Office landlord credit ain’t what it used to be.

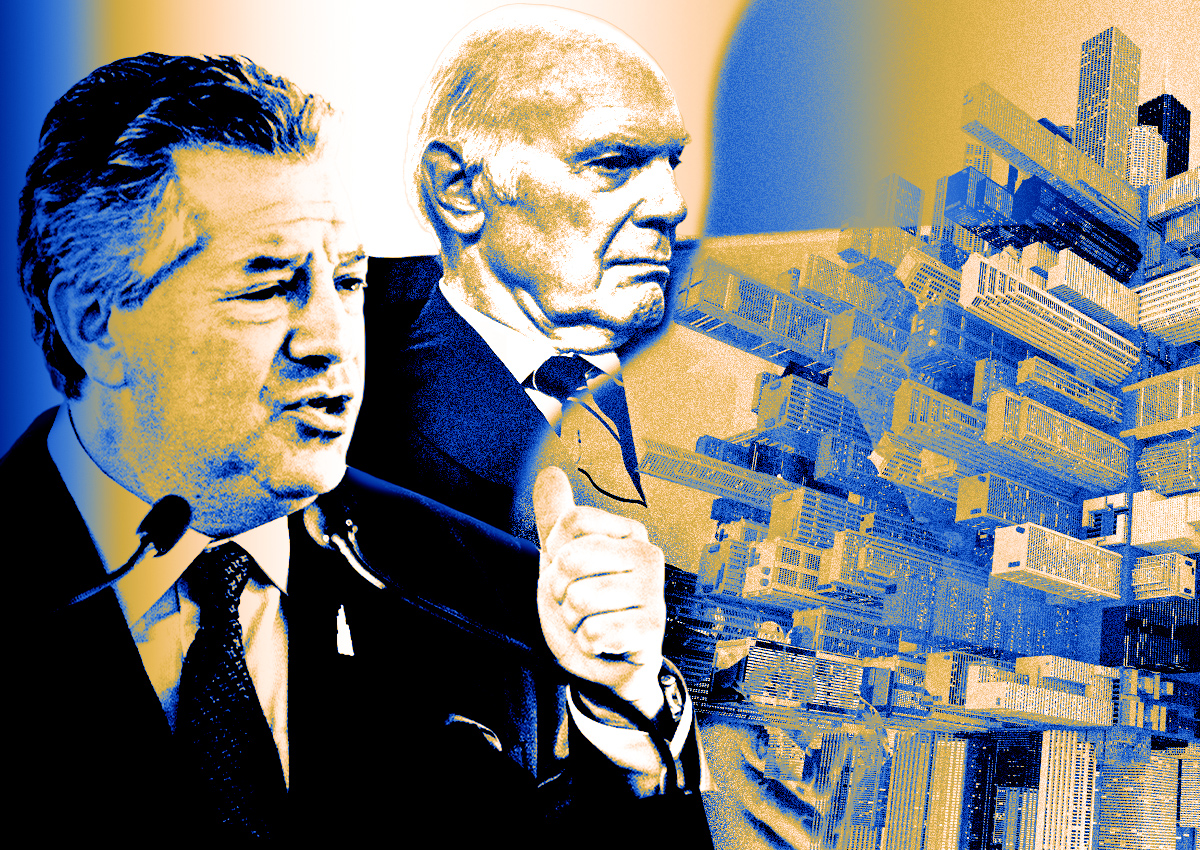

SL Green, Manhattan’s largest office owner, had its credit rating downgraded by Fitch Monday. The move mirrors a similar one the ratings agency made against Vornado Realty Trust last summer, marking a negative outlook for two of the city’s biggest office owners.

Fitch cited SL Green’s ratio of unencumbered assets to its unsecured debt that has “persisted meaningfully below 2.0x since the beginning of the Covid-19 pandemic” in its decision to drop the REIT’s credit rating from BBB- to BB+.

The agency calculated the company’s unsecured debt (such as credit facilities and corporate bonds) at 1.2 times the value of its unencumbered assets — those without mortgages or other liens.

A spokesperson for SL Green declined to comment.

Debt has certainly been on SL Green’s mind, and the company has made reducing leverage one of its top priorities for the year. The REIT made significant progress toward that goal, which Fitch noted, when it sold a stake in 245 Park Avenue in June to Japanese investor Mori Trust, which assumed a large portion of the tower’s mortgage.

Fitch noted that SL Green has a high-quality portfolio with above-average occupancy rates and said it expects the landlord to improve its credit ratio back to the 2.0 level, which would resolve its negative outlook.

It did note, however, that the Marc Holliday-led REIT faces risks with the office market and the company’s transition toward an asset management model, which could reduce its financial flexibility.

It’s the second time Fitch downgraded SL Green in the past year. The agency last June dropped its rating from BBB to BBB-, citing similar concerns over the debt ratio.

Read more

At the same time, Fitch dinged Vornado’s credit rating from BBB to BBB— due to high leverage and higher vacancy rates.

Moody’s in May said it was putting SL Green’s credit rating under review for a downgrade, though it doesn’t appear the company has made a decision.

Chief financial officer Matt DiLiberto said on the earnings call that the credit ratings are important, but SL Green was focusing on its business plan, not satisfying the ratings agencies.

“If Moody’s makes a move, that’s fine. If they don’t, that’s fine as well,” he said. “We think we’re executing on a prudent business plan for our business and for the shareholder base.”