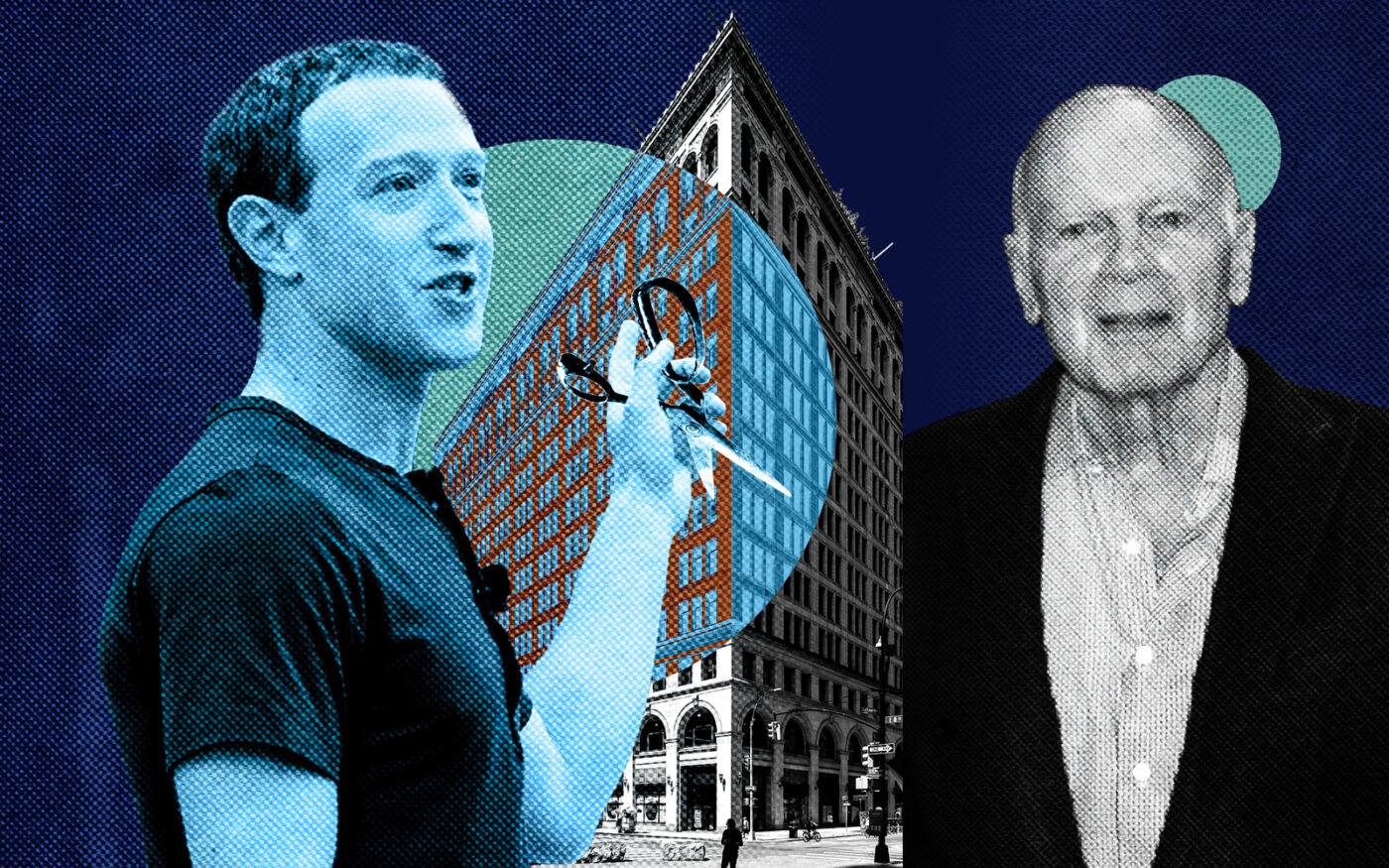

After backing out of various office expansion plans, Facebook’s parent is further shrinking its New York City office footprint.

Meta’s lease for 275,000 square feet at Vornado Realty Trust’s 770 Broadway expires in June, Vornado executives said during a fourth quarter earnings call on Tuesday. Vornado indicated that Meta will still have another approximate 500,000 square feet in the building long term after that lease expires. According to Vornado, Meta’s original lease totaled 758,000 square feet.

It is unclear how that math works exactly, given reports that Meta backed out of a plan to expand its 500,000-square-foot space on Broadway by 300,000 square feet. A representative for Meta did not immediately respond to questions seeking clarity.

Meta has been in cost-cutting mode, slashing thousands of jobs, subleasing its office space and spending millions of dollars to back out of leases early.

Still, Vornado CEO Steve Roth indicated Tuesday that the office market is “on the foothills of recovery.” To scale that mountain, tens of thousands of “obsolete, irrelevant” older office stock will “evaporate,” Roth said. Because lenders are staying away from new office development, the limited availability of new office stock will drive up demand, and therefore rents, in those spaces, he said.

In the meantime, the company sees retail as a bright spot in an otherwise bleak environment. Michael Franco, the real estate investment trust’s president and CFO, said that while financing is closed off to office properties, opportunities in retail are “wide open.”

“The world turns in funny ways and creates opportunity. The retail apocalypse is now passing, having handily survived the e-commerce attack. But now we have a C, B, D office apocalypse,” Roth said.

He pointed to how luxury brands Prada and Kering recently purchased their stores on Fifth Avenue.

“We now have the most important retailers in the world investing aggressively in real estate for their own use, on the most important retail street in our country,” Roth said. “We take this mark very personally because we own in our retail joint ventures, so 52 percent our share, a 26 percent market share of available upper Fifth Avenue and four half blocks of similar triple A quality. I’m sure you can all do the math here.”

The company is seeking to exit joint ventures tied to a handful of older office buildings, while keeping an eye out for quality office properties sold at steep discounts. When asked by an analyst, Roth indicated Vornado would be open to selling retail assets.

As for the Penn District, Vornado is waiting for the market to “thaw” before moving forward with new development. At that point, the company will consider building residential space or selling off property to another developer, Roth said.

Last year Gov. Kathy Hochul paused plans to build 10 new, mostly office buildings around Penn Station, to focus on the revamp of the station itself.

Roth, whose company controls most of the project sites, has previously indicated that Vornado would likely begin with residential construction.

Franco said high interest rates, along with lag time between lease expirations and renewals or new tenants, “dinged” revenue. In the last quarter, funds from operations were $123.8 million, or $0.63 per diluted share in the last quarter, compared to $139 million during the same period in 2022.

The company reported a net loss of $61 million for the quarter, compared to $493 million during the same quarter in the previous year. Revenue for the quarter was $441.9 million, down from $446.9 million the previous year.

Read more