The biggest real estate loans in July were a summer potpourri of debt, including lending on office, hotel, media production and residential projects.

With higher borrowing rates than a year ago, the five biggest loans in Manhattan last month brought in $716 million, compared to more than $2 billion last July. Outer-borough borrowers took in $738 million across their five largest loans, far less than the $1.8 billion during the same month last year.

Here’s a closer look at the projects that hooked the biggest loans, according to an analysis by The Real Deal.

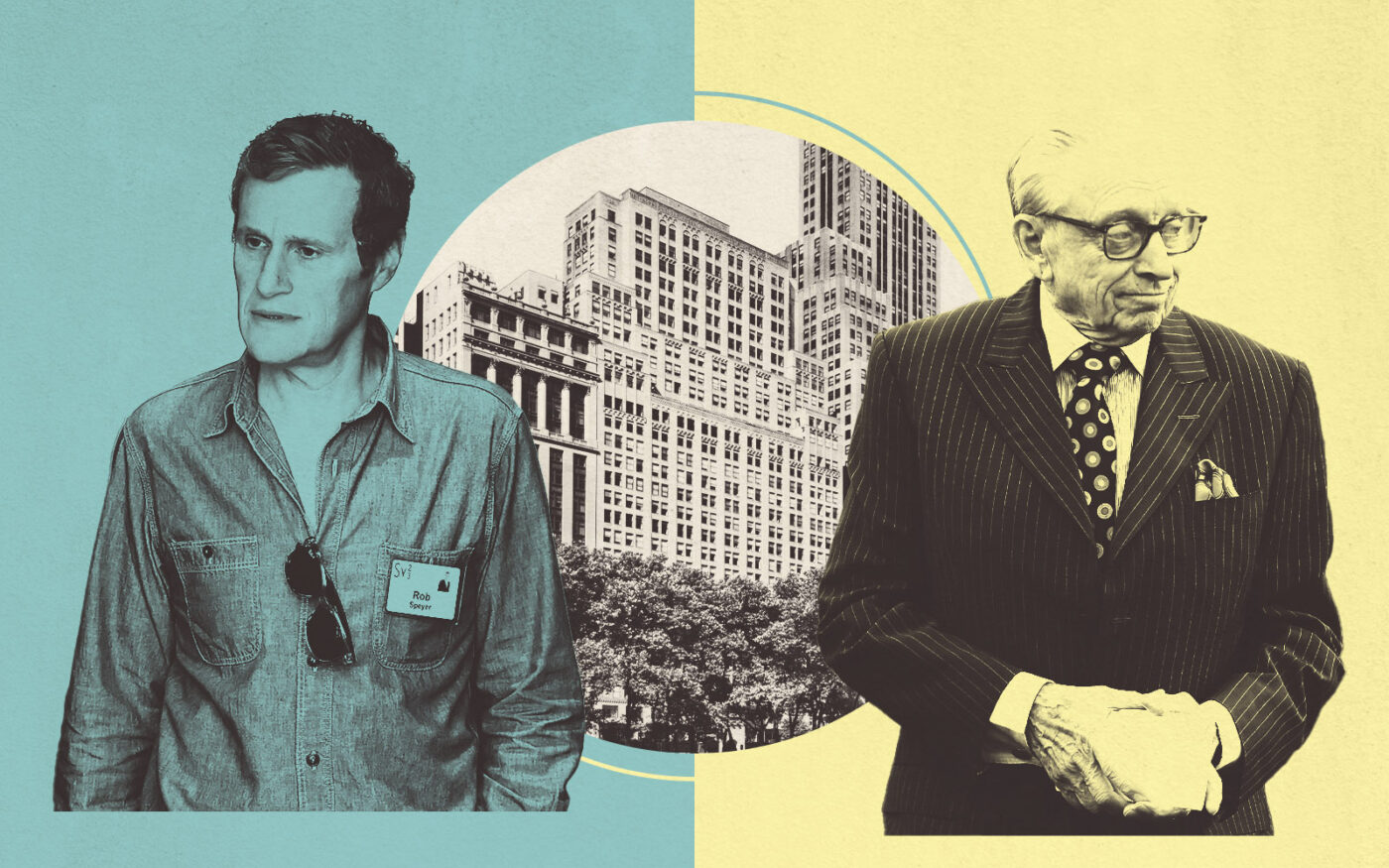

Big fish | Midtown | $330 million

Bank of America, UBS and Lennar’s LMF Commercial lent $274 million to refinance the Salmon Tower, a 950,000-square-foot office building at 11 West 42nd Street in Midtown, owned by Tishman Speyer and Silverstein Properties. Taconic Capital Advisors lent an additional $56 million in the mezzanine position. The Bryant Park building is reportedly 99 percent leased to tenants including Michael Kors, New York University and Kohn Pederson Fox. By contrast, the Manhattan office market at large notched a record amount of vacancy in July. Tishman’s coworking brand, Studio, is also a tenant in the building.

