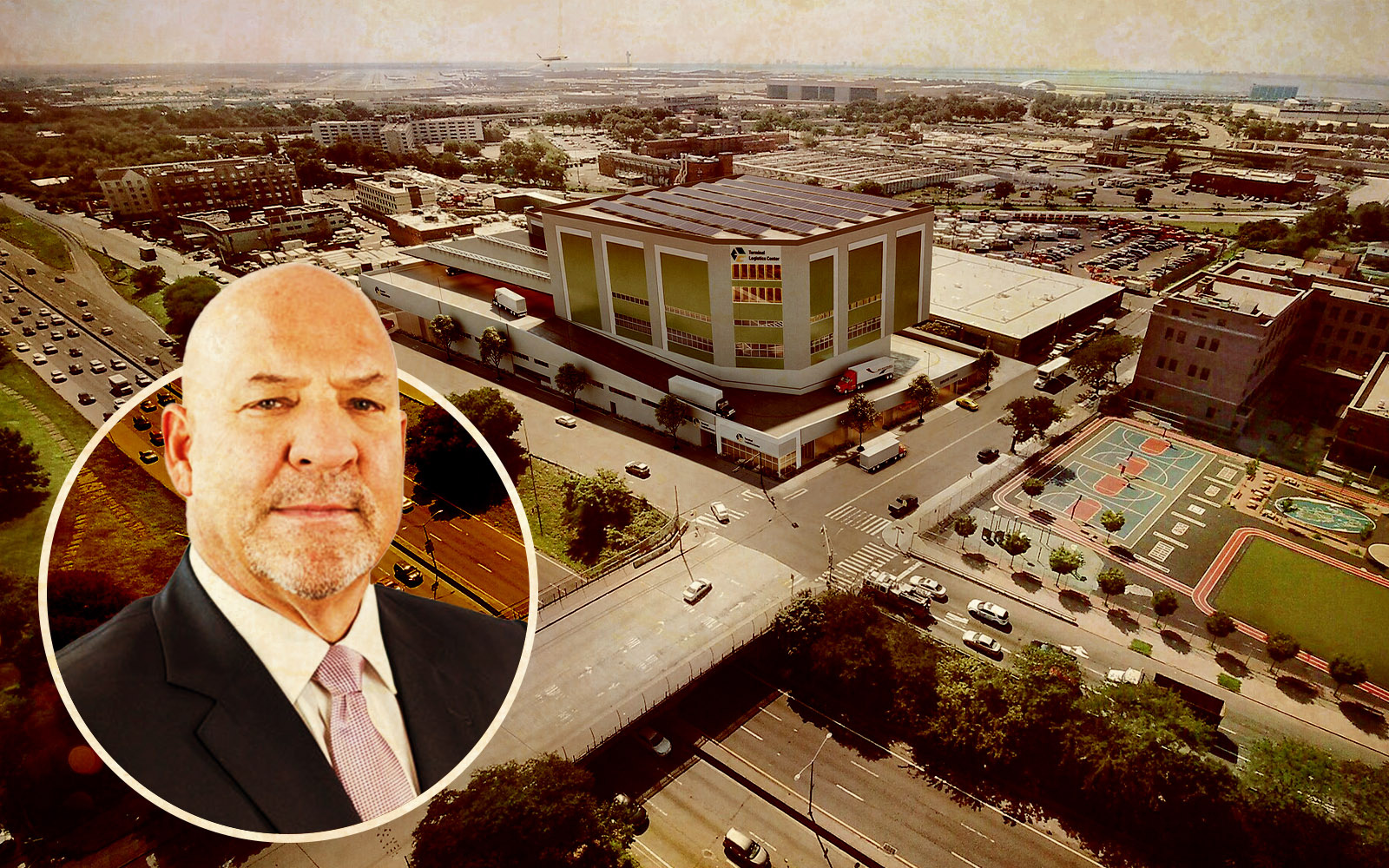

A new warehouse is in the works near JFK International Airport, where the market seems to have an insatiable appetite for logistics properties.

Realterm of Maryland received a $95M building loan and $23M project loan from JPMorgan at 154-68 Brookville Boulevard in the Jamaica neighborhood of Queens.

It was not immediately clear what Realterm’s plans are at the site, but the company’s website says it develops specialty industrial properties including “transportation-advantaged logistics facilities” and airport infrastructure.

Realterm executives did not immediately return requests for comment.

A number of firms have built or modernized logistics facilities near JFK in recent years. In April, Triangle Equities locked in financing for a warehouse by the airport at a $136 million recapitalization.

Realterm’s website says it has 13 offices across three continents and more than $11 billion in assets.

Industrial property has been perhaps real estate’s best performing asset class in the past decade, but its hot streak appears to be coming to a close. Still, year-over-year growth was strong last quarter, with asking rates for industrial space reaching $9.48 per square foot, up 18.4 percent from a year ago, according to a report by JLL.

The growth rate is expected to cool, however. Absorption tumbled 41.3 percent year-over-year as 61.9 million square feet were absorbed.

A separate report by Lee & Associates found that second-quarter net absorption was down 58 percent year-over-year, and that 2023 is on track to post the weakest annual growth in more than a decade. The vacancy rate was up 30 basis points from the first of the year to 4.7. percent.

However, those figures are for industrial property as a whole. An airport-oriented project such as Realterm’s in Jamaica may be less susceptible to a loss of momentum for last-mile delivery sites.

Read more