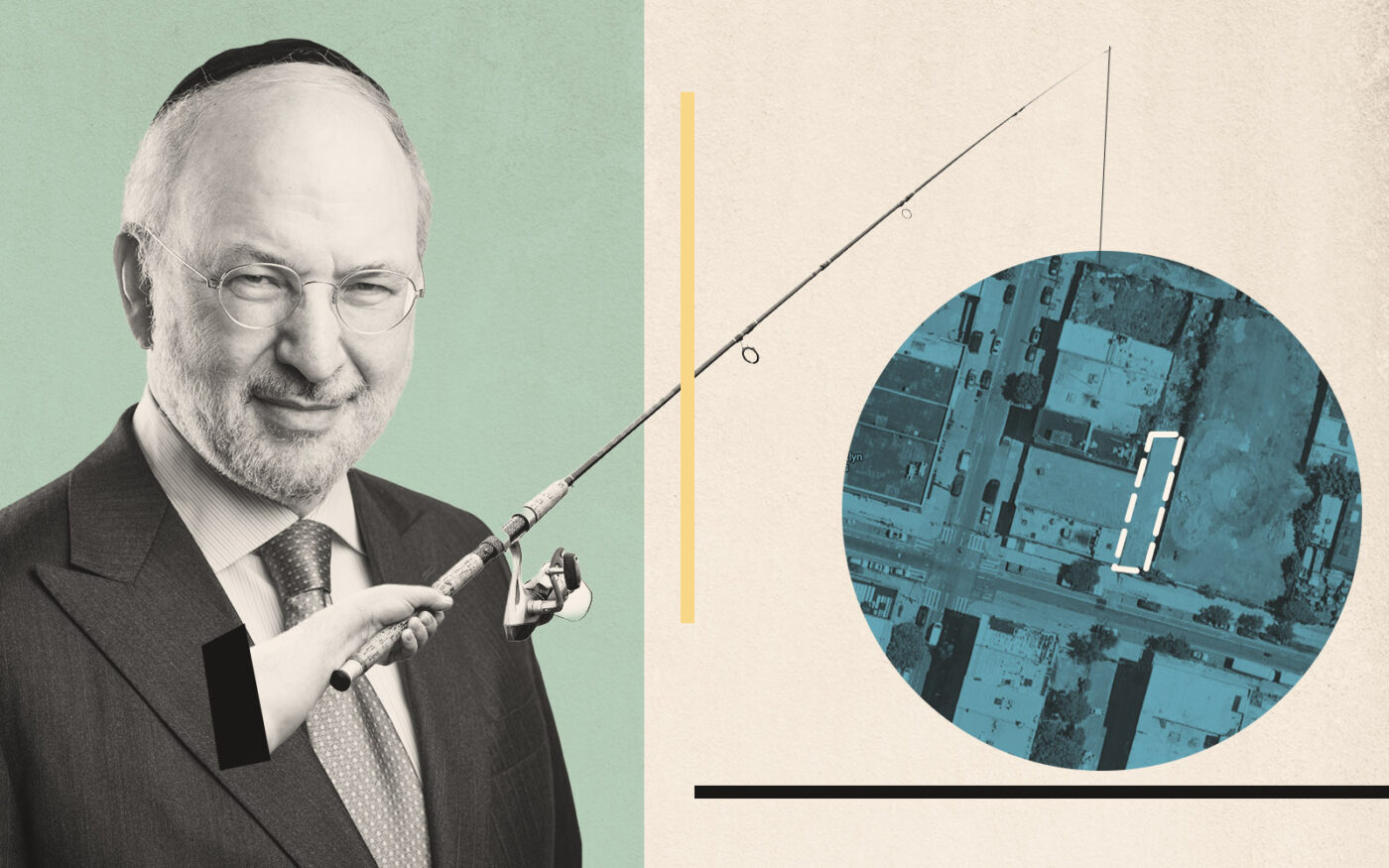

Fresh off snagging a generous tax break in East Flatbush, David Bistricer’s Clipper Equity scored a construction loan for a project in Crown Heights.

Clipper Realty — a real estate investment trust owned by Bistricer — landed a $123 million loan for a mixed-use project in the Brooklyn neighborhood, the Commercial Observer reported. Valley National Bank led the financing, joined by Bank Leumi, Bank Mizrahi-Tefahot and Be Aviv.

Landstone Capital Group’s Leah Paskus arranged the transaction. Bank Leumi previously provided a $30 million acquisition loan that helped the developer piece together the site.

The development site spans multiple lots, including 953 Dean Street and 1050 Pacific Street. Plans call for 240 apartments, two retail spaces and an 84-space parking garage. Bistricer has said 30 percent of the apartments would be set aside for affordable housing.

Bistricer’s REIT purchased 1050 Pacific Street two years ago from Harry Daskal for $26 million and 953 Dean Street last year for $4.7 million. Shortly afterwards, it filed plans for the 250,000-square-foot project.

Clipper is rolling in the financing these days. In June, Bistricer landed an Article XI tax exemption worth an estimated $191 million over 40 years at Flatbush Gardens. The break is intended for improvements to the 2,494-unit development, which has nearly 3,000 open housing code violations.

The break, which earned unanimous approval from the City Council, also requires 250 units to be set aside for the homeless.

Crown Heights has gentrified in the past 20 years, attracting multifamily developers. San Francisco-based Carmel Partners just secured a $233 million loan from Goldman Sachs for its 569-unit project at 54 Crown Street. The 17-story, 395,000-square-foot project will include commercial and community space.

— Holden Walter-Warner

Read more