With 421a gone and hope for a replacement fading, the Adams administration has come up with its own, city-funded version of the expired state tax break for rental projects.

The subsidy will be awarded on a case-by-case basis, unlike 421a, which was as-of-right. But that’s not the only factor that will limit its reach.

The Mixed Income Market Initiative program, which the New York Times reported Monday, will also require developers to provide high levels of affordability. It is designed for “high-opportunity” neighborhoods, meaning wealthy areas where market-rate rents are high enough to subsidize affordable ones.

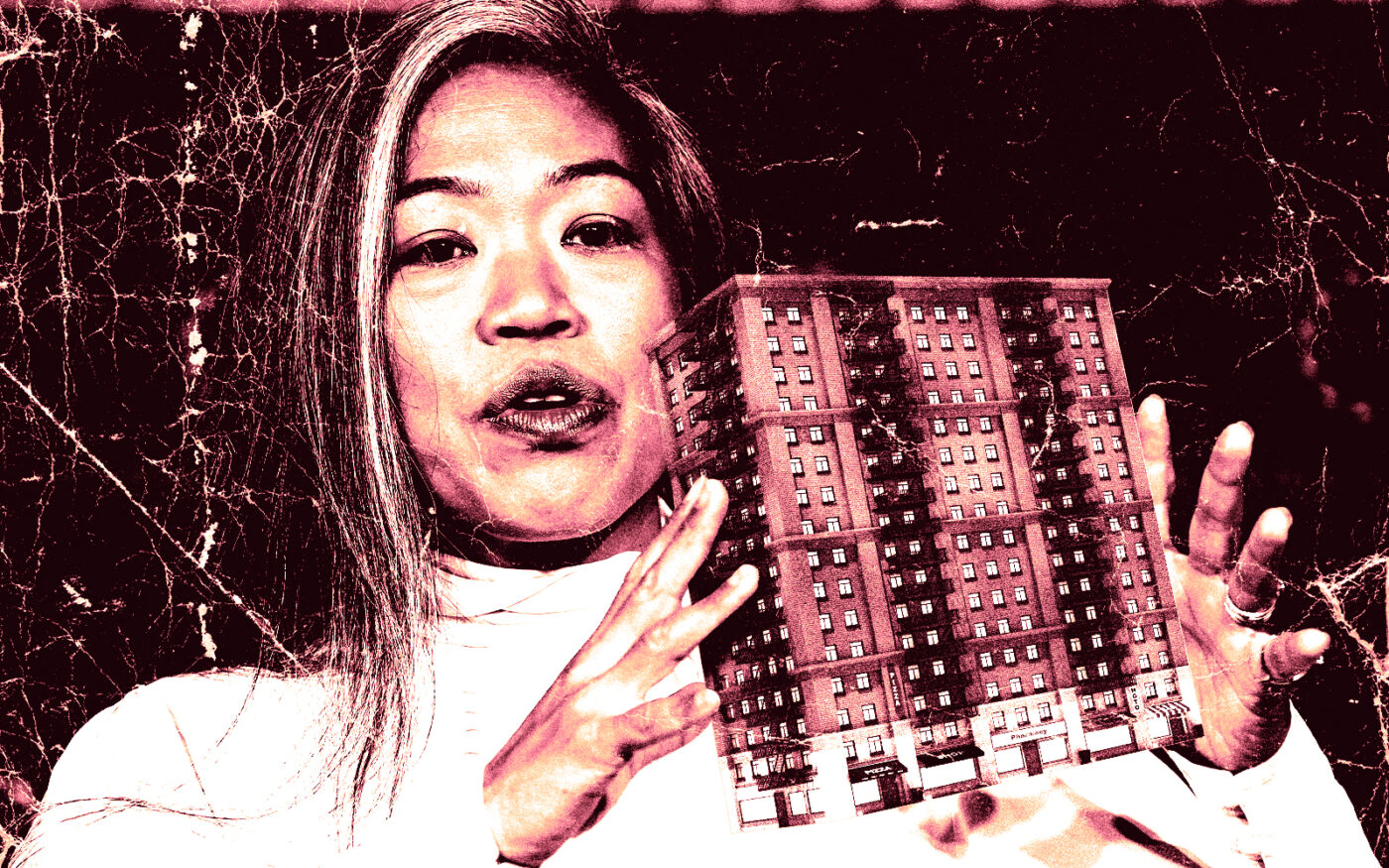

“It allows us to stretch our public resources,” Maria Torres-Springer, deputy mayor for housing, economic development and workforce, told the Times.

At least, that is the hope. Getting financing to build rental projects, which is all but impossible for those without the 421a property tax abatement, might require developers to first get city approval for the new subsidy, which is being administered by the Department of Housing Preservation and Development.

No City Council approval is needed for the program, nicknamed MIMI, which will require 70 percent of units to be income-restricted, including 7.5 percent for households earning 30 percent of the area median income and 15 percent for formerly homeless tenants.

The city did not say how much public money is being set aside for it, only that it “aims to use public resources more effectively by combining city subsidy and Article XI property tax exemptions with private financing sources and revenue from market-rate units.” It will not use Low Income Housing Tax Credits, of which the city has a limited supply.

City officials will collect feedback from the industry in January and February about how to design the subsidy. They are likely to get an earful. Developers have all but stopped filing plans for rental projects since 421a lapsed in June 2022.

Projects that were filed are expected to be mostly condominiums, which still enjoy a tax break, or rentals that won’t actually be built until property taxes for rental housing are lowered by the state. An industry-backed group has been trying to force the state to comprehensively reform property taxes.

The new program appears to be a subsidized version of the city’s Mandatory Inclusionary Housing law, which requires roughly 25 percent or 30 percent of units to be affordable in rental projects that benefit from a rezoning. That law relied on the state’s 421a subsidy.

Gov. Kathy Hochul has proposed her own 421a workaround, but only for projects in Gowanus. Nineteen have applied for it, the governor announced this month. Decisions on the applications will be made this summer.

“The Mixed Income Market Initiative is an example of how our administration is refusing to accept the status quo,” Mayor Eric Adams said in a statement, “and is relentless in our efforts to accelerate housing production, cut red tape, and get New Yorkers into safe, quality, and affordable homes.”

The administration sees MIMI not as a replacement for 421a, which it is pressing Albany to reinstate, but as a program that could complement it as well as be effective on its own. Its scale is not expected to approach that of 421a, which abates about $1.8 billion in property taxes annually.

A spokesperson for the Real Estate Board of New York applauded the mayor for seeking ways to address the housing shortage. “A variety of tools will be needed to facilitate the production of much more rental housing, particularly below market rate units that New Yorkers desperately need,” said the statement, which did not address the program’s specifics.

— Erik Engquist

This article has been updated to include comments from the mayor and REBNY and more details about the Mixed Income Market Initiative.