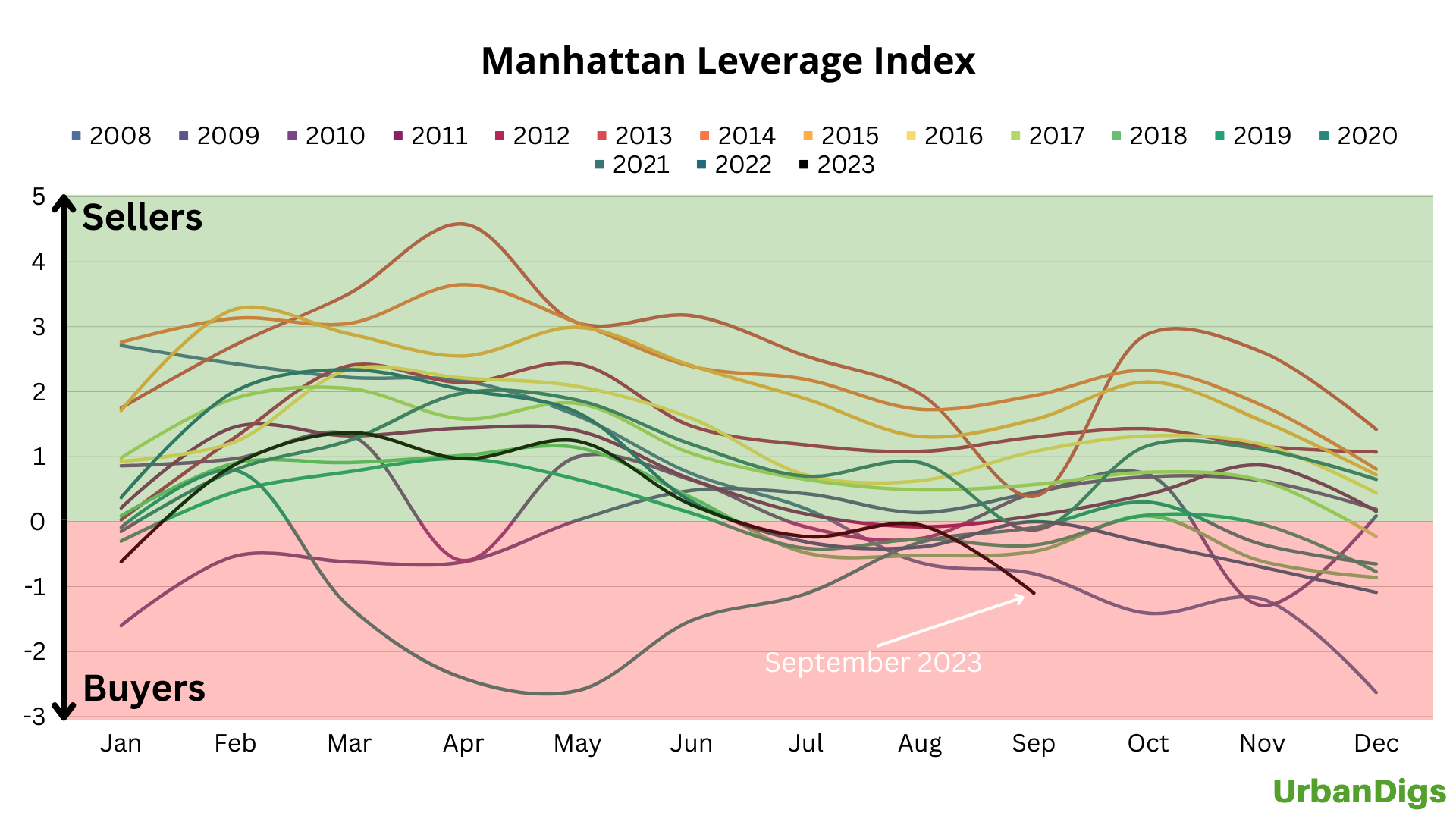

After three long years of buying homes sight-unseen, waving due diligence and generally being subject to the whims of sellers, buyers again have the upper hand in Manhattan’s residential market.

September was the best month for buyers since pandemic lockdowns hit that market in the spring of 2020, according to a report from UrbanDigs.

“The likely culprit is the drop in market liquidity, as measured by the number of contracts signed over a rolling 30-day period, which is approaching its 3-year low,” said UrbanDigs co-founder John Walkup.

The report is based on the number of sales compared to the number of properties that leave the market without a sale. Lots of sales mean sellers hold the leverage, while properties going off-market without a deal indicates the market favors buyers.

With the number of active listings is running slightly higher than seasonal norms, the report suggests the lack of deals is due to a lack of buyers.

“If you’re a buyer, you really have been waiting for this for a couple years,” Walkup said. “You’ve got a decent amount of choice and you’ve got the market to yourself.”

UrbanDigs’ data shows that besides being one of the strongest Septembers for buyers, the balance of power between buyers and sellers is in a similar place as it was the same month in 2008.

Walkup said similarity is “a little spooky,” but thinks the market is most likely in store for a mild rebound, not a collapse.

“Typically, the market picks up momentum in late September and early October after buyers have had a chance to shop,” he said. “The strength of that rebound is shaping up to be mild.”

Whether the fall turns into a historically strong market for buyers remains to be seen. Walkup attributed the lack of buyers in the September market to the three holiday weekends — Labor Day, Rosh Hashanah and Yom Kippur — and the rainy weather that closed out September with flooding across the boroughs.

Activity seems to be picking up after a slow end of summer in Manhattan, according to Berkshire Hathaway’s Diane Ramirez.

“There’s been some price adjustments,” she said of new products. “The buyers out there are looking for deals and they’re finding them. It’s not at bargain prices, it’s at good value prices.”

Despite a change in leverage, some buyers and sellers are still sidelined by elevated interest rates.

But the buyers who remain in the market have more power than last year, when prices jumped up from pandemic lows and bidding wars dominated. Brokers told The Real Deal at the time the hyper competitive market meant seller adjustments like a shortened due diligence period, sometimes giving buyers just five business days to go into contract.

“Sellers definitely are negotiable,” said Ramirez.

Read more