Deep in the acronym-laden world of affordable housing programs exists one called FFB Risk-Sharing, which has helped state agencies finance 42,000 homes since its inception in 2015.

The Trump administration let it expire at the end of 2018, but President Joe Biden revived it in September 2021.

However, the Federal Financing Bank’s Risk-Sharing is poised to die again: Biden’s commitment was for three years, meaning no applications will be accepted after Sept. 30.

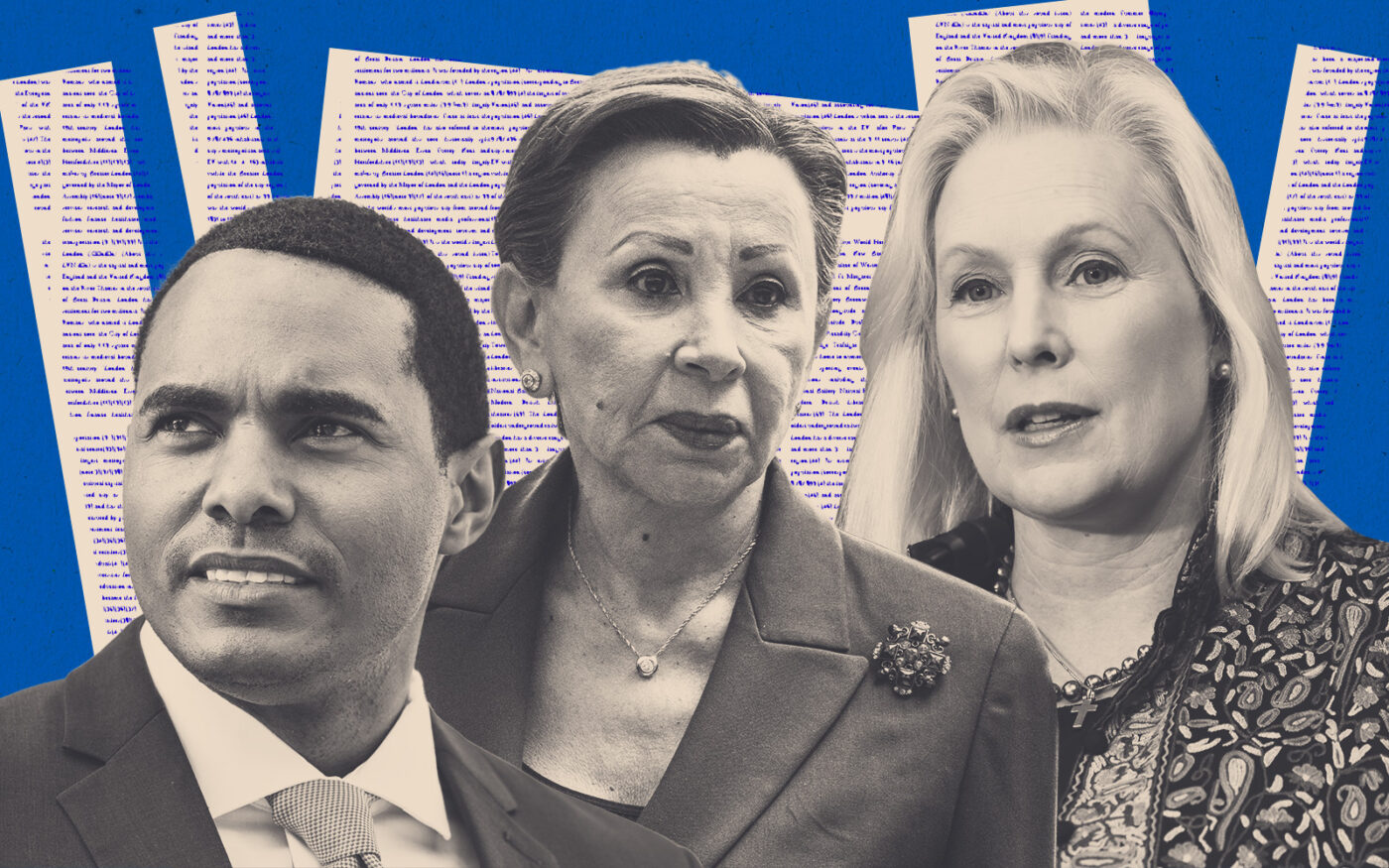

Now, Democratic members of Congress including New Yorkers Rep. Ritchie Torres, Rep. Nydia Velazquez and Sen. Kirsten Gillibrand are imploring the administration to make the FFB program permanent.

“Our nation continues to face a severe affordable housing shortage … and losing this critical funding stream will make closing our housing gap even more difficult,” the 37 Democrats wrote Friday to the heads of Treasury, Housing and Urban Development, National Economic Council and Office of Management and Budget.

HUD is already on board — Secretary Marcia Fudge said at a recent congressional hearing that she favors continuing the program — but the housing agency and Treasury Department must decide in consultation with NEC and OMB whether to authorize the FFB to provide the financing to housing finance agencies, or HFAs.

Within the alphabet soup is a program little known to the public but very much on the radar of developers needing long-term, fixed-rate financing for affordable projects.

“This is a very important program, especially in New York,” Jolie Milstein, executive director of the New York State Association for Affordable Housing, said by email. “Over the years I’ve been to D.C. to advocate with the head of Treasury on reinstating and preserving this important financing tool for affordable housing.”

The funding closes a funding gap in the private markets, Torres and his colleagues wrote, adding that the need has only grown: The National Low Income Housing Coalition estimates the U.S. is short 7.3 million units for the lowest income Americans.

In a similar letter Feb. 16, the National Council of State Housing Agencies pointed out that the program “is making a hefty profit for the government.” The council also recommended several improvements.

Velazquez and Gillibrand led a similar effort in 2021 to get the newly elected Biden to reinstate Risk-Sharing.

At the time, Buzz Roberts, president and CEO of the National Association of Affordable Housing Lenders, told Affordable Housing Finance that the program is especially helpful for small projects that cannot go to the capital markets for bond financing because the transactional costs are too high. The Risk-Sharing program’s costs are negligible.

Risk-Sharing also allows housing finance agencies to use their own underwriting rather than HUD’s, as they must for the federal agency’s regular multifamily programs, Roberts said.

Democrats could try to pass a bill to make it permanent — Velazquez, in fact, introduced one in 2020 — but that would require getting House Republicans to agree. The faster and more plausible path is to get the administration to authorize the funding, which is not part of the appropriations process.