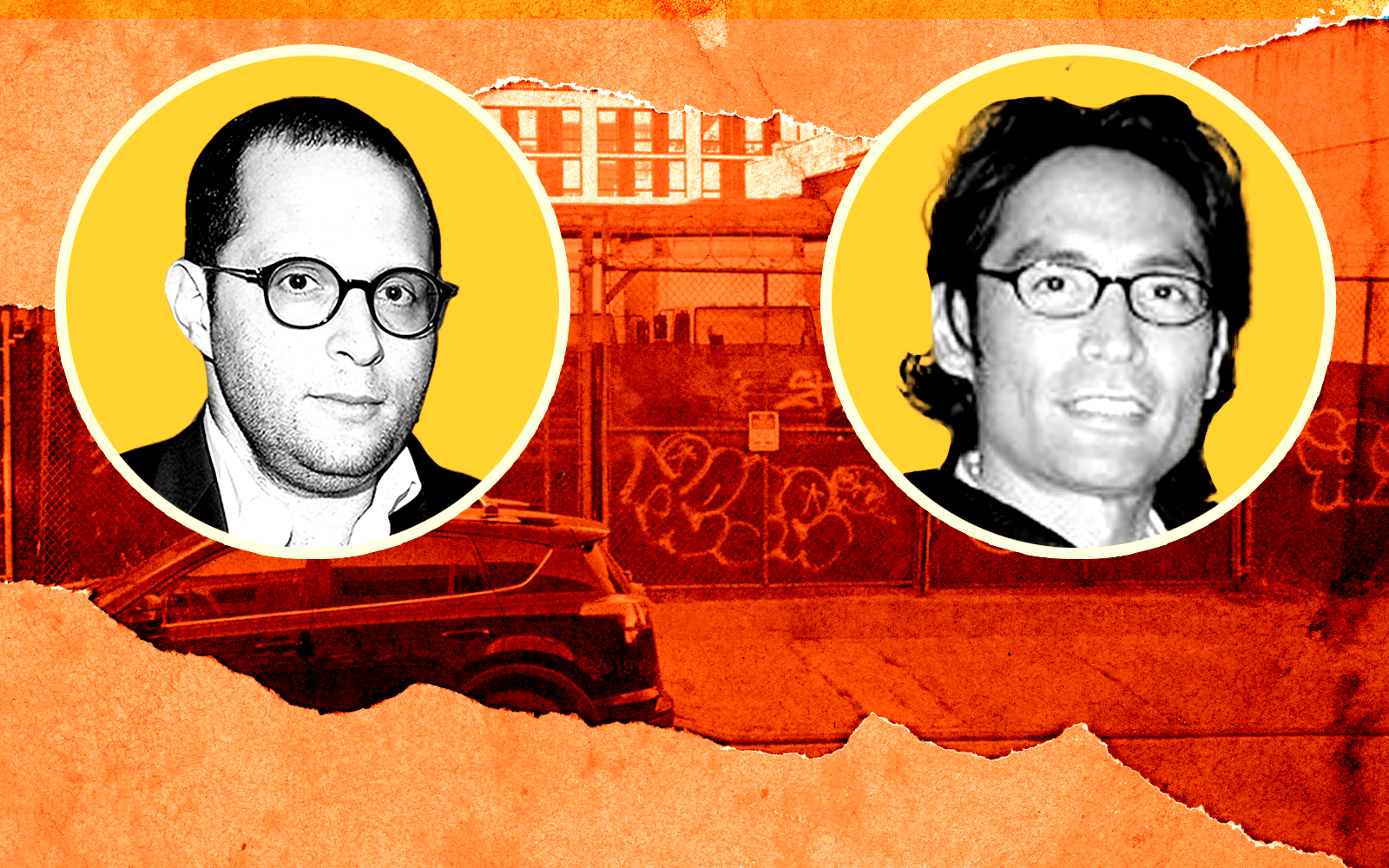

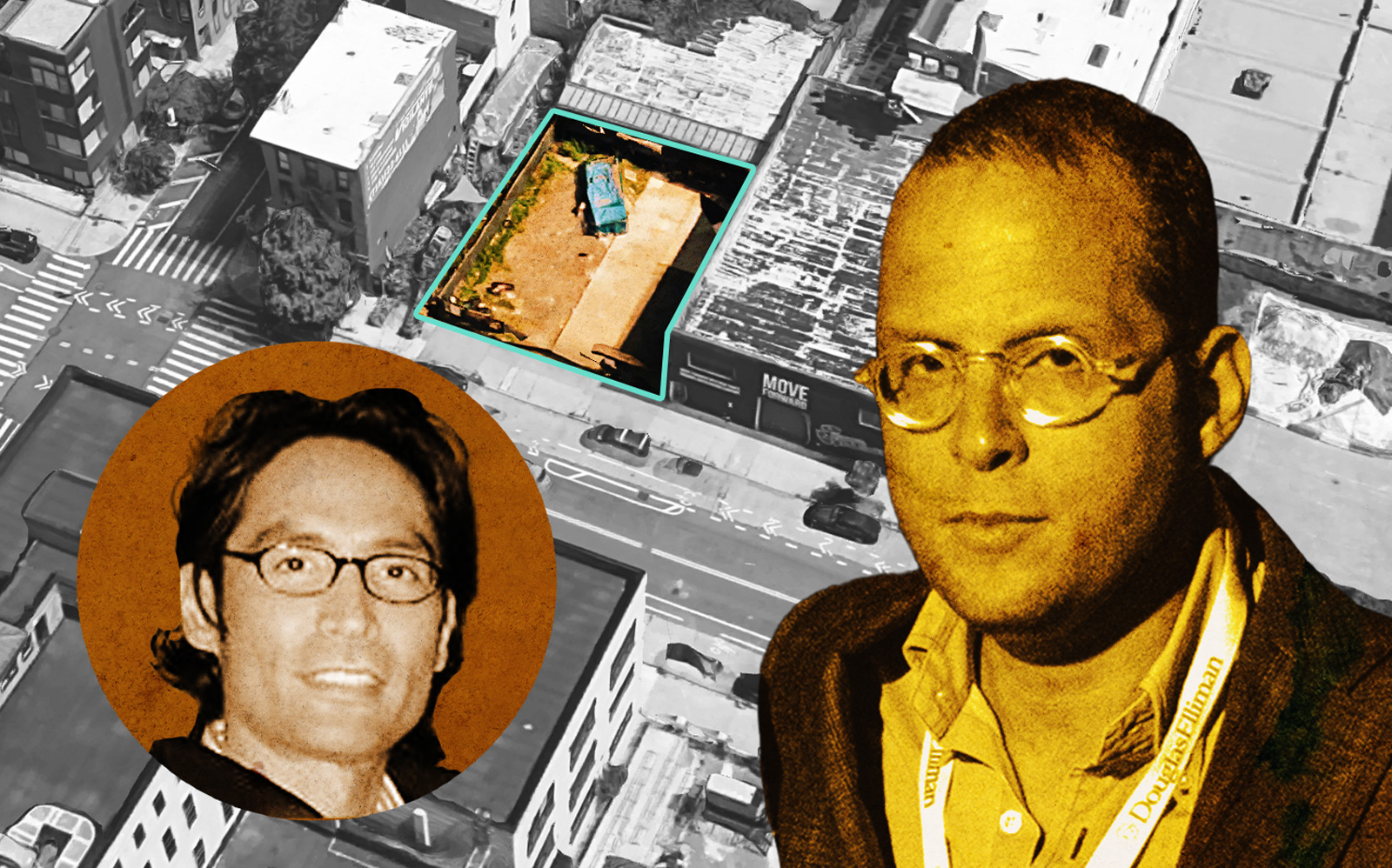

A new player will take a crack at developing 125 Third Street in Gowanus, but it won’t be Rotem Rosen.

Rosen’s $27.5 million bid for the site was blocked by one of its owners, Andrew Bradfield’s Orange Management, earlier this year, with help from the courts. Now Bradfield has bought out his partners and sold the Brooklyn development site to Allan Lebovits, Joel Wertzberger and Moishe Loketch for $29.5 million, Crain’s reported.

The buyers are part of BridgeCity Capital, but are undertaking the Gowanus project on their own. They will continue with plans filed for the site, which call for a 14-story, 130-unit project.

The site is still eligible for the expired 421a tax break, but if the new owners aim to build rentals, they will have to hustle. Projects must be completed by mid 2026 to receive the tax break, and lenders typically only finance those that can beat the deadline by a year, in case something goes wrong.

A dispute among owners, for example.

That’s what happened after Bradfield’s firm, Eyal Ben-Yosef and Sterling Town Equities purchased the Brooklyn site early last year for $21.6 million. Rosen entered the picture, offering $27.5 million, which Ben-Yosef wanted to accept. But Bradfield didn’t, and a Manhattan judge agreed in May that he had a right to match the offer.

Bradfield paid his partners about $21 million for their shares, then flipped the property.

Ariel Property Advisors’ Sean Kelly and Stephen Vorvolakos were part of the team representing Orange, while Cushman & Wakefield’s Daniel O’Brien and Caroline Hodes represented the BridgeCity Capital partners.

Gowanus has been a development hotbed since the city rezoned it in late 2021, estimating that the move would yield 8,500 new homes by 2035. Project filings flowed in even as opponents of the rezoning challenged it in court, unsuccessfully.

Developers are on pace to blow through city officials’ prediction, although the 421a deadline could stop that momentum. Gov. Kathy Hochul launched a workaround for developers who cannot beat the timeline, but her program has similar affordability requirements and a deadline of its own.

A fallback for developers is to build condominiums, which can benefit from a different property tax break.

— Holden Walter-Warner

Read more