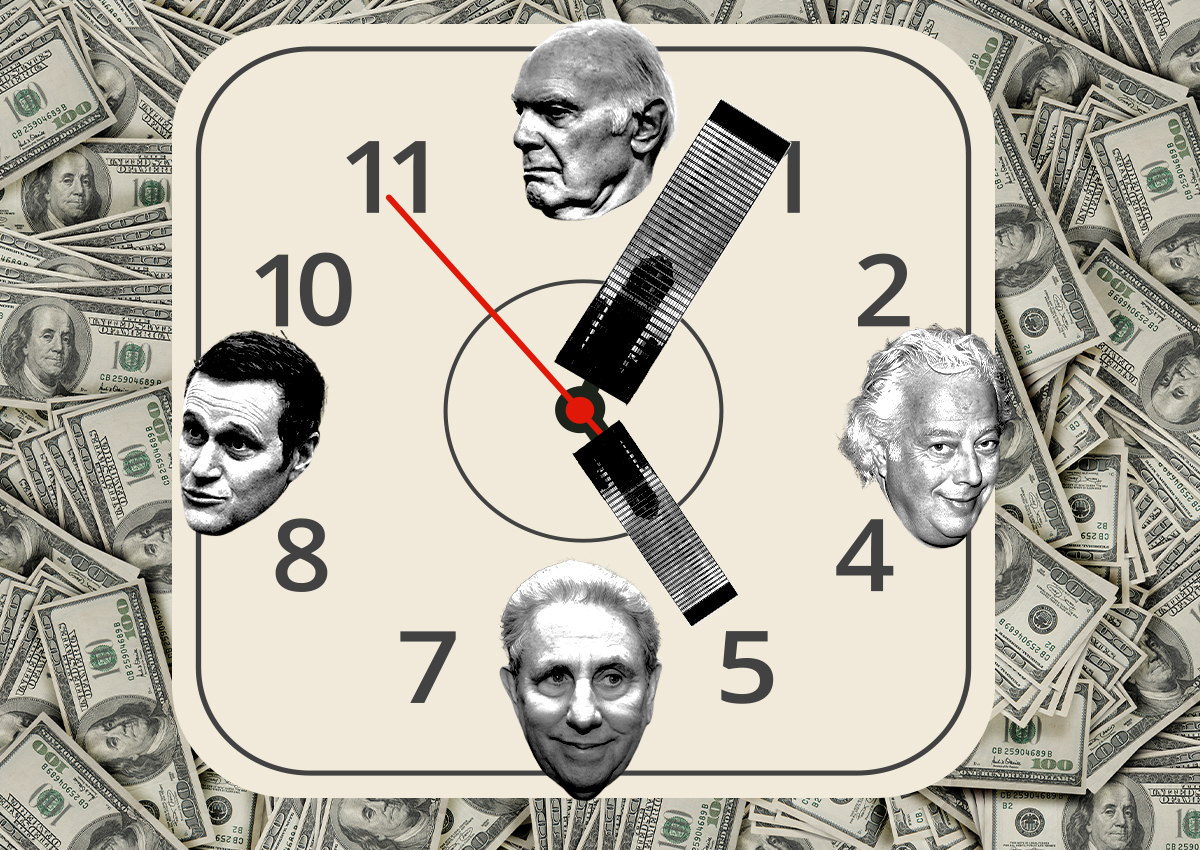

Scott Rechler’s RXR negotiated a modification on the largest loan in its portfolio — a deal that could serve as a model for borrowers struggling to refinance office properties.

RXR modified the $1.2 billion loan on 1285 Sixth Avenue, a 1.8-million-square-foot tower across from Rockefeller Center, with lenders Morgan Stanley and AIG, company president Michael Maturo told The Real Deal.

As part of the deal, RXR put in $220 million of equity to provide for reserves and pay down the loan’s balance to $980 million. The senior loan’s original interest rate of about 4 percent increased to 6 percent, and the debt’s maturity was extended for five years.

Rechler had set alarms off across the industry earlier this year when he said that RXR would walk away from struggling office properties that couldn’t be refinanced. But he also said the company would continue to invest in well-performing buildings.

Maturo said 1285 Sixth Avenue, which is 100 percent leased, is an example of the kinds of buildings that RXR and its lenders are willing to sustain.

“Everyone’s very confident in this building,” he said. “It’s got very strong cash flow, and this was very helpful in getting [the lenders] feeling good about doing an extension and modification on the loan.”

The company does not see 6 percent as a rate it wants to pay long-term, however.

“I think everyone was very satisfied in terms of where we’re winding up at the end of the day and giving this building some time to get through this liquidity period,” he added. “After the five-year term, hopefully we’ll be in a better environment to refinance.”

The modified loan also provides for a $60 million facility to pay for future capital costs.

RXR, David Werner and China Life Insurance Company secured the original loan in 2016, when they bought the 42-story office tower between West 51st and West 52nd streets for $1.7 billion. The loan matured in March, and the borrowers got a short extension to continue negotiations.

Maturo said RXR had gone out to the market to try to refinance the loan at its original maturity date, but couldn’t get to the loan levels the firm needed with prospective lenders.

The building’s largest tenant is the Swiss bank UBS, which in June took over struggling competitor Credit Suisse. UBS has indicated it plans to move some of its employees into Credit Suisse’s offices at 11 Madison Avenue, but it’s not clear how that will affect the bank’s space needs at RXR’s building. Its lease there runs through 2032.

Elsewhere in RXR’s portfolio, the company earlier this year defaulted on its $240 million loan at 61 Broadway — one of two properties Rechler had earlier indicated the company would surrender. Lender Aareal Bank has put the loan up for sale. RXR has said it is willing to hand over the keys through a deed in lieu of foreclosure.

Some other large office owners have worked out loan modifications in which they have put cash in to pay down their balances.

Aby Rosen’s RFR got an extension on its $1 billion mortgage at the Seagram Building at 375 Park Avenue. The company agreed to pay down $40 million on the loan over the next two years.

Read more