New York’s commercial sales market felt the full brunt of interest rate hikes in 2023.

The deals were few and far between in the year, and those that did get done were small by the Big Apple’s standards.

No sale cracked the $1 billion mark, and the year’s top 10 biggest deals totaled $4.83 billion, down from $7.63 billion the previous year.

The Fed’s rate hike cycle (which is set to reverse course this year), the negative outlook for offices and the difficulty with rent-stabilized multifamily buildings all contributed to the sluggish sales activity.

Here, then, are the top CRE investment sales of 2023:

- $998M | 245 Park Avenue (49% stake @ $2B valuation)

Buyer: Moori Trust

Seller: SL Green

Broker N/A

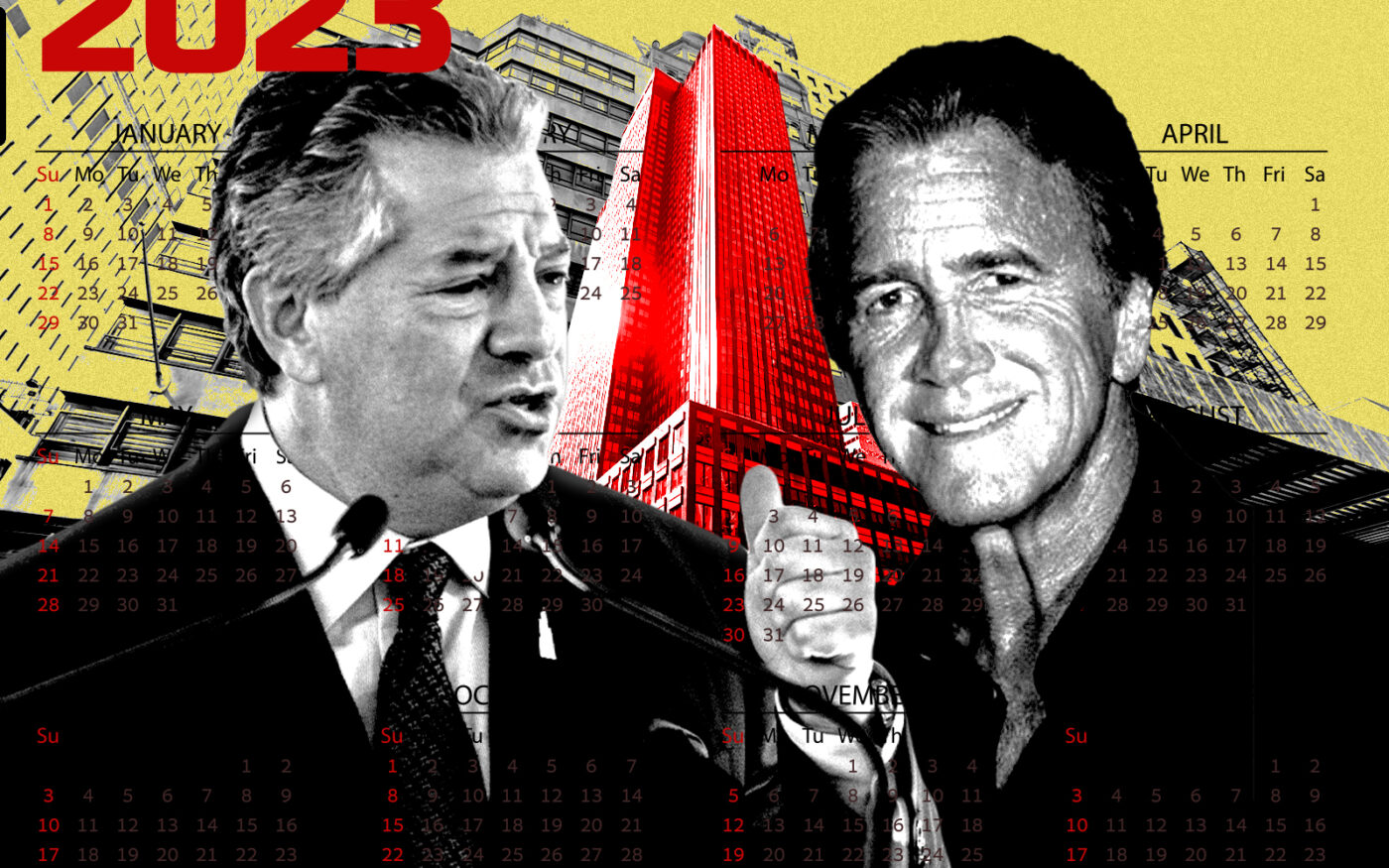

Marc Holliday’s SL Green was one of the few investors determined to make deals in 2023, despite all the headwinds in the sales market.

With debt to pay down and some properties acquired through special situations, the REIT had needs for cash and a few creative ways to find it. Case in point: 245 Park Avenue.

SL Green had taken the building over after its previous owner, China’s HNA Group, put the tower into bankruptcy. SL Green searched its contacts list and did a direct deal for the building with Japan’s Moori Trust, selling a 49 percent stake valuing the property at $2 billion.

That’s the same valuation SL Green paid when it acquired the tower out of bankruptcy, but a discount to the $2.2 billion HNA paid in 2017. SL Green and Moori Trust are working to modernize the tower.

- $835M | 720 and 724 5th Avenue

Buyer: Prada

Seller: Wharton Properties

Broker: Eastdil Secured

Jeff Sutton didn’t have to look too far to find a buyer for a pair of prized Fifth Avenue buildings.

