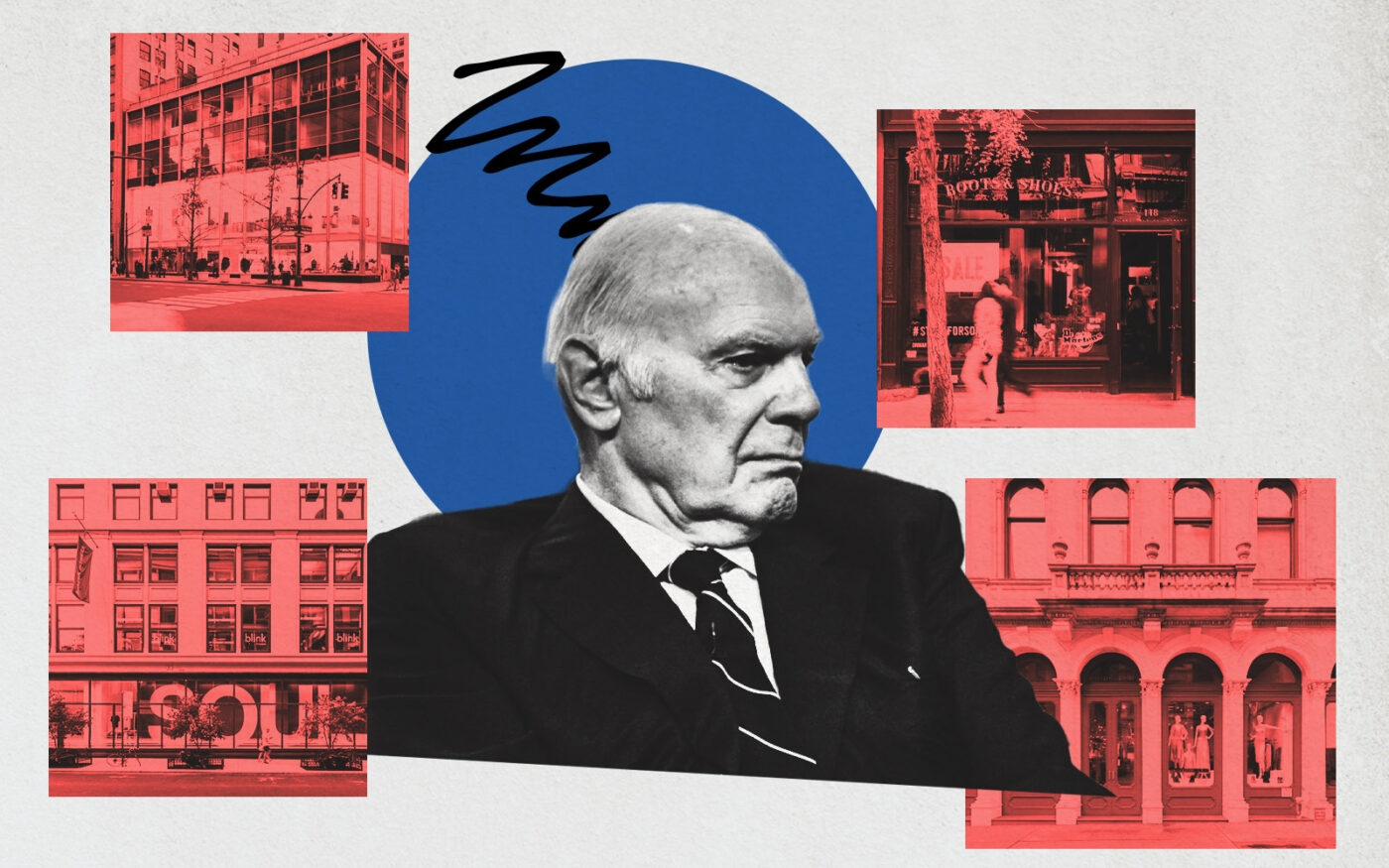

Vornado Realty Trust is offloading four retail and office properties for $100 million.

The real estate investment trust reached an agreement to sell 510 Fifth Avenue, 148-150 Spring Street, 443 Broadway and 692 Broadway, the firm announced. The REIT is also selling the Armory Show in New York, an international art fair, for $24.4 million.

The buyer and individual sale price for each building have not been publicly disclosed. The sales are expected to close in the third quarter of this year.

Vornado acquired the four buildings, primarily located in Soho and NoHo, in the 2000s. At the Fifth Avenue property, formerly the Hanover Trust Building, Vornado filed lawsuits in 2020 against tenants Elie Tahari, a womenswear chain, and co-working space the Yard for unpaid rent, though those cases have since been resolved, court records show.

Retail has wreaked havoc on other parts of the REIT’s portfolio. In February, Vornado wrote down the value of its real estate portfolio by $600 million, 80 percent of which was attributed to seven Midtown properties with street-level retail. The REIT has since been able to work out a five-year extension to a loan tied to one of those buildings at 697-703 Fifth Avenue.

The company released its second quarter earnings Monday evening, reporting $46.4 million in net income and $472 million in revenue.

Funds from operations were $140.7 million, or 72 cents per share on an as-adjusted basis, down from 83 cents for the same period last year, but up from last quarter’s 60 cents per share.

The firm is selling assets in part to fund a $200 million stock buyback. As of June 30, Vornado had repurchased 1.7 million common shares for $23.2 million, at an average of $13.48 per share. Its shares were trading at a little more than $22 Tuesday afternoon, up from a low of $12.31 in May.

Read more