The unseasonably warm weather is thawing New York’s condo market.

New condo sales in New York grew for a third straight month in February, rising 12 percent from a year ago, according to a Marketproof report. “Despite a rise in mortgage rates, the new development market showed sustained growth,” said Marketproof CEO Kael Goodman.

Mortgage rates climbed back above 6.7 percent last month after falling from a high of nearly 8 percent last November, chilling the slow season even further. But New York City buyers have been increasingly paying in cash.

With spring ahead, Goodman said he was optimistic about the market’s resilience.

In Manhattan, new condo sales grew 19 percent from January, the first month that the central borough bested its pre-pandemic average since last summer. Last month, Brooklyn climbed above its pre-pandemic average of monthly new condo sales for the first time since June.

Top sellers included Related Companies’ Tribeca Green, a co-op conversion in Battery Park City that put 12 units into contract last month. A Gramercy Park condo building by Glacier Global Partners and Tidhar Group put seven units into contract at 200 East 20th Street.

The priciest Manhattan closing in February was for an apartment at Steve Witkoff and Access Industries’ One High Line for $3,679 per square foot. The biggest ask was a penthouse at the Midtown Aman Residences, at 730 Fifth Avenue, for $8,900 per square foot.

Sales rose by more than a quarter in Brooklyn, fetching $166 million to Manhattan’s $482 million, and the median price dipped slightly to $1,400, compared with $2,060 in Manhattan.

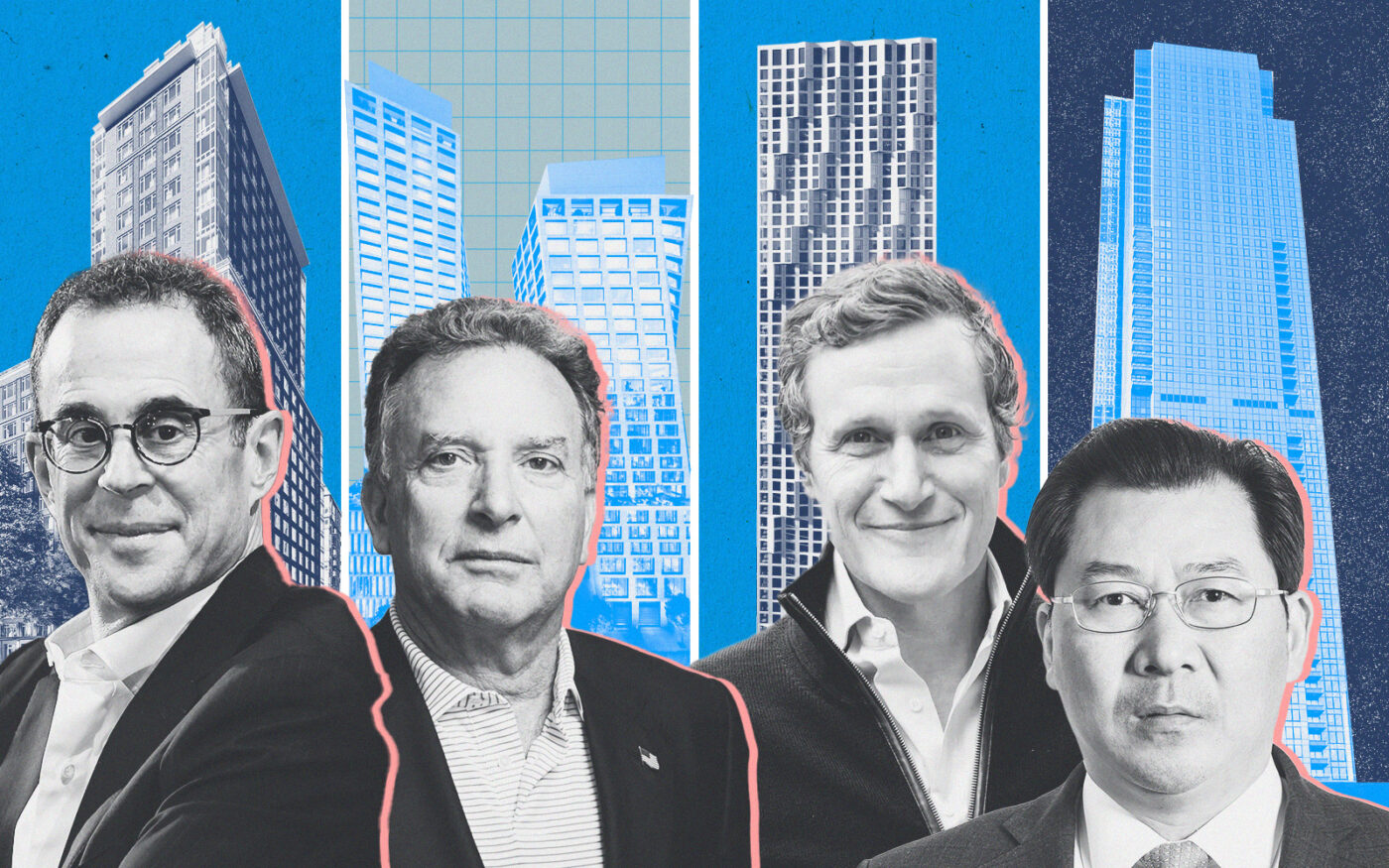

Tishman Speyer and Vanke put 11 deals into contract at 11 Hoyt Street in Downtown Brooklyn, and Dido Properties reported six contracts for the month at 650 Greene Avenue, in Bedford-Stuyvesant, making them the best selling projects in the borough.

The priciest closing went for about $2,050 per square foot at 415 Degraw Street in Boerum Hill and the biggest ask was $2,365 per square foot at Fortis’ curving Olympia Dumbo.

Sales of new condos grew 13 percent in Queens from January, although it was the only borough stuck beneath a 12 month sales average. Sunlight Development’s 134-16 35th Avenue in Flushing sold the most, with 10 new contracts, and Chris Jiashu Xu’s Skyline Tower put five units into contract and had the priciest closing at $2,025 per square foot.

The median contract price for a new condo in Queens fell to about $1,200 per square foot.

Read more