The so-called “King of Retail” sold his building at 724 Fifth Avenue for $425 million to its tenant, Prada, which for the past 25 years has leased the property for its flagship retail store.

At the same time, Sutton cut a deal to sell the building next door at 720 Fifth Avenue to the Prada family for $410 million.

The two deals totaled $835 million and give Prada control of a prime stretch of Fifth Avenue where other luxury retailer are planning major improvements to their stores.

- $623M | Park Lane Hotel

Buyer: QIA

Seller: Witkoff

Broker: N/A

Steve Witkoff closed a chapter on one of New York’s most storied properties when he sold the Park Lane Hotel to the Qatari Investment Authority for $623 million.

Sitting directly across the street from Central Park, the property was once considered one of the best development sites in the world. That’s likely what Witkoff had in mind when he paid $654 million to buy the hotel in 2013 with a plan to convert the bulk of the building’s 600 or so rooms into high-end condos.

But the project got caught up in the $4 billion Mubadala Investment Company scandal, and the Justice Department worked to recover the funds misappropriated by Malaysian businessman Jho Low.

Witkoff and his partners sold the property to the QIA, which is also an investor in Michael Stern and Kevin Maloney’s Billionaires’ Row tower at 111 West 57th Street.

- $550M | 20 Hudson Yards

Buyer: Wells Fargo

Seller: Related Companies, Oxford Properties Group

Broker: Newmark

Steve Ross’ Related Companies had a problem on its hands at Hudson Yards.

After Neiman Marcus went bankrupt in 2020, Related and its partner Oxford Properties Group had a 400,000-square-foot vacancy at the mall they built around Neiman’s department store as an anchor.

Their plan was to convert the space to office, and at one point Facebook was rumored to be interested in the space. But the developers ultimately did a deal with Wells Fargo, which already owns its 500,000-square-foot office condo at 30 Hudson Yards.

- $490M | One Liberty Plaza (49% stake @ $1B valuation)

Buyer: Brookfield Properties

Seller: Blackstone Group

Broker: Newmark

Brookfield bought out its partner the Blackstone Group at the 2.3 million-square-foot skyscraper at 165 Broadway, and took a big hit to the property’s value in the process.

The Canadian private equity firm bought Blackstone’s 49-percent stake in the tower at a $1 billion valuation. That was a significant drop from the $1.5 billion the 1970s-era tower was valued at in 2018 when Brookfield sold the minority stake to Blackstone. At the time it was one of the most expensive deals ever in the Financial District.

- $302M | 150 West 48th Street

Buyer: Dauntless Capital Partners

Seller: McSam Hotel Group

Broker: CBRE

Sam Chang was busy selling down his budget-hotel empire in 2023.

The McSam Hotel Group exec sold the hotel condo at 150 West 48th Street — home to the Hampton Inn and Home2Suites by Hilton Times Square hotels — to the Houston-based private equity firm Dauntless Capital Partners for $302 million.

The deal followed another sale at the same property earlier in the year, when Chang sold another hotel condo (this one home to Hilton’s Motto Hotel) to Magna Hospitality Group for $160 million.

Chang declared he was retiring after the city passed a law in 2019 limiting development of the kinds of hotels he specialized in. Chang has continued to sell off other properties in his portfolio.

- $285M | 125 Greenwich Street

Buyer: Fortress Investment Group

Seller: Bizzi & Partners

Broker:

The supertall tower at 125 Greenwich Street was supposed to be the Financial District’s answer to Billionaires Row, but instead it’s been a revolving door of stakeholders.

In the latest twist, Fortress Investment Group earlier this year converted $285 million worth of its debt into equity into the stalled condo project. Fortress and its partner, Bizzi & Partners, also landed a $313 million loan from Northwind Group.

Fortress’ equity swap replaced former partners Howard Lorber’s New Valley and Chinese private equity firm Cindat.

- $275M | 15 Laight Street

Buyer: Hyundai Motor Group

Seller: Vanbarton Group

Broker: Newmark

While investors sat on the sideline, users stepped up to ink some of the year’s biggest deals.

One such purchase was Hyundai’s deal to buy the Tribeca office building at 15 Laight Street from developer Vanbarton Group.

Hyundai plans to use the 108,000-square-foot building for a showroom and offices. Vanbarton had developed the building — formerly home to the Tribeca Film Festival — after purchasing the site for $90 million in 2016.

- $266M | 850 Third Avenue

Buyer: HPS Investments

Seller: Chetrit Organization

Broker: N/A

Jacob Chetrit’s firm transferred the office property at 850 Third Avenue to private investment firm HPS Investment Partners for $266 million — a big discount to the price the investor paid a few years ago.

Chetrit bought the 21-story building in 2019 for $422 million from HNA Group, which was selling off properties to get out from under a pile of debt.

Chetrit had previously faced foreclosure on the property in 2021, but was able to avoid losing the building.

- $210M | 377 East 33rd Street

Buyer: NYU

Seller: Verbena Road Holdings

Broker: Eastdil Secured

Rounding out the year’s top deals, New York University paid $210 million to buy the 23-story, 209-unit rental building at 377 East 33rd in Kips Bay.

The college plans to use the building for faculty, staff, and trainees.

“The purchase will also enable NYU Langone to dispose of third-party leased units in and around the neighborhood,” an NYU representative said.