The Brodsky Organization closed on its investment in the Flatiron building, Rockfarmer Properties sold a couple of assets near its recently completed Astoria condominium, and Kushner Companies parted with a multifamily property in the East Village.

The trades highlighted transactions so far this month in the middle market, defined as commercial sales between $10 million and $40 million. All are below, ranked by dollar amount:

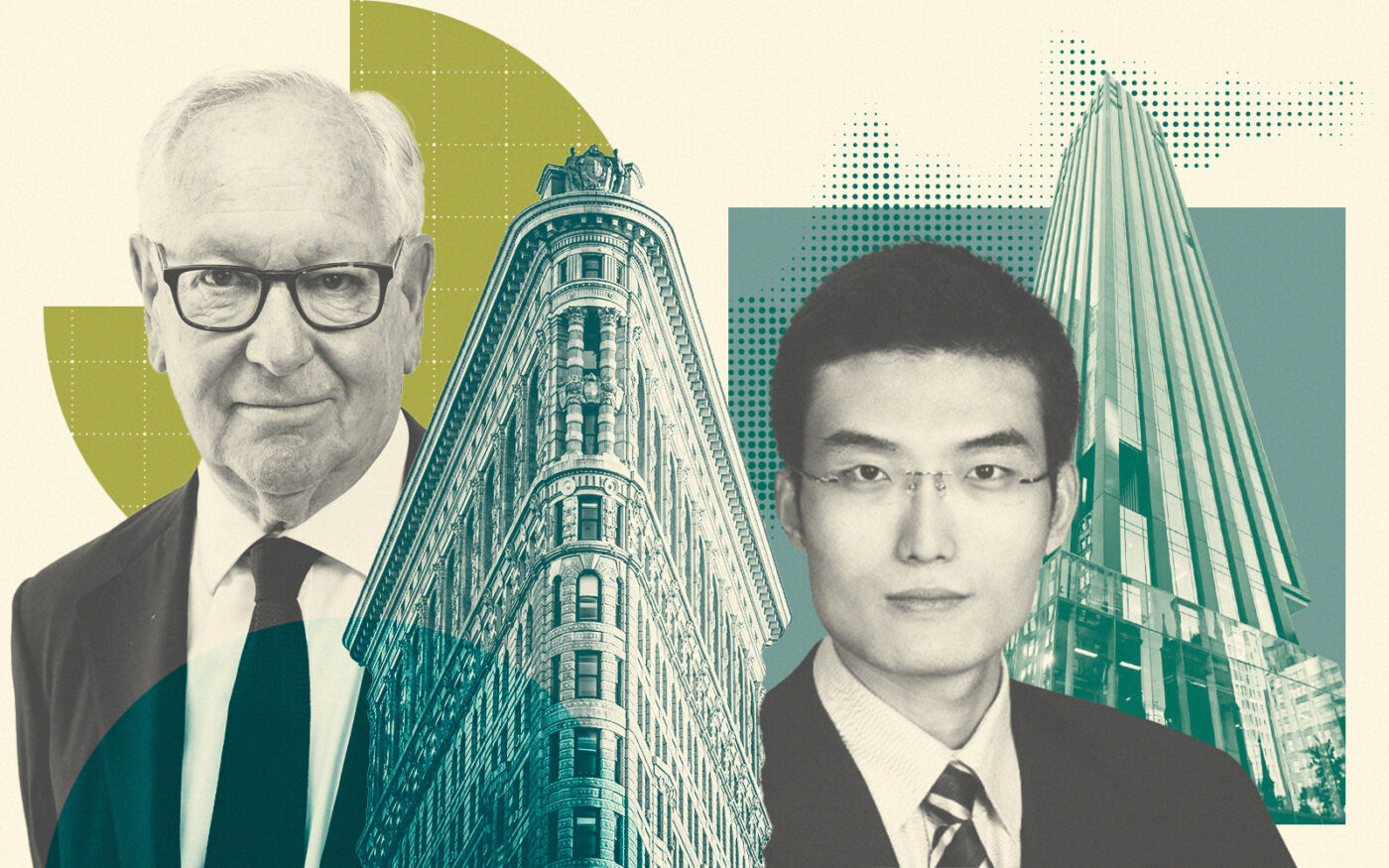

The Brodsky Organization paid $40 million for a 25 percent stake in the famed Flatiron Building, which is going (mostly) residential. The property became available after its owners, which included Jeff Gural’s GFP Real Estate, couldn’t agree on what to do with the vacant office building. In related transactions, GFP transferred at no cost its 70 percent stake in the building. Brodsky paid $6.7 million to ABS Partners for the rest of the property.

The Shokai Group bought unsold apartments at 277 Fifth Avenue, paying $35 million to Victor Group for three units. In 2021, Lendlease and Victor sold Shokai, a partner in the condominium development, 22 units for $81 million.

Brooklyn-based Minako Realty acquired 6 West 48th Street for $34.7 million from Commonwealth Holding of Massachusetts. The Midtown structure is the long-term home to a FedEx office.

Astral Weeks Development bought 12 Franklin Street from Simon Baron Development for $23 million; the property had been initially listed in 2019 for $50 million. Simon Baron purchased the site in 2016, saying it would take a wait-and-see approach as the neighborhood evolved. At the time, Toby Moskovits was seeking approval for a large project nearby at 25 Kent Avenue. The 500,000-square-foot building was billed as the borough’s first major Class A office construction in about 50 years when it opened.

An entity tied to Weitao Shi paid $21 million to RockFarmer for properties at 21-13 and 21-07 31st street in Astoria. The buildings are near RockFarmer’s recently completed luxury condominium, The Rowan.

Kushner Companies sold a multifamily property at 504-508 East 12th Street for $19.5 million. An entity controlled by Sabet Group bought the East Village property, which contains about 50 units.

An Idaho-based lender took control of five condo units at 46-48 Lispenard Street in Tribeca after foreclosing on a $19.5 million loan it provided in 2019 to an entity connected to Great Neck-based Continental Equities Group. A10 Capital, which filed for foreclosure in 2020, nominally paid $19.5 million for the units, likely using a credit bid.

An entity connected to Tim Ziss’ Allied Properties paid $15.6 million for 9201 Fourth Avenue in Bay Ridge. The purchase stems from a bankruptcy auction this year that was canceled at the last minute. To buy the 100,000-square-foot property, Ziss, who was owed $25.1 million on the property, used a credit bid. The sale was part of SPL Partners’ reorganization plan approved by the bankruptcy court in June.

Friedland Properties paid $10.2 million for a mostly rent-stabilized property at 788 Riverside Drive. Mardave Management owned the building for decades, and accepted 26 percent below its asking price.