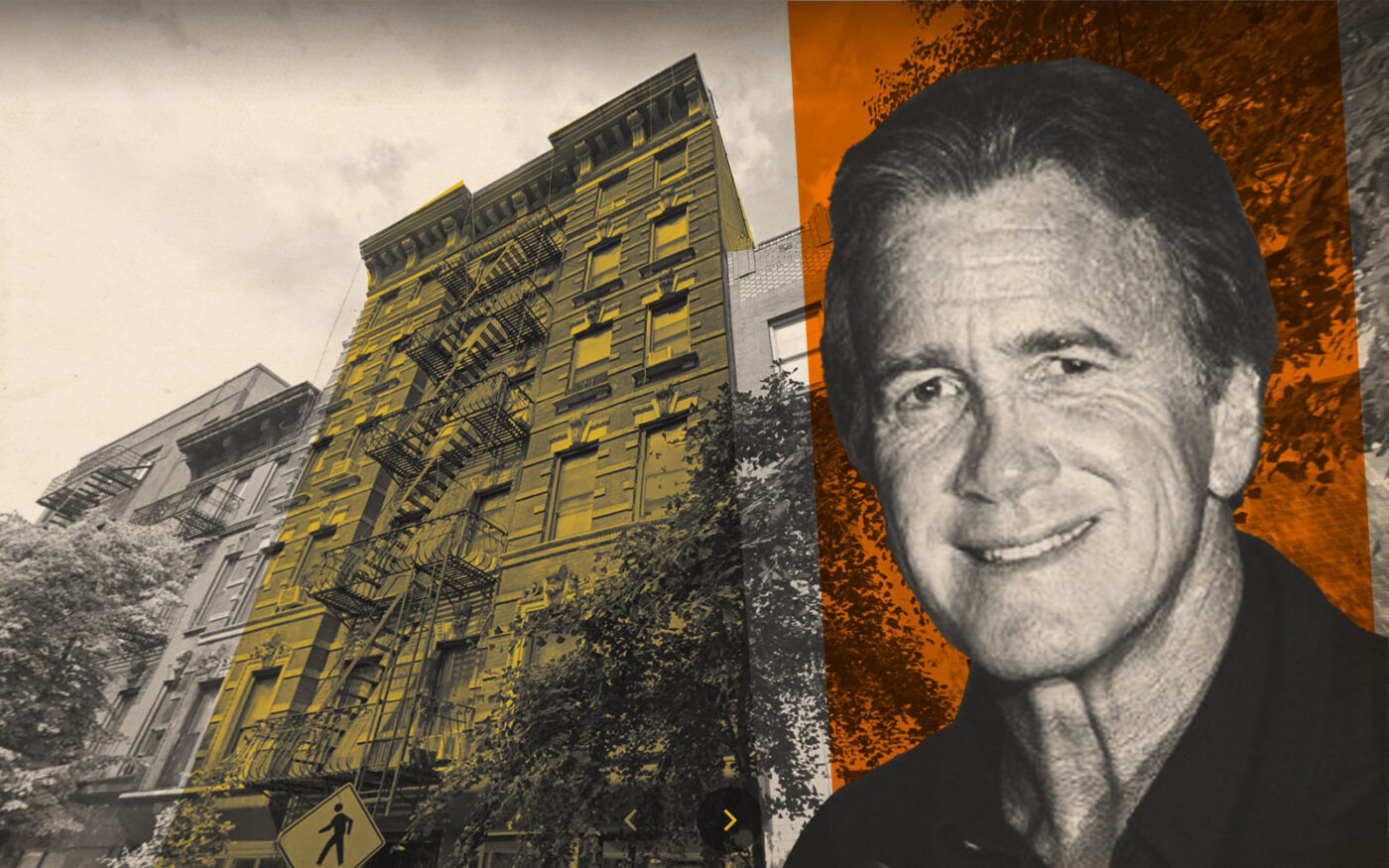

Jeff Sutton’s Wharton Properties has added to its Downtown portfolio.

The company shelled out $13.5 million to buy a West Village multifamily building from Michael Laub, who had purchased it in 2006 for $6.5 million. It’s Wharton’s second property in the neighborhood to go along with eight in SoHo, according to its website.

Located at 14 Bedford Street, the 123-year-old building is a 13,000-square-foot walkup with 21 residential units and two ground-floor commercial spaces. According to Wharton, 16 of the apartments are free-market.

Three Rosewood Realty Group brokers including Aaron Jungreis and Ben Khakshoor represented the buyer and the seller.

The West Village swap highlighted last week’s transactions in the middle market, defined as those between $10 million and $40 million. The rest are below, ranked by dollar amount.

- Daniel Heflin and Marc Young’s Torchlight Investors acquired a Midtown retail space from Jordan Slone’s Harbor Group after a long foreclosure battle. The three commercial condo units are in a 33-story condo tower at 445 Fifth Avenue.

The purchase price was $40 million, down considerably from the $68 million Harbor paid Thor Equities for the three units in 2015. Harbor fell behind on a $40 million loan from CIBC after the pandemic began, and Torchlight moved to foreclose after buying the loan from CIBC. - Jenel Management Group sold two properties in Jamaica for $19.2 million. The Chehebar family’s Jackson Group is the buyer.

The first property, located at 162-21 Jamaica Avenue, is an office building with two units over four floors and 79,000 square feet. The other, at 89-66 163rd Street, is a duplex neighboring the Jamaica Avenue property. Jenel bought the buildings in 1999. - David Halberstam purchased a Fort Greene development site from Marisol Diaz for $13.2 million. The lot is located at 340 Myrtle Avenue. To fund the purchase, Halberstam secured an $8.9 million loan from S3. The mortgage also covers the purchase of neighboring 155 Carlton Avenue.

According to New York YIMBY, the site, which is home to a laundromat, will get a seven-story tower with 43 apartments and 4,000 square feet of commercial space. Diaz bought the site in 1998. - The Chera family’s Crown Acquisitions unloaded a two-unit office building in Bensonhurst that it purchased just two months ago. The sale price was $10.26 million. Chera paid $7.7 million for it in July.

The site, at 6505 18th Avenue, features two buildings, each its own one-floor unit. Samuel Brach signed for the buyer, and the address in property records traces back to the Brach Foundation. Brach secured a $5 million mortgage from East West Bank.

Read more