The parent company of Property Building Corp is seeking to buy its debt on 10 Bryant from JPMorgan as its anchor tenant prepares to leave.

The Israeli-based company, Discount Investment Corp, plans to issue corporate bonds in Israel to raise at least $400 million to buy and then pay off its debt on the 30-story tower, according to documents filed with the Tel Aviv Stock Exchange. The raise is expected to close in 30 to 60 days.

The raise will allow PBC to own the building without any debt. This allows PBC flexibility to make improvements without the lender’s consent. The building’s outstanding debt, including the senior and mezzanine loan, totals $385 million. If more than $385 million is raised, the proceeds can go toward property improvements.

The tower is 94 percent leased, but its anchor tenant, HSBC, will vacate its lease next year. The property is in the midst of a repositioning and is now known as 10 Bryant.

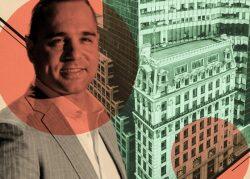

PBC, led by Eli Elefant, purchased the 30-story tower at 452 Fifth Avenue for $330 million, or $381 per square foot, in 2010 from HSBC, as the bank was selling off properties in the wake of the financial crisis. PBC spent more than $100 million on renovations. The property also includes a Beaux Arts 10-story building at the base, which was constructed at the start of the 20th century.

PBC listed the building in October 2021 as part of its larger plan to sell off a $2 billion portfolio of U.S. real estate assets. Waterman Clark, the investment firm led by former Brookfield Properties head Ric Clark, the German fund Commerz Real, the Chera family’s Crown Acquisitions, George Comfort & Sons, Savanna and Hines all participated in the bidding.

Andrew Chung’s Innovo Property Group was the winning bidder, reaching a deal to buy the building for $855 million. Chung’s investor deck showed that after one to three years, he planned to sell the property or recapitalize at a valuation of $1.2 billion.

But Chung never lined up financing and failed to close.

PBC changed course, opting to keep the property and reposition it. The owner secured a refinance loan from JPMorgan in 2022, replacing a maturing $380 million loan. But the building’s appraised value has dropped to $650 million amid rising interest rates.

Read more