2018.

Because Fortress is a private lender, there is no public information about building revenue shortfalls that likely caused Cohen’s $534 million default. The landlord failed to pay a $5 million deferred amortization payment and $14 million in interest on Feb. 1, then another $5 million in interest on Feb. 15, Fortress’ suit alleges.

Cohen’s cinemas likely took a beating during Covid. The Nickelodeon Theatre shuttered in 2020 and is listed by Google as permanently closed. Landmark-leased theaters in the Bay Area, Milwaukee and Dallas have all shut their doors in the past year — the Texas location because of “lease issues.”

As for the New York office building, Tower 57, Cohen was in talks to surrender the property in December after vacancy issues triggered a ground lease default. Cohen claimed his landlord wouldn’t sign off on his proposed residential conversion of the property.

It’s unclear how South Florida’s Design Center of the Americas or Le Méridien Dania Beach, a hotel at the Fort Lauderdale Airport, have performed recently.

The last piece of collateral, the former Doral Arrowwood hotel in the Westchester County town of Rye Brook, was slated to be demolished and redeveloped as a mixed-use property, Greenwich Time reported.

As recently as January, Cohen graced a village meeting to preview his plans.

“It’s something we think will raise the bar significantly … and put Rye Brook at the forefront,” he told the village board.

Read more