Neptune’s trident | Brooklyn | $252 million

Valley National Bank led lending of $252 million to Rubie Schron’s Cammeby’s International Group and Rybak Development to build a 499-unit multifamily building at 532 Neptune Avenue in Coney Island, Brooklyn. Renderings show a symmetrical, three-building structure that rises 22 stories across 760,000 square feet, including 40,000 square feet of retail, with 30 percent of apartments set aside as affordable. The project was opposed by the neighboring Trump Village cooperative, developed by Fred Trump, before a lawsuit over the height of the new development was discontinued in March. The construction financing replaces prior debt held by Signature Bank.

Lights, camera, loan! | Queens | $193 million

Canyon Partners Real Estate and JP Morgan Chase provided East End Capital with $193 million to build a 275,000-square-foot media production studio at 48-02 48th Avenue, between Queens Boulevard and the Long Island Expressway, in Sunnyside. The project, expected to wrap in early 2025, will have 75,000-square-feet of sound stages with 37-foot ceilings. Several new studio projects have been spurred in New York City by state tax credits, including Steiner Studios’ project in Sunset Park and Robert DeNiro’s Wildflower Studios in Astoria.

Booked up | Midtown | $120 million

Beach Point Capital Management finally shelled out $120 million in construction loans for a 400-key hotel at 711 Seventh Avenue in Midtown. Plans for the lodging were put forward in 2021, before the City Council froze hotel development with new regulation. Last year, Atlas Hospitality agreed to lease the property for 49 years from owner Byram River Associates for $59 million. The joint venture behind the project, which includes Flintlock Construction, then sued rival hotel developer Sam Chang, and others, for allegedly blocking demolition of retail buildings on the site. Earlier this month, a judge ordered demolition to proceed. IHG Hotels & Resorts will operate the new digs under its Voco brand. Gene Kaufman Architect is the architect of record. The 113,000-square-foot building is expected to stand 32 stories tall.

Premiums proffered | Brooklyn | $120 million

Insurance giant MassMutual lent $120 million to Tavros and Charney’s latest Gowanus project, a 261-unit development at 251 Douglas Street spanning 224,000 square feet. The Brooklyn neighborhood is poised to smash through official new housing targets following its rezoning by the city. The development will have 50,000-square-feet of retail and 65 apartments reserved as affordable. Equity investment in the project totals $64.4 million, with Canyon Partners Real Estate as the lead investor.

Gottlieb’s garden | West Village | $114 million

Aurora Capital Associates’ condo project at 134 Jane Street in the West Village secured $114 million from an insurance company owned by Apollo Global Management. The 100,000-square-foot building will hold just 15 residential condos, filings with the Department of Buildings show. The property, a surface-level parking lot, was among the many in the West Village owned by William Gottlieb, an inscrutable, prolific investor who was also a notorious “tightwad.”

Rental refi | Brooklyn | $95 million

JP Morgan Chase took over lending at 309 Gold Street, a 254-unit rental building in Downtown Brooklyn, with a $95 million loan to Lalezarian Properties. The funds replaced Wells Fargo as senior lender. Apartments for rent at the property range from a studio for $3,850 per month to a two-bedroom at $6,250. Completed in 2014, the building was among those that “spun gold” after a city rezoning spurred residential development in Downtown Brooklyn.

Second life | Soho | $83 million

Ramsfield Hospitality Finance and funds managed by Alliance Bernstein’s CarVal Investors provided CIM Group with an $83 million loan to refinance the Dominick Hotel, with 391 keys in Soho. The Los Angeles-based investor acquired the 46-story glass tower through foreclosure in 2014 and rebranded it in 2017. CIM had explored selling the property formerly known as Trump Soho after terminating the licensing agreement with the Trump Organization. Ramsfield’s joint venture with AB CarVal is one of the most active hotel lenders in New York City, and has loaned more than $1 billion over the past 20 months, according to Ramsfield president Richard Mandel.

Rezone unlocked | Queens | $78 million

Valley National Bank and Bank Hapoalim lent $78 million to RJ Capital Holdings to build a 170-unit multifamily building at 98 Queens Boulevard in Rego Park. Last year, the city approved the rezoning application needed to construct the 16-story, 134,000-square-foot project, which will replace a single-story diner and movie theater. The project is also known by the address 98-14 66 Avenue. SLCE is the architect of record.

Hotel living | Upper West Side | $69 million

Deutsche Bank took over lending at the Excelsior Hotel, at 45 West 81st Street on the Upper West Side, with a $68.5 million loan to John Young’s Emmut Properties. The funds replace a matured CMBS loan which Emmut used to buy the hotel in 2021. Emmut will convert the existing 126-key hotel, which closed during Covid, into 129 rental apartments, one-third of which will be furnished, and 6,500 square feet of medical office space.

Read more