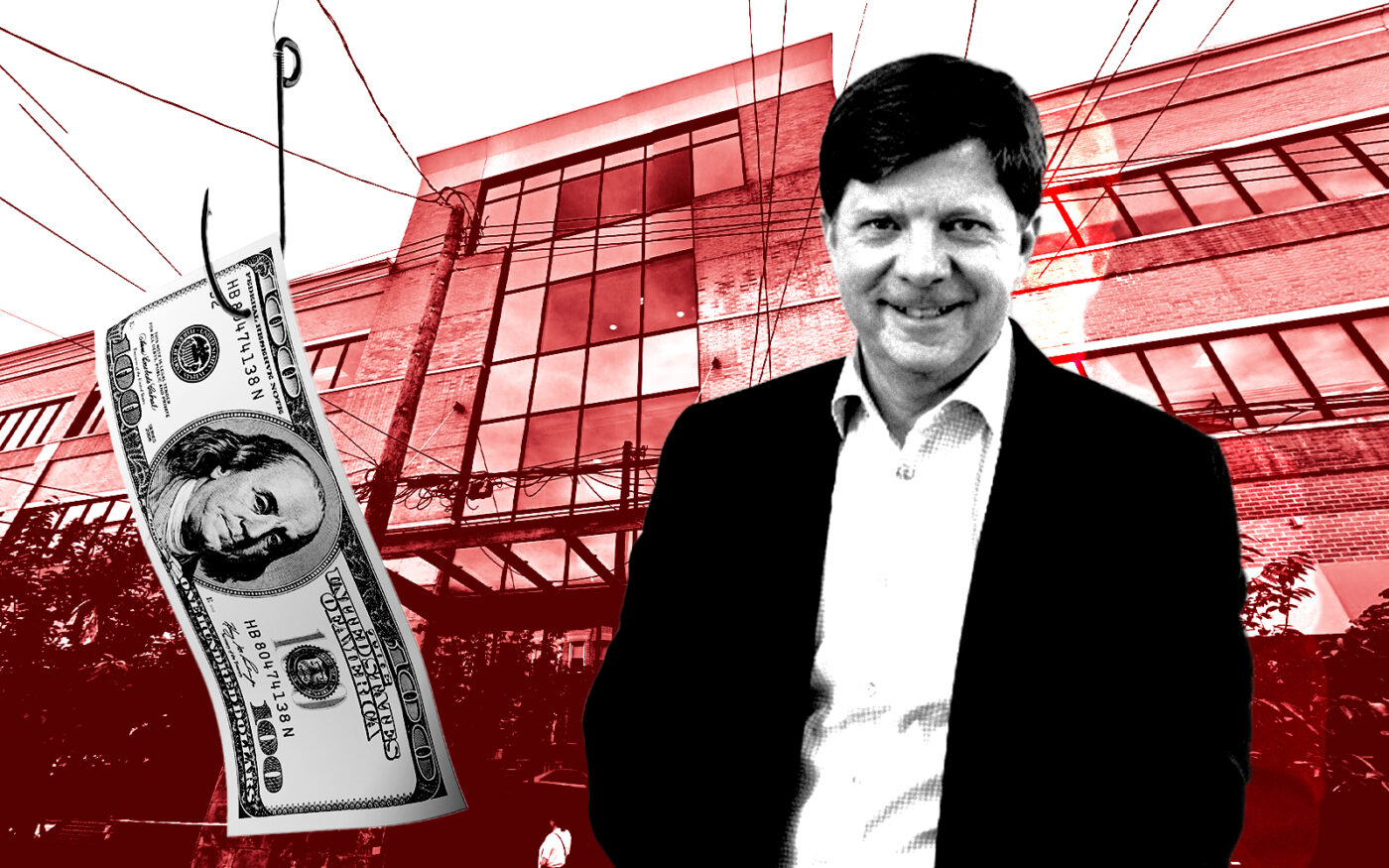

Months after Wells Fargo filed to foreclose on the Kingswood Center in Midwood, the receiver at the Urban Edge Properties building is dangling the distressed debt.

IRPG managing partner Yanni Marmarou says the debt at 1630 East 15th Street could come with an interest rate that is 7 or 8 percentage points lower than what bridge loans are now charging. Marmarou touts that as a big selling point in a high-interest, liquidity-challenged environment. But the buyer of the note would have to pass muster with the lender to be able to assume its favorable terms, he said.

Assuming the terms of the note — just under 5.1 percent interest until 2028 — would give an investor a few years to stabilize the finances of the mixed-use property, which originated with a $65.5 million loan. A comparable bridge or mezzanine loan would mature much sooner, in a year or two, and have a much higher interest rate, perhaps 12 percent or 13 percent, Marmarou said.

Distressed opportunities are increasing in New York City’s commercial market, but investors lacking the cash to jump take advantage may be sidelined by high interest rates and a liquidity crunch.

The 2nd District Judicial Court appointed the receiver to protect the collateral backing the debt. Marmarou is tasked with overseeing day-to-day operations and marketing the distressed CMBS note attached to the property, the Commercial Observer reported.

The three-story, 129,000-square-foot mixed-use building is one of the largest such properties in Brooklyn south of Prospect Park. The building includes 82,000 square feet of office space and 47,000 square feet of retail space.

Trouble came for Urban Edge this summer when the bank filed to foreclose after one missed loan payment. The lender asked that a receiver be appointed at the property, which Jeffrey Olson’s Urban Edge acquired from Elie Schwartz’s Nightingale and Steve Kassin’s Infinity Real Estate, along with a second building, for $88.8 million in February 2020, just before the pandemic reached the city.

The previous ownership group borrowed from LoanCore Capital in 2018 to buy the 2007-built Kingswood Center. The debt transferred upon sale of the property, though it’s not clear when Wells Fargo became the trustee for the loan.

The loan was transferred to special servicing in May after several tenants departed, including New York Sports Club and VTA Management Services. The property is 73 percent leased, with remaining tenants including TJ Maxx and an eye and ear infirmary.

Read more

A foreclosure date and bidding deadline for the debt have not been set. Marmarou told The Real Deal that a note sale won’t affect operations and that the receiver has been getting lease proposals from various nonprofits.

Marmarou said, “There has been interest from a number of major real estate players and nonprofit institutions” in buying the note.

Correction: An earlier version of this story misstated the terms of the debt being marketed.