Lobbyists arrived in Albany last year ready to talk casinos, zoning and good cause eviction.

The state Commission on Ethics and Lobbying in Government’s annual lobbying report detailing 2022’s top spenders included several real estate companies and groups.

Homeowners for an Affordable New York was the seventh highest spender overall and No. 2 among property interests.

The coalition, which included the Real Estate Board of New York, the Rent Stabilization Association and the Community Housing Improvement Program, among others, paid Fontas Advisers $1.4 million, making it the seventh highest spender in the state last year.

The coalition has paid the firm $971,000 so far this year. Its main focus both years was to block good cause eviction, which failed to pass despite a strong push by tenant advocates in each of the past two legislative sessions. This year, good cause was omitted from the state budget and died along with several other housing proposals at the end of the session.

Tenant advocates are expected to push good cause again next year, but for now, a deal involving 421a and good cause eviction seems out of reach. Mayor Eric Adams did say last week that he is hopeful such an agreement could be reached, but it is not clear that his optimism was based on any negotiations to that effect.

Gambling also inspired a great deal of lobbying.

The state budget last year included provisions that sped up the authorization process for three casino licenses in and around New York City. Several companies competing for the downstate licenses were among the top real estate spenders, including SL Green Realty, which is seeking to redevelop 1515 Broadway in Times Square as a casino.

The Genting Group, which runs Resorts World New York City in Queens, was the third highest spender. The venue, next to Aqueduct Racetrack, is seen as having the inside track on one of the casino licenses.

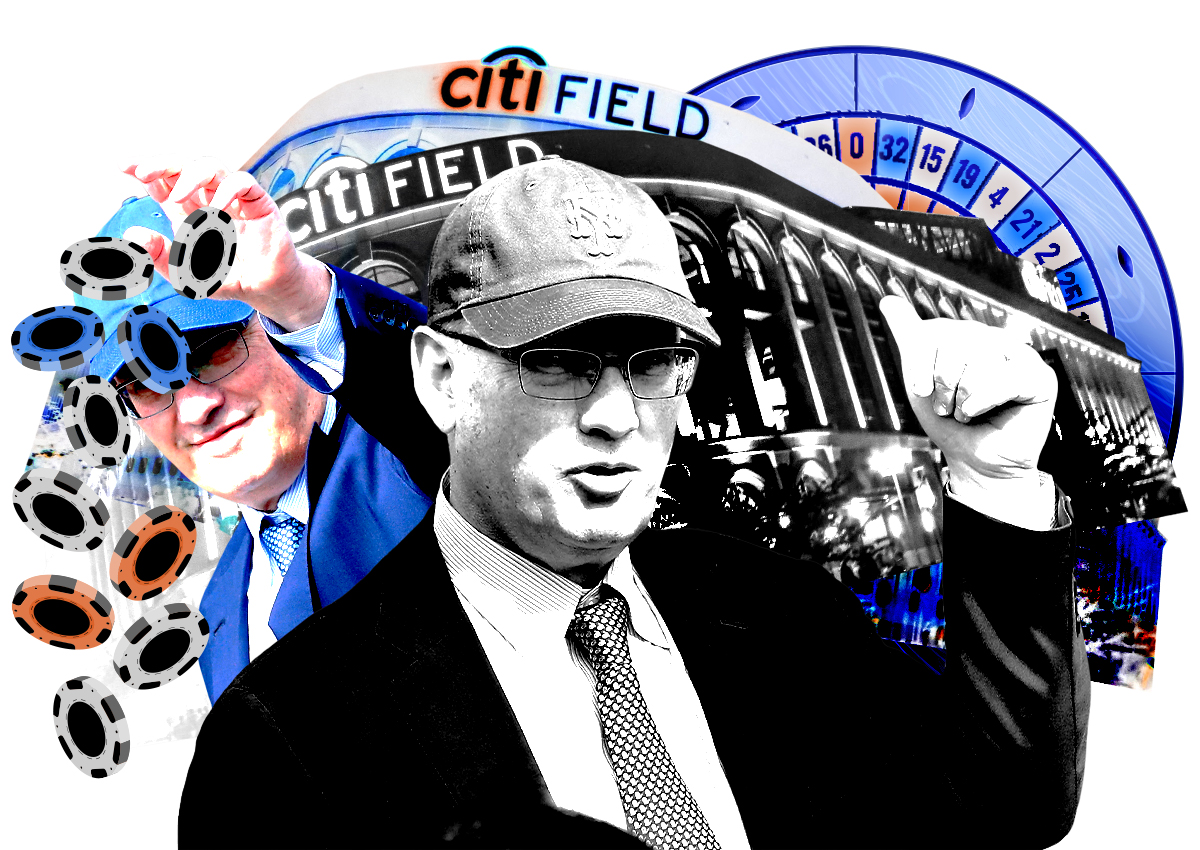

Mets owner Steve Cohen’s Point72 Asset Management, along with Seminole Hard Rock, are pushing for a casino near the team’s stadium in Willets Point, Queens. Filings also list land use issues near Citi Field among Point72’s lobbying topics. State Sen. Jessica Ramos stands in the way of Cohen’s plans.

Silverstein Properties, which only recently announced that it would compete for a gaming license, listed “relationship building” related to its proposed casino site, 520 West 41st Street, among the issues handled by its lobbyists.

Read more

Other issues for Silverstein’s representatives included 5 World Trade Center and its massive development planned for Astoria, Innovation QNS. That project’s future is imperiled by the expiration of 421a.

Vornado Realty Trust paid lobbyists to advocate for zoning changes to expand the Otis Elevator Building at 260 11th Avenue; they were approved in March. The company also hired experts to explore the possibility of rezoning a development site in Queens that it sold in May. Filings also list the Penn District and Pier 94 as Vornado lobbying topics. The latter project, at least, is moving ahead.

Here are the real estate firms and groups that spent the most last year on lobbying, including lobbyist retention costs and expenses.

1) Genting Group: $2.5 million

Issue: gaming, casino policies

2) Homeowners for an Affordable New York: $1.4 million

Issues: Good cause eviction

3) Vornado Realty Trust: $883,151

Issues: Penn District, Pier 94 and other land use issues

4) Association of Realtors: $879,974

Issues: Good cause eviction and other brokerage-related bills

5) SL Green Realty: $782,871

Issues: Land use, casinos

6) Point72 Asset Management: $727,318

Issues: Casinos, affordable housing, mass transit, Willets Point

7) Real Estate Board of New York: $563,473

Issues: Affordable housing (421a and other policies), sustainability, brokerage

8) Brookfield Financial Properties: $501,209

Issues: Local Law 97, commercial development, parking regulations

(other Brookfield arms filed separately)

9) Seminole Hard Rock Entertainment: $495,000

Issue: Casinos

10) Silverstein Properties: $494,000

Issues: Innovation QNS, extending tax breaks for nonprofits at 120 Water Street, 520

West 41st Street, brownfield tax credits, 5 WTC