Josh Friedman’s Canyon Partners is getting the gang back together.

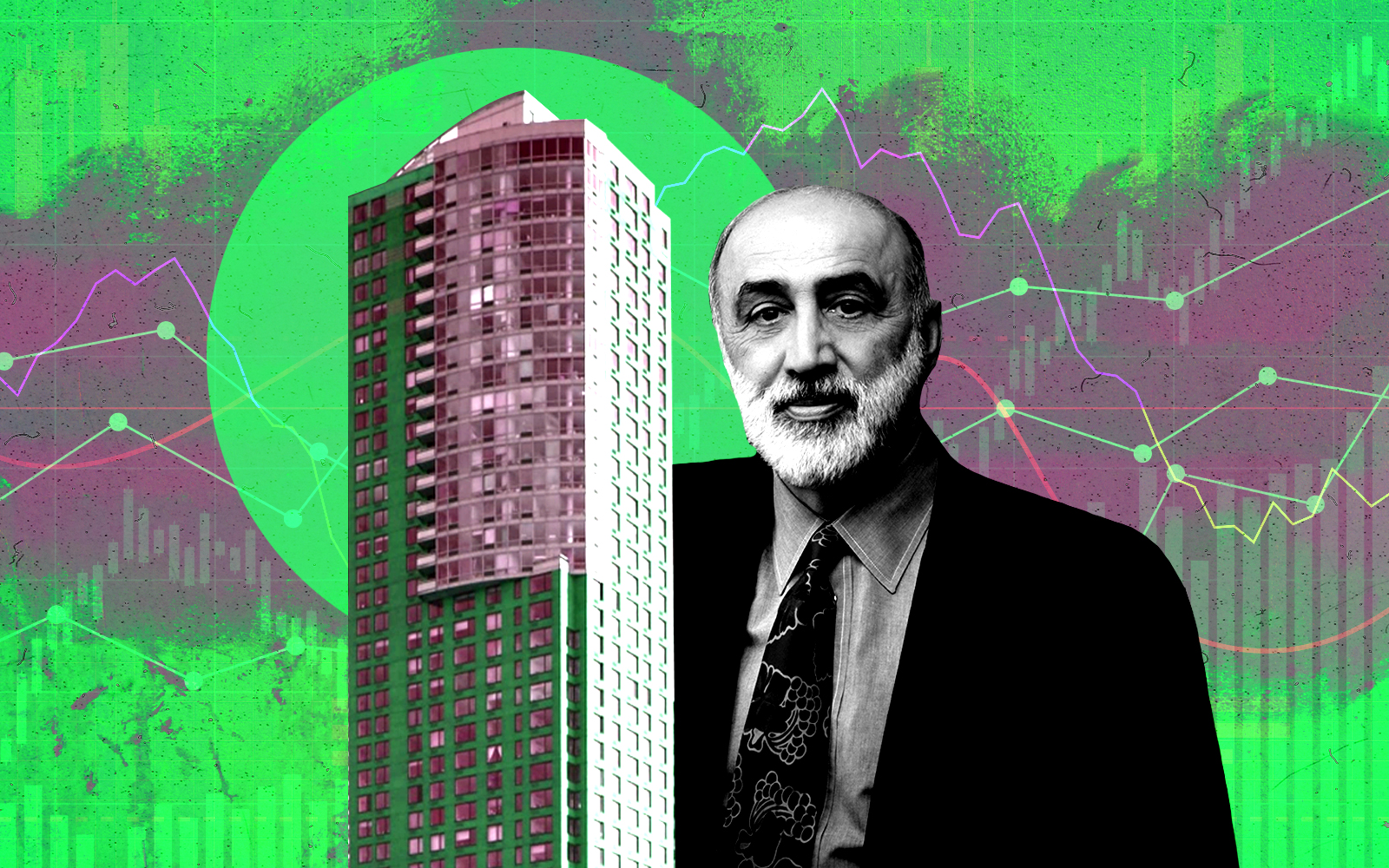

The company purchased a 55 percent stake in a Gowanus development site for $30.5 million, putting it in another Gowanus project partnership with Sam Charney’s Charney Companies and Nicholas Silvers’ Tavros Capital.

Tavros bought the site in 2020 for $22.5 million. The developers are planning a 261-unit residential building on the lot, located at 251 Douglass Street. The three parties are also working together at 585 Union Street, which will be a mixed-use building with ground-floor retail and 224 residential units, according to Charney’s website.

Both developments are located in Opportunity Zones, which allow for deferral of capital gains taxes. The program was billed as a benefit for depressed areas but has been used in booming ones as well, such as Gowanus and Long Island City.

The deal was the highlight of last week’s eight middle market investment sales, defined as those between $10 million and $40 million. The others are below, ranked by dollar amount.

- Samuel Loughlin’s Paceline Equity Partners of Dallas shelled out $34.5 million for a hotel in Long Island City. The company assumes a $24 million mortgage on the property, which is located at 29-14 39th Avenue and features 11 stories and 99 units. The seller is Radson Development, which bought the building in 2011.

- A commercial building in Flatiron swapped hands for $28.1 million. The buyer is David Levy’s Adams & Company, which took on a $36 million mortgage from Apple Bank for Savings. The seller is Rockrose Development, controlled by part of the Elghanayan family. Located at 47 West 17th Street, the building is 12 stories with 15 units over 180,000 square feet.

- Hyundai Motor America bought Manhattan’s last hourly hotel for $22.5 million, and is likely to become a car dealership. The Liberty Inn at 500 West 14th Street in the Meatpacking District closed in February after 54 years in business. The triangular lot has just shy of 11,000 square feet of buildable space. The sellers were Edward Raboy and Richard Loring Moss. Hyundai owns a number of nearby buildings.

- Kenneth Bernardo’s Bay Crane Companies purchased a construction equipment storage site and two nearby lots in Maspeth for $16.1 million. The company took out a $16.1 million mortgage from VNB New York on the three lots, in addition to six others in the area. Located at 54-04 44th Street, the lot is home to a one-story, one-unit building. The seller is Robert Weiss’ Weiss Properties, which acquired the site in 2010.

- Jonathan Davis’ Davis Companies of Boston picked up two development sites in Central Harlem for $12 million. The neighboring lots — 1971 Madison Avenue and 45 East 126th Street — combine for 15,000 square feet. The Madison Avenue lot includes a three-unit, three story structure. The seller is Robert Kaliner’s Round Square Development, which picked up the lots from Metropolitan Community United Methodist Church in 2019 for $16 million. Round Square had planned an eight-story mixed-use building on the site.

- Four lots at 377 Broadway in Tribeca changed hands for $11.95 million. The buyer’s address traces back to Jeff Kransnoff’s Rialto Capital. The office condominium was bought by B+B Capital in 2014 for $10 million, but a foreclosure was filed in 2020 tied to a 2015 loan; Rialto is the special servicer. The seller is listed as referee Elaine Shay. The property has 11 stories and 17 units over 80,000 square feet. Keller Williams was the owner before B+B.

Read more